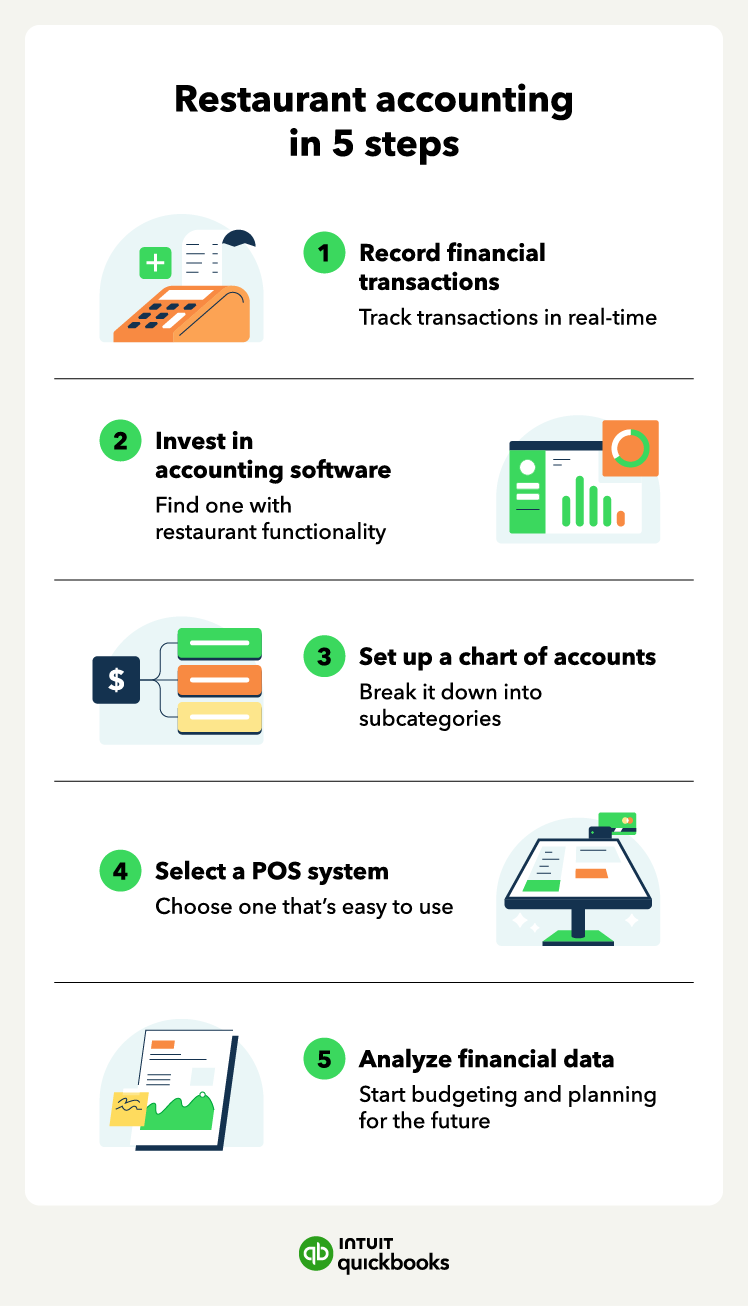

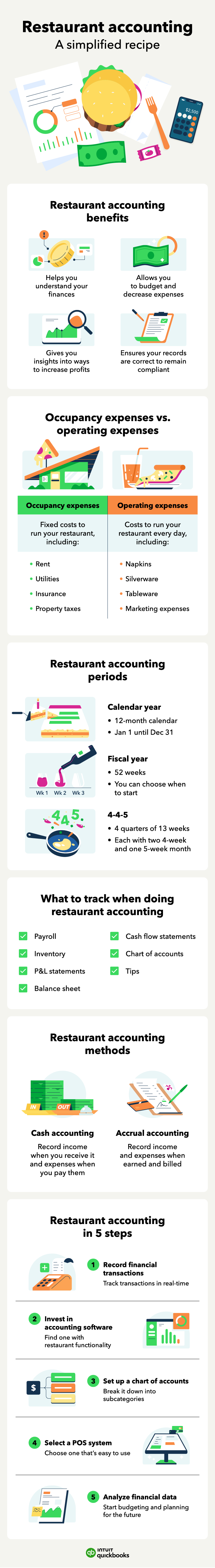

1. Record your financial transactions

The first step is to record and keep track of your restaurant’s financial transactions, including expenses, sales, and payments. Make a habit of tracking in real-time any transactions you make and spend time at the end of each day to document them.

Ensure that you keep all receipts and invoices organized and record your transactions accurately. For this step, it can be helpful to hire a bookkeeper to do this for you so you can focus on other parts of your business.

2. Use accounting software

Whether you hire a restaurant accountant or do it yourself, it’s important to invest in accounting software to streamline the process. Consider software that has specific functionality for your restaurants and integrates with your restaurant management system.

Here are some accounting software options to consider:

- QuickBooks: simplified accounting for restaurants that lets you monitor your transactions, create customized reports, and capture delivery orders and supply pickup trips.

- Restaurant365: restaurant management software with accounting functionalities, including sales and labor data, daily journal entries, and expense tracking tools.

- MarginEdge: another restaurant management software that helps you manage food costs, track inventory, and automatically export sales and labor data into other accounting software.

With restaurant accounting software, you can create financial statements, like income statements, cash flow statements, and balance sheets. Which provides a snapshot of your restaurant’s financial health so you can make informed decisions about pricing and budgeting.

3. Set up a chart of accounts

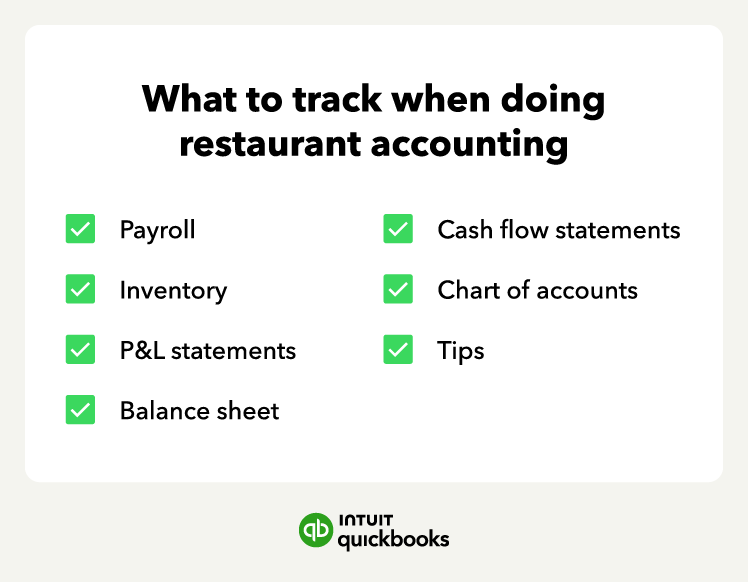

Next, set up a chart of accounts, which is a system that organizes your restaurant’s accounts into categories, such as assets, liabilities, income, and expenses.

You can break these categories into subcategories to provide a more digestible breakdown of your financial transactions, such as food and beverage, marketing, and labor costs. A chart of accounts makes it easier to locate specific accounts to identify trends, generate accurate financial statements, and make improvements.

4. Pick a point-of-sale system

After setting up a chart of accounts, you should pick a point-of-sale (POS) system to process your restaurant’s transactions and streamline your operations. The POS system usually includes an electronic cash register and a software system that tracks purchases daily.

It’s important to get a user-friendly system that meets your restaurant's needs and integrates with your accounting software. A POS system helps you automate tasks such as tracking inventory, creating sales reports, processing customer orders, and employee tips.

5. Analyze your financial data

The last step is analyzing your financial data to budget and plan for the future. Plan to analyze your financial data weekly and for each period, and work with your accountant (if you have one) to set financial goals and develop strategies to achieve them.

For example, you can set a goal to reduce expenses or increase revenue. You can use your financial data to budget and plan your restaurant’s long-term success.

Outsourcing vs. in-house restaurant accounting

Whether you're not the best with numbers or want to focus on the food, you might be wondering if you should do restaurant accounting in-house or outsource it.

When outsourcing bookkeepers or accountants, you’ll hire an external company to take care of your restaurant accounting, which includes a couple of benefits:

- More expertise: Restaurant accountants are experts in the area and specialize in managing restaurant finances, which gives you more accurate records.

- Saves money: You won’t need to hire them full-time, provide office space, or invest in accounting software since they usually have that already.

- Saves time: Gives you more time to focus on managing your restaurant instead of doing accounting or overseeing an accountant.

On the downside, outsourcing accounting for your restaurant could lead to communication lapses, especially if they’re in a different time zone or city. You’ll also give them your financial information, trust their financial decisions, and might have to pay a higher price upfront.