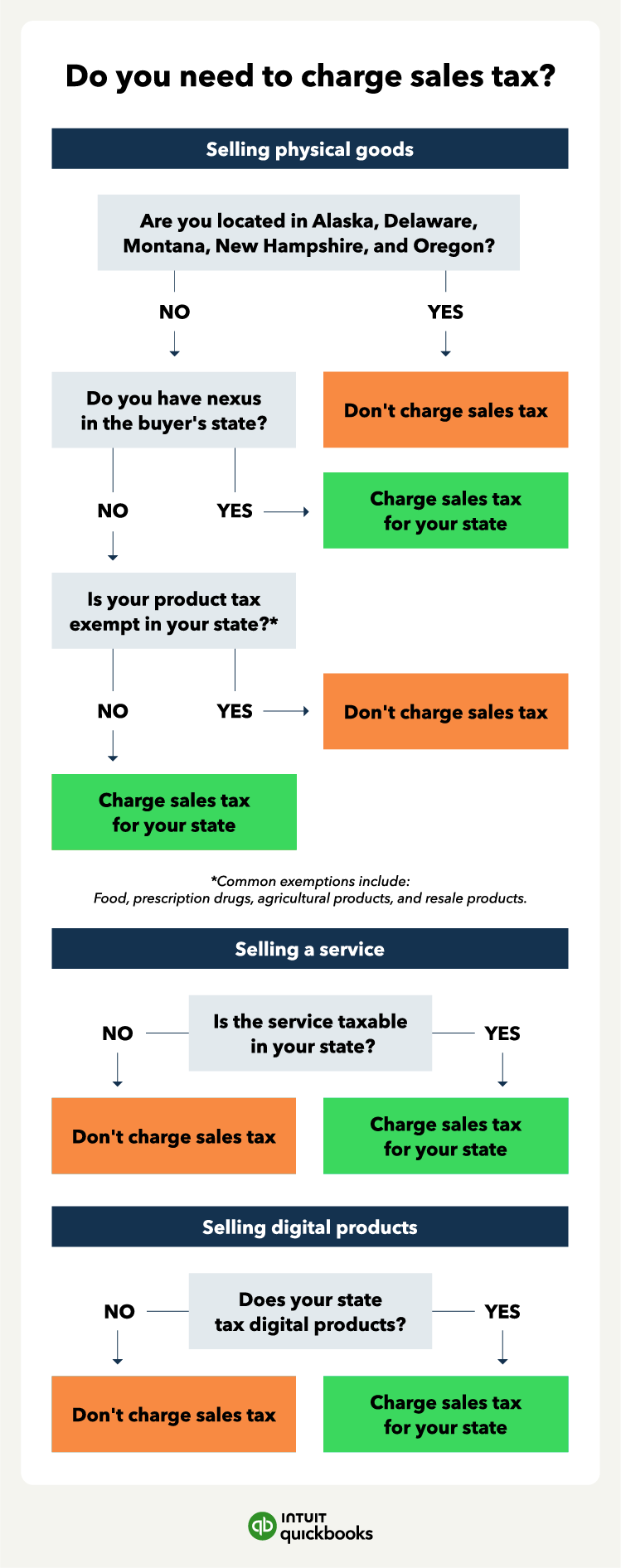

The remaining 41 states might require business owners to charge sales tax on services—although plenty still don’t. Taxes will depend on the type of service they offer, so it’s best to consult an accountant for advice.

Generally, services fall into one of the following six buckets:

- Amusement and recreation: Providing admission to recreational activities, theme parks, and other forms of entertainment and enjoyment. For example, a small concert venue that showcases local music acts.

- Business services: Providing services for other companies rather than individual consumers. For example,an extermination service that specializes in eliminating pests from office buildings.

- Personal services: Providing services to individual customers. Service-based businesses in this category typically fall into the personal grooming category. For example, a mom-and-pop barbershop.

- Professional services: Providing services that require specialized expertise, training, and, often, a license. For example, a consulting business or a law firm specializing in intellectual property law.

- Services to tangible personal property: Providing services to improve or fix TPP. For example, a mechanic with a small engine repair shop.

- Services to real property: Providing services to improve or repair land or buildings. For example, a custodial company that cleans and completes small repairs for various commercial buildings.

States will tax those categories differently or even not at all. For example, Alabama charges sales tax only for amusement and recreation services, while Virginia charges sales tax only for services to TPP.

Most religious and nonprofit organizations are exempt from sales tax. Check with an accountant or tax professional in your state to confirm whether your service-based business has a sales tax exemption.

Digital products

Sales tax laws get even trickier when talking about online sales of digital products, such as intangible products purchased and downloaded or accessed online.

This area continues to evolve, and several states haven’t yet clearly stated how they’ll charge digital products. Some states treat them like tangible personal property, while others treat them as tax-exempt.

Additionally, some states distinguish between software and digital products. Others tax differently depending on people accessing the product (whether it’s downloaded to a personal device or accessed online).

Out-of-state

Considering there are 50 different states (each with its complex tax laws), it’s no surprise that business owners are daunted by out-of-state sales taxes.

Out-of-state sellers, also called remote sellers, generally won’t need to collect taxes from their customers unless they have a nexus within that state.

Translated as a “connection,” a nexus means that your business meets one or more of the following criteria:

- Your business has a physical location in that state

- Some of your employees reside in and work in that state

- Your business has property (including intangible property like trademarks, copyrights, and patents) in that state

- Your employees regularly seek or perform business in that state (for example, you have an active salesperson in that state)

So, many online sellers can ship goods out of state without charging or collecting sales tax, provided they don’t have a physical presence in that state.

You might come across one more term as you research your state tax rates: use tax, a type of excise tax. The IRS defines use tax as a tax imposed on the sale of specific goods or services or certain uses.

Use tax is often used for out-of-state purchases but is generally not the seller’s responsibility. In most cases, the purchaser should declare and file this tax in their home state.

Each state has its own list of taxable goods. In most cases, you can find it on your

Each state has its own list of taxable goods. In most cases, you can find it on your  In some states, you'll also have to obtain a seller’s permit at the state level. In others, you'll also have to obtain a license from your city, county, or jurisdiction.

In some states, you'll also have to obtain a seller’s permit at the state level. In others, you'll also have to obtain a license from your city, county, or jurisdiction.