Keeping up with tax compliance often feels like trying to hit a moving target. This year is no exception, as 2026 brings some of the biggest 1099 shakeups we’ve seen in decades. Whether you’re hiring a freelancer, paying rent for your office, or watching your business savings grow through interest, those 1099 forms are the essential link between your bank account and the IRS.

Recent legislation just shifted the goalposts by raising reporting thresholds and making digital filing the new standard for nearly every business. Mastering these updates optimizes your bookkeeping and protects you from 2026’s increased penalties.

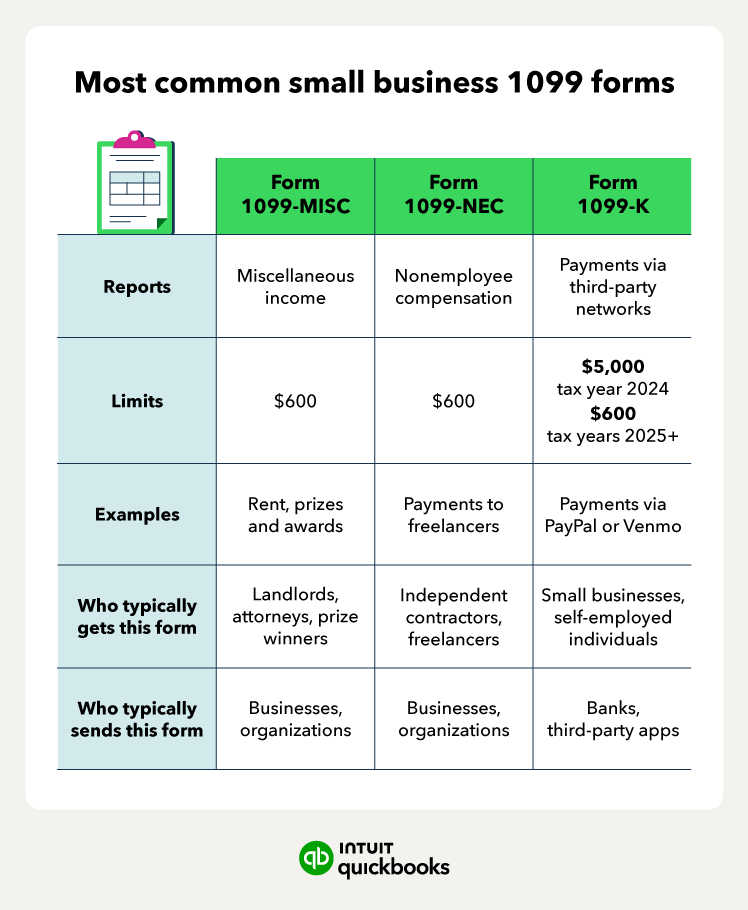

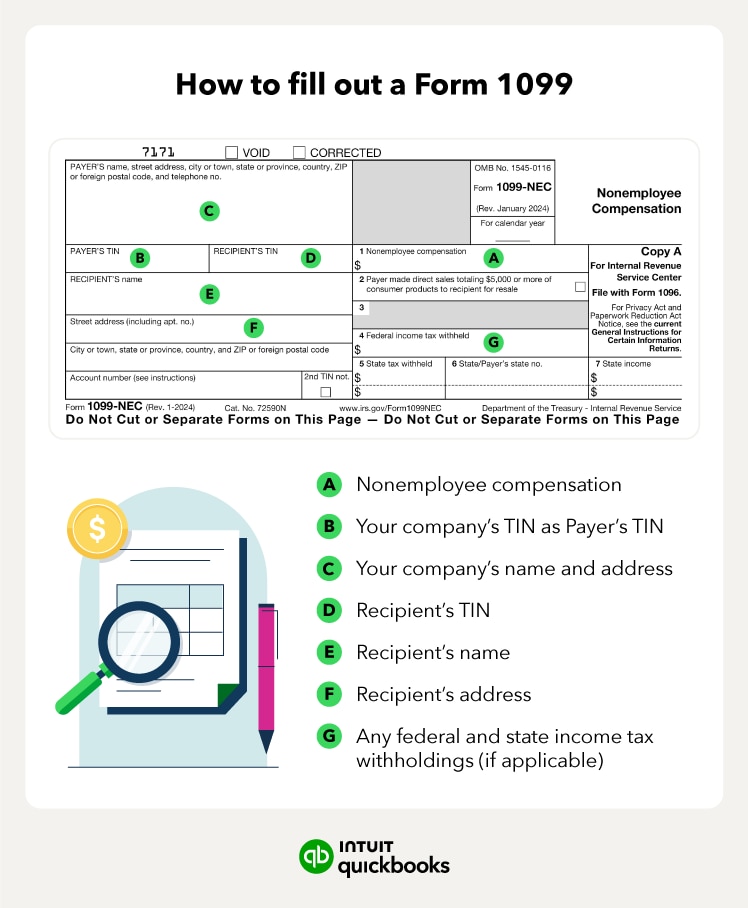

In this guide, we’ll break down the latest 1099 rules, clear up the confusion between different form types, and share the best ways to automate your filing so you can spend less time on paperwork and more time growing your business.