Managing business finances doesn’t have to be the bane of your professional existence. Nor does it have to take you away from the personal reasons you started your company in the first place.

Instead, the basics of small business accounting come down to a handful of best practices and only three essential reports: your balance sheet, income statement, and cash flow statement. These might sound like they require a professional bookkeeper, but the truth is far from it.

The following accounting checklist lays out a recommended timeline for the accounting functions that will show the state of your business and allow you to streamline your tax preparation. For a thorough understanding of business accounting, continue reading. If you’re looking for a specific answer, use the links below to jump to a section of your choosing.

What is business accounting?

Whether you’re the proud owner of a new startup or entering your 10th year working your way up the ladder, you may be wondering, “what is business accounting?” A simple business accounting definition goes as follows:

Business accounting is the process of gathering and analyzing financial information on business activity, recording transactions, and producing financial statements.

Business accounting is important for a variety of reasons. Keeping tabs on all of your assets, liabilities, inventory, and other records can help you secure investors, protect your assets from theft, and find ways to grow your company and take it to the next level. Primary duties of small business accounting include bookkeeping, preparing and filing tax returns, and drafting financial reports.

- Through business accounting, you can better manage your finances to make informed financial decisions for your company. Many small business owners take on accounting themselves in the early stages to save money. If you’re in the same boat, it’s essential you have a firm grasp on business accounting basics.

Business accounting basics

There are a few business accounting basics you should understand to ensure your business operations run smoothly. While you may be an expert at sales or marketing, you should never undermine the importance of basic accounting. Without a clear financial picture, it can be nearly impossible to move your business forward. Below, you’ll find important accounting terms and principles that can help you get started. For a more in-depth understanding, take a look at our accounting terms and accounting principles articles.

- Accounts payable is money that you owe to creditors and vendors, which are listed as liabilities because you are legally obligated to pay.

- Accounts receivable is money owed by customers for any purchase of goods or services they made, which is often listed as a creditable asset because they are legally obligated to pay.

- Accrual basis accounting is an accounting method in which businesses recognize revenues and expenses at the time of a sale.

- Assets are anything your company owns that has value, such as bank accounts, accounts receivable, inventory, furniture, equipment, and real estate.

- Balance sheet is a financial document that serves as a snapshot of your company’s financial standing at the end of a specific period. It includes your business’s assets, liabilities, and shareholder’s equity.

- Cash basis accounting is an accounting method in which businesses recognize a sale when a payment is received.

- Double-entry bookkeeping is a bookkeeping method in which accountants make two entries for every transaction. There are two corresponding sides that must be equal, with one side listing debits and another side listing credits.

- Liabilities are anything considered a debt or financial obligation to a company, such as accounts payable, income taxes, wages, loans, and other accounts owed.

- Profit and loss statement, also referred to as the income statement, reports earnings, expenses, and net profits for a specific period.

How to do small business accounting

Accounting is an essential part of running a business, whether you’re a small mom-and-pop shop or a large corporation. With the business accounting basics under your belt, you’ll be able to get started on keeping track of your company’s financial information. Small business accounting is done by recording all of the income and expenses your company generates and using that information to make forecasts, generate invoices, complete payroll, and file taxes.

While accounting may not be what motivates you to go to work every day, it’s a part of the job. There are daily, weekly, monthly, quarterly, and annual accounting tasks you need to complete to ensure your business’s success. Not every small business can hire the help of a Certified Public Accountant (CPA) to produce financial records, manage cash flow, complete tax returns, and analyze the financial health of their company.

At QuickBooks, our business accounting software is intuitive and easy to use, to ensure you can achieve these tasks with ease. From managing your taxes to generating financial reports, our business accounting software can make running your business easier than ever. Take a look at the accounting duties you will have to manage for your business below.

Daily business accounting tasks

When it comes to daily accounting business needs, you have a pretty light plate. You have plenty of financial statements to review every week, month, quarter, and so on, but your daily business accounting responsibilities consist of one main task.

1. Check cash position

Since cash is the fuel for your business, you never want to be running on or near empty. Start your day by checking how much cash you have. Knowing how much you expect to receive and how much you expect to pay during the upcoming weeks and months is important too.

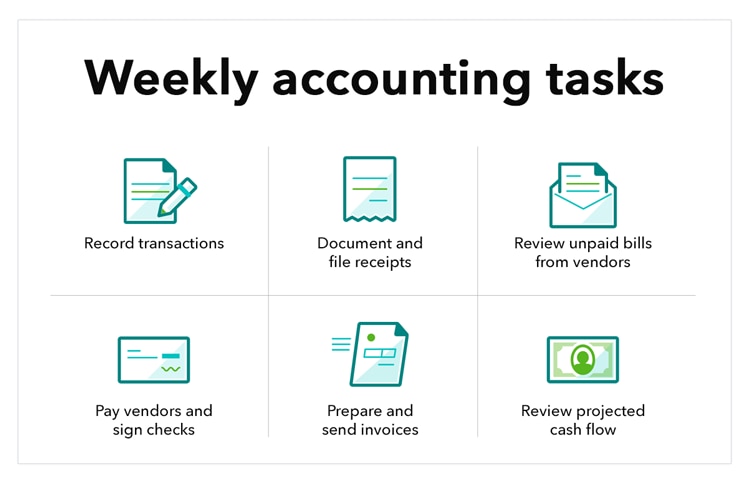

Weekly accounting tasks

Weekly accounting tasks are a little more involved. They include invoicing, financial data management, and other business bank account fun. This is where having a great accounting system really pays off.

2. Record transactions

Record each transaction (billing customers, receiving cash from customers, paying vendors, etc.) daily or weekly, depending on volume. Although recording transactions manually or in a digital spreadsheet is acceptable, it is probably easier to use a small business accounting software like QuickBooks. The benefits and control far outweigh the cost.

3. Document and file receipts

Keep copies of all invoices sent, all cash receipts (cash, check, and credit card deposits), and all cash payments (cash, check, credit card statements, etc.).

Start a vendor file sorted alphabetically for easy access. Create a payroll file sorted by payroll date and a bank statement file sorted by month. A common habit is to toss all paper receipts into a box and try to decipher them at tax time, but unless you have a very small volume of transactions, it’s better to organize separate files for assorted receipts as they come in. Many accounting software systems let you scan paper receipts and avoid physical files altogether.

4. Review unpaid bills from vendors

Every business should have an “unpaid vendors” folder. Keep a record of each of your vendors that includes billing dates, amounts due, and payment due dates. If vendors offer discounts for early payment, you may want to take advantage.

5. Pay vendors and sign checks

Track your accounts payable and have funds earmarked to pay your suppliers on time to avoid late fees and disgruntled associates. If you can extend payment dates to net 60 or net 90, all the better. Whether you make payments online or drop a check in the mail, keep copies of invoices sent and received using accounting software to really make things easier during tax time.

6. Prepare and send invoices

Be sure to include payment terms. Most invoices are due within 30 days, noted as “Net 30” at the bottom of your invoice. Without a due date, you will have more trouble forecasting monthly revenue. Read more about getting paid faster in our guide to getting invoices paid on time.

7. Review projected cash flow

Managing your cash flow is critical, especially in the first year of your business. Forecasting how much cash you will need in the coming weeks and months will help you reserve enough money to pay bills and your employees and suppliers. Plus, you can make more informed business decisions about how to spend your cash.

All you need is a simple statement showing your current cash position, expected upcoming cash receipts, and expected cash payments for this period. This is known as a cash flow statement.

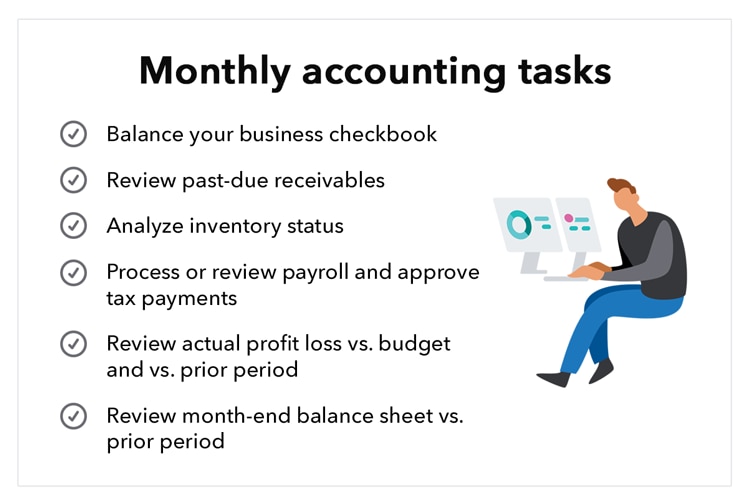

Monthly accounting tasks

Whether you have a seasoned or new business, brick and mortar shop, or online store, you need to handle numerous monthly accounting tasks.

8. Balance your business checkbook

Just as you reconcile your personal checking account, you need to know that your cash business transaction entries are accurate and that you are working with the correct cash position. Reconciling your cash makes it easier to discover and correct any errors or omissions—either by you or by the bank—in time to correct them.

9. Review past-due receivables

Be sure to include an “aging” column to separate “open invoices” by the number of days a bill is past due. This gives you a quick view of outstanding customer payments. The beginning of the month is a good time to send overdue reminder statements to customers, clients, and anyone else who owes you money.

At the end of your fiscal year, you will look at this account again to determine what receivables you will need to send to collections or write off for a deduction.

10. Analyze inventory status

If you’re managing inventory, set aside time to reorder products that sell quickly and identify others that are moving slowly and may have to be marked down or written off. If you check regularly (and compare to prior months’ numbers), it’s easier to make adjustments so you are neither short nor overloaded.

11. Process or review payroll and approve tax payments

While you have an established schedule to pay your employees (usually semimonthly), you need to meet payroll tax requirements based on federal, state, and local laws at different times, so be sure to withhold, report, and deposit the applicable income tax, Social Security, Medicare, and disability taxes to the appropriate agencies on the required dates.

Review the payroll summary before payments are disbursed to avoid making corrections during the next payroll period. A payroll service provider can do all this to save you time and ensure accuracy at a reasonable cost. You can also use our free paycheck calculator to figure out what you need to withhold from each paycheck.

12. Review actual profit loss vs. budget and vs. prior period

Your profit and loss statement (also known as P&L or an income statement), both for the current month and year-to-date, tells you how much you earned and how much you spent. Measure it against your monthly or quarterly budget. Comparing your actual numbers to your planned numbers highlights where you may spend too much or not enough.

If you have not prepared a budget, compare your current year-to-date P&L with the same prior period, year-to-date income statement to identify variances and make adjustments.

13. Review month-end balance sheet vs. prior period

By comparing your balance sheet at one date—June 30, 2019, for example—to a balance sheet from an earlier date—December 31, 2018—you get a picture of how you are managing assets and liabilities. The key is to look for what is significantly up and/or down and understand why. For example, if your accounts receivable are up, is it due to increased recent sales or because of slower payments from customers?

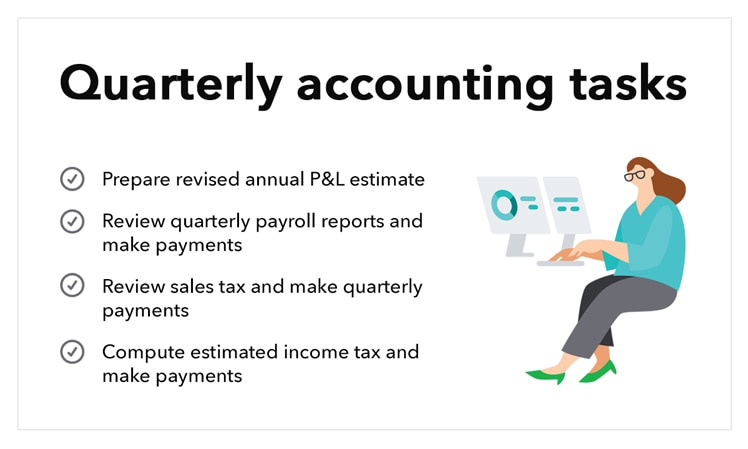

Quarterly accounting tasks

As Benjamin Franklin almost said, “…in this world, nothing can be said to be certain, except tax season and the importance of thorough bookkeeping.” (Just take my word for it and don’t fact-check that quote.)

The quarterly accounting tasks largely deal with the big picture elements of running a small business or being self-employed: tax estimates, quarterly payments, and a constant reminder that you need a great accounting solution.

14. Prepare revised annual P&L estimate

It’s time to evaluate how much money you are actually making, whether your net assets are going up or down, the difference between revenues and expenses, what caused those changes, and how you spend profits. While you’re at it, you’ll identify trouble spots and make adjustments to improve sales and margins.

15. Review quarterly payroll reports and make payments

You have been reviewing your semimonthly payroll reports. However, the IRS and most states require quarterly payroll reports and any remaining quarterly payments. Again, it’s best if your payroll service provider completes these reports and files them. Your job is to review payroll processes and data to make sure they appear reasonable. To ensure you are keeping best practices, view our What Is Payroll guide, created by accounting experts.

16. Review sales tax and make quarterly payments

If your company operates in a state that requires sales tax, make sure you comply to avoid serious penalties. The U.S. Small Business Administration (SBA) can help you determine your state tax obligations. You can also use our free sales tax calculator to help calculate sales tax.

17. Compute estimated income tax and make payments

The IRS collects income taxes, as do most states. Review your year-to-date P&L to see if you owe any estimated taxes for that quarter. Your tax accountant can assist if necessary.

Annual business accounting tasks

Once a year, you celebrate a few things: your birthday, important anniversaries, and probably some holidays. You likely don’t have “inventory review” or “tax filing” on your list of things to celebrate, but they’re still important—especially when we’re talking about annual accounting tasks.

18. Review past-due receivables

Now it’s time to check significant past due receivables and decide whether you think customers will eventually pay, whether to send past due bills to a collection agency, or whether to write them off for a deduction.

19. Review your inventory

Review your current inventory to determine the value of items not sold. Any write-down of inventory translates to a deduction on your year-end taxes. If you do not write down unsellable inventory, you are overstating your inventory balance and paying additional taxes that you don’t owe.

20. Fill out IRS forms W-2 and 1099-MISC

The IRS has a January 31 deadline for reporting the annual earnings of your full-time employees (W-2s) and most independent contractors (1099s). This deadline includes mailing copies of the tax forms to the people who worked for you.

Note: A 1099 form is not required for contractors who earned less than $600. Consider saving time and avoiding errors with an e-filing service.

For help determining whether your worker is an independent contractor or an employee, see our 1099 vs. W2 article. If you employ independent contractors or freelancers, check out our How to File 1099 guide.

21. Review and approve full-year financial reports and tax returns

At tax time, carefully review your company’s full-year financial reports before giving them to your accountant. Before you sign your return, be sure to review it for accuracy based on your full-year financial reports. If the IRS audits your company and finds any underpayment of taxes, it will come to you, not your accountant, for any additional taxes, penalty, and interest.

Business accounting checklist for success

If these accounting needs sound like a lot, that’s okay: they are. But with proper planning and a few deep breaths, you can do this.

Accounting software like QuickBooks can help you generate financial reports, manage taxes, and take care of other small business accounting tasks. This kind of software can make your life as a business owner much easier. If you’re still feeling uncertain, don’t be afraid to speak with a professional bookkeeping service about securing their help.