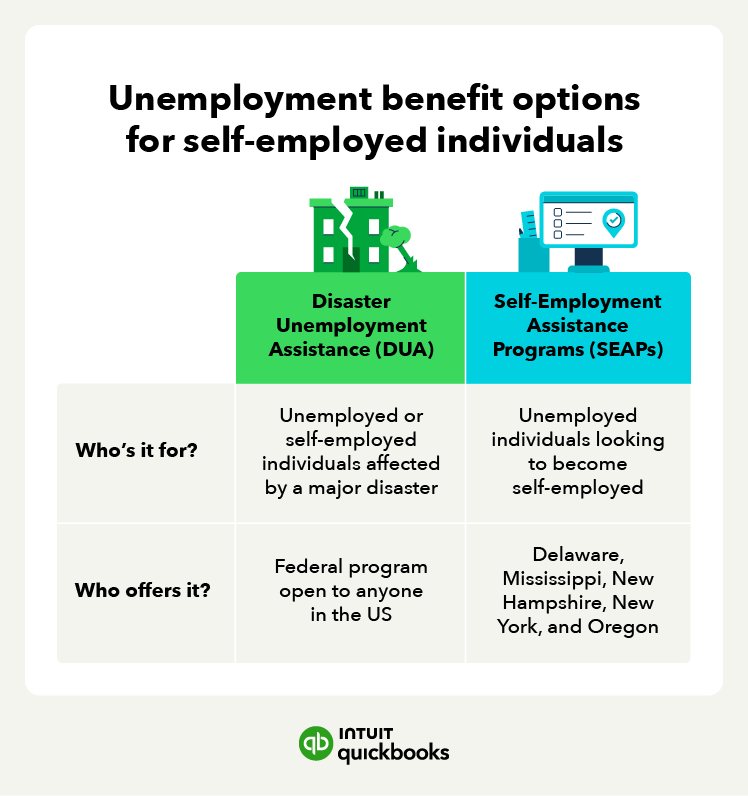

Disaster Unemployment and Assistance (DUA) program

The Disaster Unemployment Assistance (DUA) program offers benefits to self-employed individuals who lose income due to major disasters. DUA is a federal program available to anyone in the US whose job or self-employment income is affected by a natural disaster, such as a hurricane or an earthquake.

You can get help from this program if both are true:

- You lose your job or income due to a presidentially declared disaster.

- You aren't eligible for regular unemployment insurance benefits.

To check your eligibility and apply, you’ll need to contact your state’s unemployment office. The DUA is available if you were self-employed or an employee of a company who had their employment affected by a disaster.

Self-Employment Assistance Programs (SEAPs)

Some states offer Self-Employment Assistance Programs (SEAPs) for unemployed workers who want to become self-employed. Generally, the individual plans to be self-employed full-time, which can include entrepreneurial training.

States that offer self-employment assistance programs include:

- Delaware

- Mississippi

- New Hampshire

- New York

- Oregon

These states pay an allowance, similar to regular unemployment insurance benefits, that self-employed workers can use to fund their businesses.