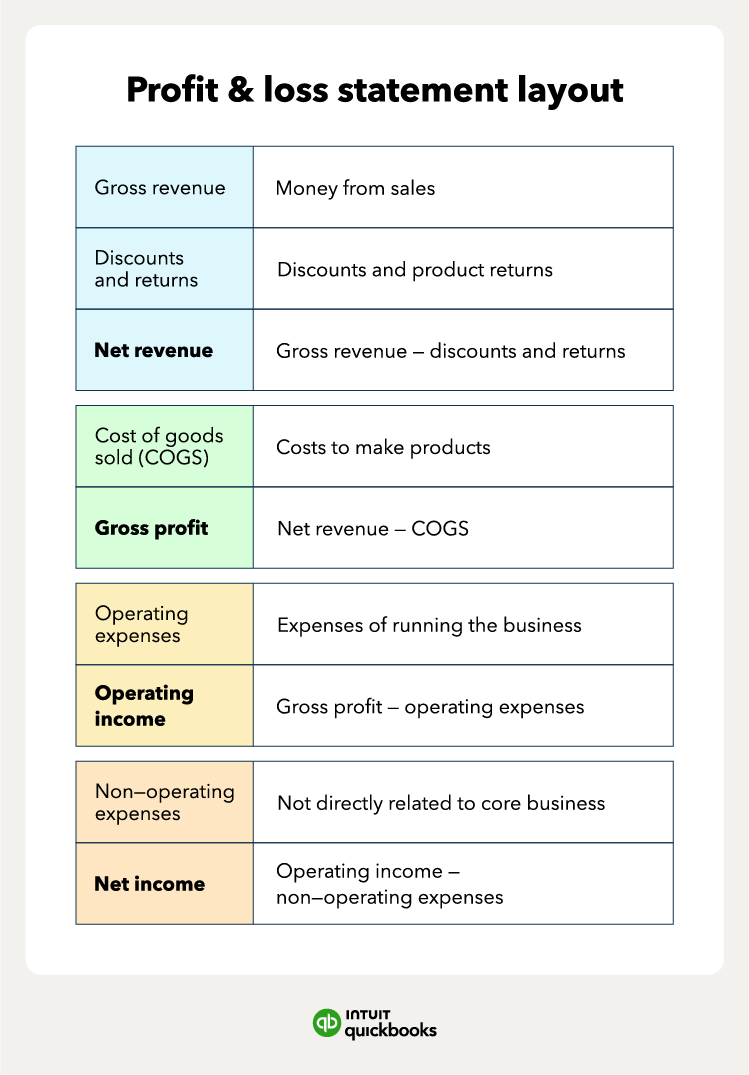

Revenue

Revenue is the money your business makes from selling goods or services. It’s the very first line on the profit and loss statement. Note there are two types of revenue:

- Gross revenue, or total revenue or sales, is the total amount you make before accounting for discounts, returns, or expenses.

- Net revenue, also known as net sales, is the money you make after deducting discounts and returns.

Note that net revenue is gross revenue minus discounts and returns.

Expenses

The expenses of a business include all the costs to generate revenue.

Cost of goods sold (COGS) is the cost of materials and labor a company uses to make a product or service. It’s also known as the cost of sales. The costs can include raw materials or direct wages for employees. But also certain overhead costs, such as utilities.

COGS are expenses that show up on the top part of the P&L before gross profit. Gross profit is the money you make from sales after subtracting your cost of goods sold, using the formula:

Gross profit = Net revenue - Cost of goods sold

Other expenses can be operating or non-operating.

Operating expenses are the costs of running your business. While COGS are for making a product, operating expenses are the costs to support that process. Operating expenses include:

- Rent

- Marketing costs

- Salaries for admin staff

- Depreciation

- Licensing fees

Non-operating expenses are costs not part of your core operations. These include taxes, fines, legal fees, and interest. Non-operating expenses include anything unlikely to happen again. For example, losses due to shutting down a business operation.

Consider creating a quarterly profit and loss statement. This will help you see where your business stands throughout the year so you can adjust your strategies as needed.

Consider creating a quarterly profit and loss statement. This will help you see where your business stands throughout the year so you can adjust your strategies as needed.