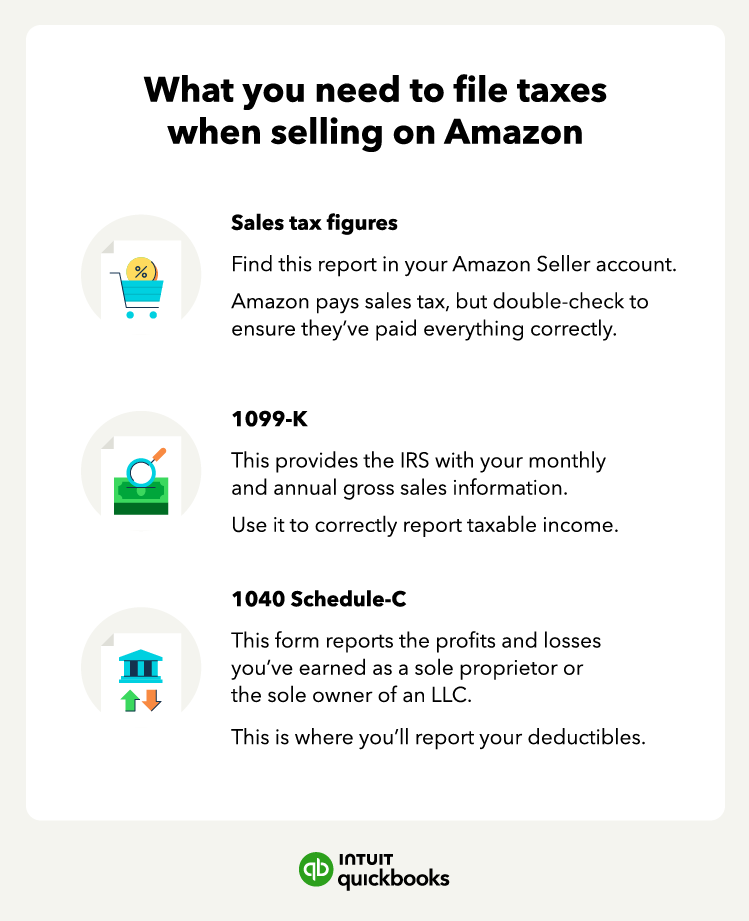

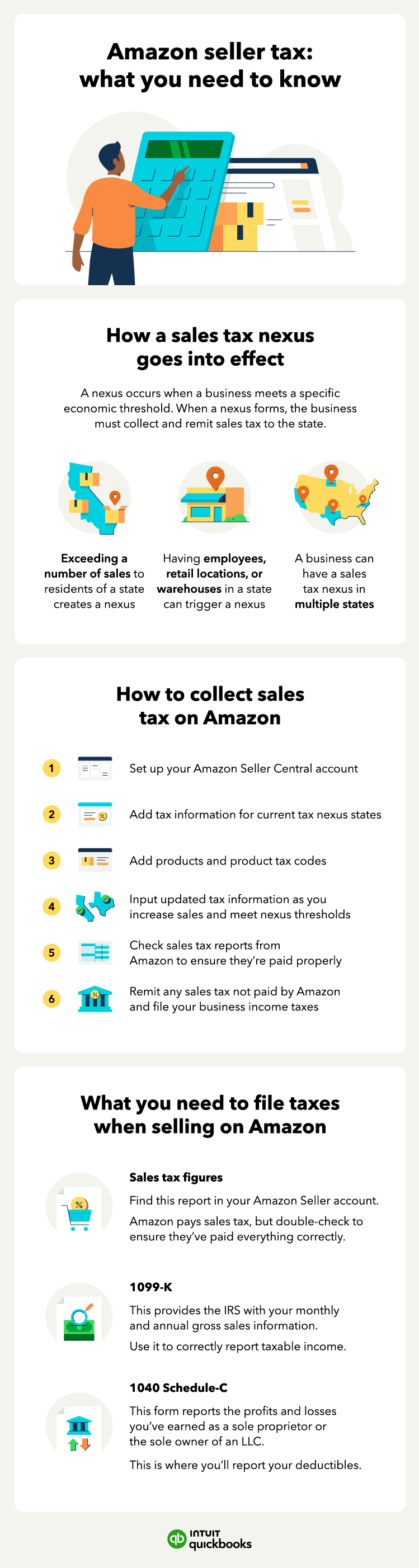

Just because Amazon handles sales tax on your behalf doesn’t mean they take care of any income tax your business owes. You’ll need to access to several small business tax forms, including your sales tax figures, your 1099-K tax form, and a 1040 Schedule-C when you file your income taxes.

Sales tax

If you sell items at a retail establishment or through your own website, you’ll need to collect and remit sales tax on those items. Most point-of-sale systems will have these tax amounts built in, but you can also use a sales tax calculator to ensure you’re charging the right amount.

Even though Amazon takes care of paying sales tax on your behalf, you’ll still need to report it on your income tax return. You can find Amazon seller tax forms in your Seller Central account.

- Navigate to the “Reports” section and find the Tax Document Library

- Look for the “Sales Tax Reports” section and click the button that says “Generate Tax Report”

- You can choose from 1 of 3 reports: the Sales Tax Calculation Report is for the sales tax that you are responsible for paying, the Marketplace Tax Collection Report covers all of the taxes that Amazon has collected and remitted for you, and the Combined Sales Tax Report covers both.

With that information, you can file and pay taxes according to the proper schedule.

1099-K tax forms

IRS form 1099-K is used to report payment card and third-party network transactions. Individual online sellers don’t need to complete a 1099-K themselves. Amazon will handle this and send the form to both the IRS and the sellers if the sellers meet specific criteria.

Starting with the 2025 tax year (for forms issued in early 2026), sellers will receive the 1099-K if their sales have reached $2,500 or more. This is part of a phased approach by the IRS, which has delayed the implementation of the $600 threshold originally mandated by the American Rescue Plan Act. The timeline for further lowering the threshold has not been specified. Keep in mind that while the reporting threshold is changing, all taxable income still needs to be reported, regardless of whether a 1099-K is received or not.

Amazon requires professional and individual sellers with more than 50 yearly transactions to also provide their tax information, even if they don't meet the above criteria. Otherwise they may risk losing seller status. Though this isn’t a requirement from the IRS, Amazon does this to ensure they have everyone’s tax information to comply with all IRS regulations.

1040 Schedule-C

If you’re operating as a sole proprietorship or the sole owner of an LLC in your state, and you have a business license, you’ll need to file Schedule C or Form 1040. Generally speaking, you don’t need a business license to become a seller on Amazon. However, some states will require you to get one. The criteria for getting a business license differ by state, but if you have employees, inventories, and offices in multiple states, you’ll probably need one.

If you’re just running a one-person operation out of your home, you likely won’t need one. It’s crucial to check your state’s requirements to avoid any mistakes. Remember that you’ll need to report income to the IRS whether you have a business license or not.

Deductions for Amazon sellers

Amazon sellers can claim deductibles on things like home office expenses and education costs. Make sure to keep all receipts that can be related to your online activities. Here are some important deductions that may come in handy for sellers:

- Amount you paid for goods sold, including the wholesale price or the cost of manufacturing

- Shipping costs, including supplies and fees

- Home office expenses, including computers, office furniture, office supplies

- Amazon Seller fees

- Mileage

- Donations

- Subscriptions

- Education related to e-commerce and online business

- Accounting, tax, POS, and inventory software

- Advertising, including digital ads, business cards, print materials

- Salary and benefit costs

- Consultant fees, including attorneys, accountants, copywriters, and web designers

It’s always a good idea to take advantage of tax breaks for small businesses so you can keep your company growing.