Advantages of electing S-corp status

The tax advantages and liability protection offered by S-corp status make it an attractive option for small business owners and solopreneurs alike.

Electing S-corp status has major pros for shareholders:

S-corp self-employment tax

For S-corp owners who also work for the company, part of your income can be classified as salary, subject to payroll taxes, while the remaining profits are distributed as dividends and may not be subject to self-employment tax.

Pass-through taxation

Refers to the taxation method where business profits "pass-through" the S-corp and are directly taxed on the owners' individual income tax returns, allowing S-corporation profits and losses to be reported on shareholders' personal tax returns, avoiding double taxation.

Limited liability protection

Like a C corporation, an S-corp is a separate legal entity from its owners. This means that as a shareholder, your personal assets are protected from the business's debts and liabilities. This separation provides a crucial layer of security, giving you peace of mind as you grow your business.

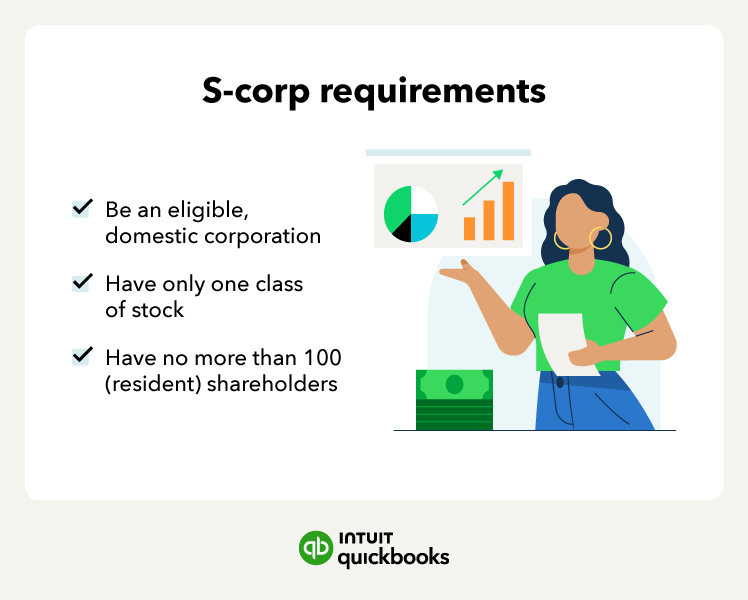

Shareholder and stock limits

To qualify for S-corp status, a business must meet strict IRS requirements. These include having no more than 100 shareholders, all of whom must be US citizens or residents. The company can only have a single class of stock.

Although an S-corp has unique taxation requirements, there are payroll services for S corporations available. If these tax write-off wins sound advantageous for your business, it’s time to consider whether an S-corp is right for you.