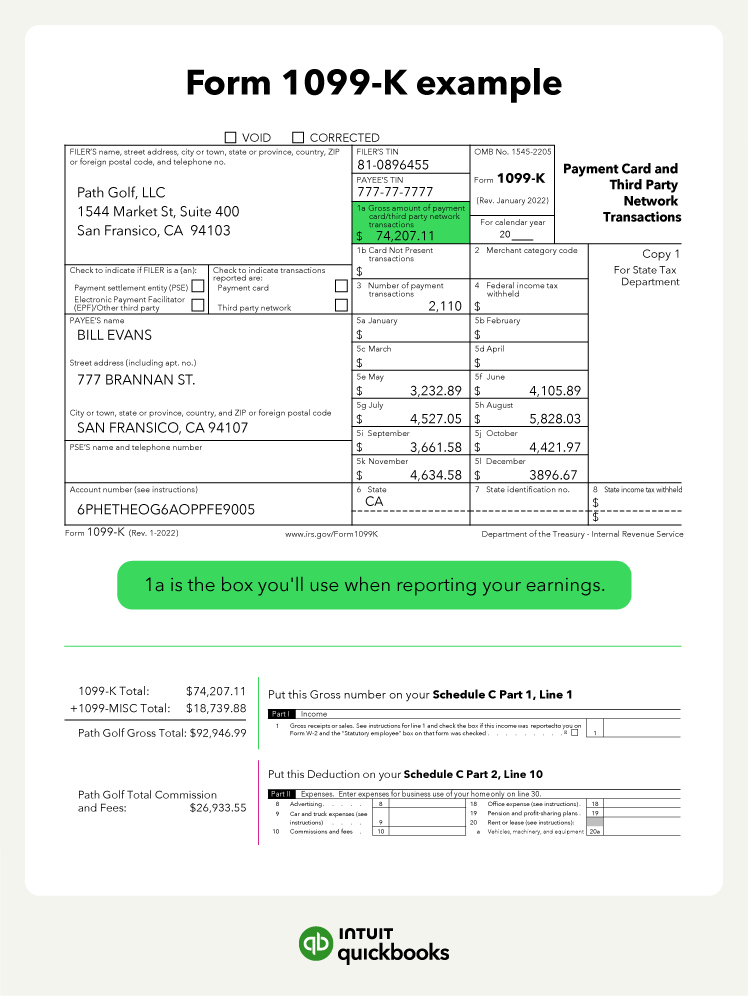

As a small business owner, you're likely familiar with the mountain of tax paperwork that comes with the territory, from issuing W-2 Forms to your employees or gathering your income and expenses for your tax return. One other form you might encounter is Form 1099-K, which reports certain payment transactions.

For the 2026 tax filing season, the IRS has significantly changed the rules around Form 1099-K. The One Big Beautiful Bill Act (OBBBA), signed into law in July 2025, retroactively reinstated the previous federal threshold: $20,000 in gross payments and more than 200 transactions.

You likely won't receive a 1099-K in the upcoming filing season unless you meet both of those requirements. However, since each payment processor tracks this independently, your reporting responsibilities can still feel like a moving target.

Let's explore what Form 1099-K is, why you're receiving it (if you get one), and what you need to do.

Jump to: