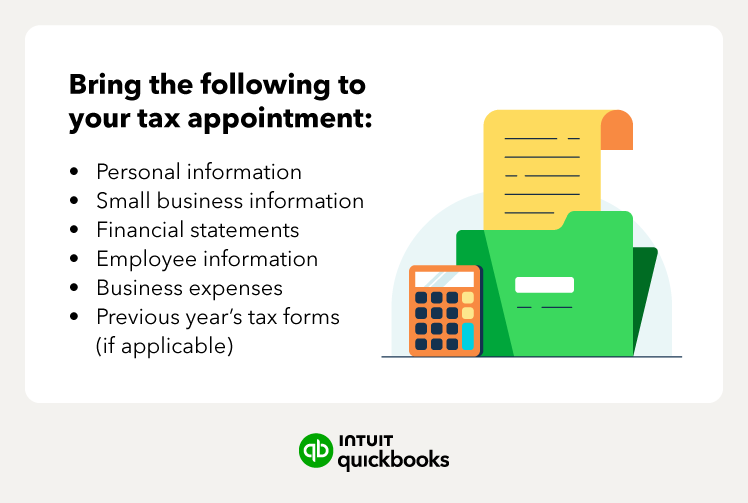

If you’re working with a tax preparer for the first time, keep in mind that the process is not completely hands-off. You will need to provide the preparer with the information they’ll need to complete your small business tax return.

Here’s what to give your accountant for small business taxes:

Personal information

This includes information you would normally provide on an income tax return, such as your legal name, address, and Social Security number, among other things. If you completed a small business tax return last year, simply bring the old tax forms along with you, as they should include all of the above information.

Your previous small business tax returns will also give your tax preparer a high-level view of your business needs and the previous tax year’s deductions.

Small business information

In addition to your personal information, you’ll need to provide information about your small business. That includes your Employer Identification Number (EIN), if you have one, as well as your legal business name. This, too, will be listed on last year’s income tax return if you have it.

If you lost or misplaced your EIN, the IRS advises you to look for the computer-generated notice sent when you applied for it, find a previous tax return, or contact them.

Financial statements

You can find the bulk of the information you’ll need to give to your tax preparer in your financial statements. This includes things like:

These documents will provide your tax professional with information about the financial standing of your company. This financial information includes business income, business expenses, and the origins and recipients of those payments.

Relevant tax forms

It’s important to bring your tax forms with you to your appointment. Do you have employees or contractors? If so, you’ll need to provide your tax preparer with payroll information.

You’ll also need to provide a W-2 for each employee. Finally, you’ll need to file a 1099-MISC for each contractor to whom you paid $600 or more over the year.

And if you provide health insurance to your employees, gather that information as well—it can be used as a tax deduction for your business.

Business expenses

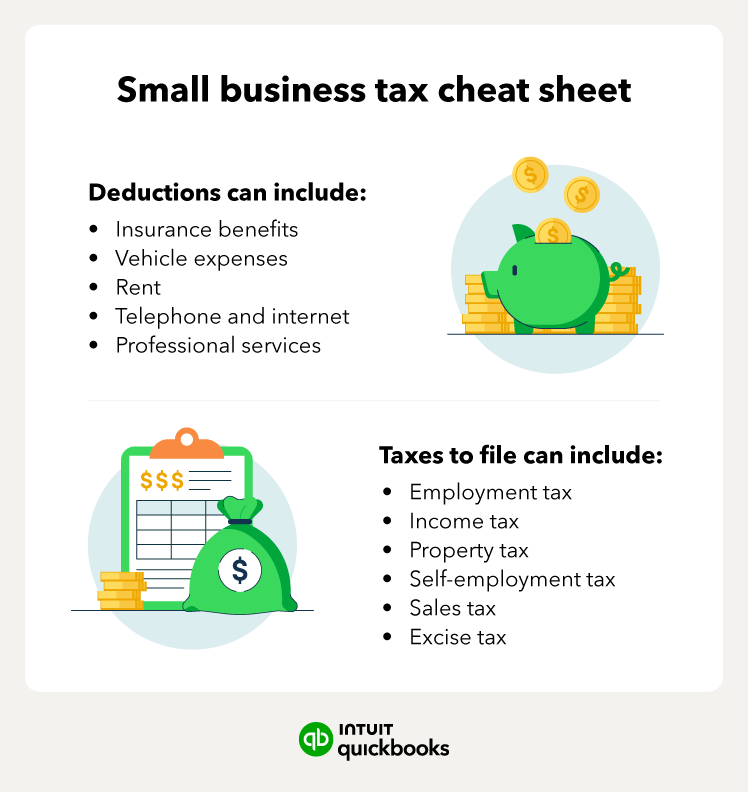

Gather all information about any business-related expenses to be considered for tax deductions. This is also a great time to gather your full business records. The list of relevant expenses is lengthy but includes things such as:

Expenses relating to your office, including:

- Rent

- Utilities

- Office supplies

- Wi-Fi and phone

Travel expenses, including:

- Motor vehicle expenses

- Flights

- Meals

- Hotels

Legal and professional fees, including:

- Bookkeeping services

- Legal consult

- Accounting services

If you have any questions on the information you need, it’s best to consult your tax advisor prior to your appointment to file your small business taxes.