Forms 1099-MISC vs. 1099-NEC: How to file each

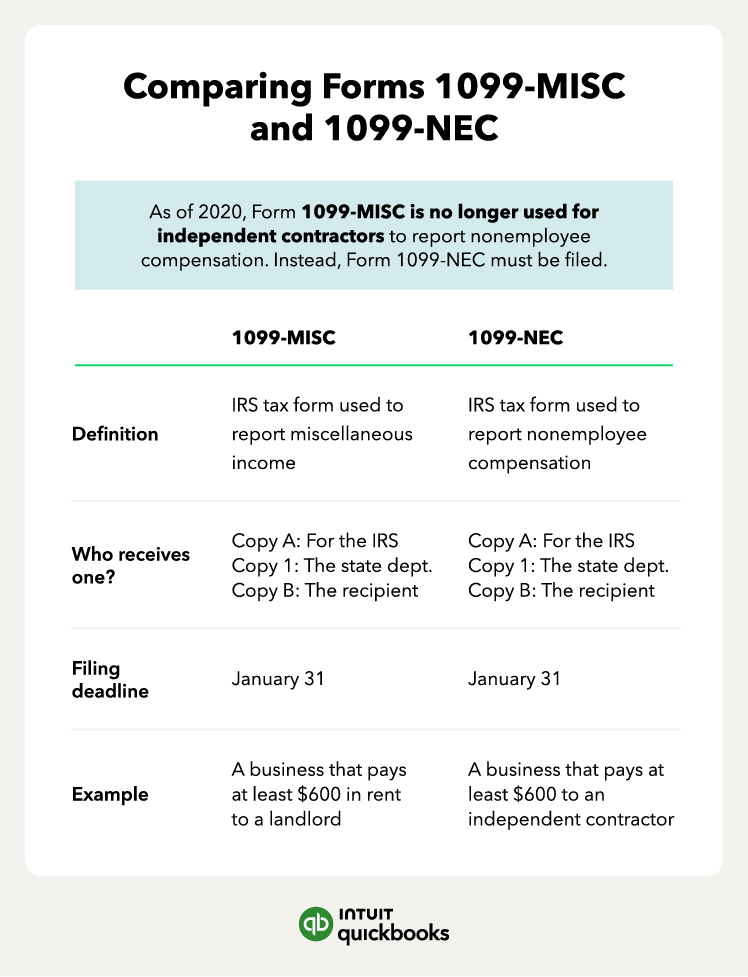

When preparing to file your 1099 forms by the deadline, the first step is to ensure you have them ready by the deadline. A key difference between 1099-MISC and 1099-NEC forms is the filing deadline. The filing deadline for these two forms is:

- Form 1099-MISC: March 31 if filing electronically (Feb 28 if filing paper copies)

- Form 1099-NEC: Jan 31

As for the rest of the process, let’s look at where each copy goes:

1. Filing with the IRS

Filing Copy A with the IRS is a crucial part of the tax filing process for both forms. There are two methods for filing Copy A:

- Electronic filing: This is the fastest way to get it done. You’ll use the IRS’ FIRE (Filing Information Returns Electronically) system, which allows you to submit your forms faster with fewer errors. If you use accounting software with payroll integrations like QuickBooks Payroll, you can e-file directly from your software.

- Paper filing: This is the slower option. You’ll submit your copies by mail to a specific address, depending on where your business is.

If you use accounting software or contractor payment services, they can likely file electronically for you.

2. Sending copies to the recipient

Next, you’ll send the recipient their copies—Copy B and Copy 2. With their consent, you can send the form electronically. Again, if you use software or a service, they can likely send these for you.

3. State filing requirements

State filing requirements for Forms 1099-MISC and 1099-NEC vary depending on the state. Some states require you to file these forms with the state, while others do not have such requirements.

States exempt from 1099 filing include Alaska, Florida, Illinois, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming. If you are a business or independent contractor operating in these states, you do not have to submit 1099 forms to the state.

Filing requirements can change, so you’ll want to check with each state's tax authority for the most up-to-date information.

Keep detailed records of all 1099 payments to simply file and ensure timely submissions.

Organize contracts, invoices, and payments for easy access during tax season.

Keep detailed records of all 1099 payments to simply file and ensure timely submissions.

Organize contracts, invoices, and payments for easy access during tax season.