When to update your business plan

Your business plan isn’t something you create once and forget about. It’s a living document that should evolve with your business.

The U.S. Chamber of Commerce (USCC) recommends reviewing and updating your business plan regularly to ensure it aligns with your company’s goals, market conditions, and financial health.

According to USCC, here are eight key times when updating your business plan is a smart move:

1. It’s been over a year

If you haven’t looked at your business plan in over a year, it might be outdated. Markets shift, industries evolve, and new opportunities pop up. It’s a good idea to do a quick review every quarter and a thorough update at least once a year to keep your strategy relevant.

2. You’ve expanded your products or services

Launching a new product or service? This impacts your marketing, sales, and financial projections, so updating your business plan ensures your growth is strategic and well-funded.

3. The market or competition has changed

Your business strategy may need a refresh if a new competitor enters the market, customer preferences shift, or external factors like inflation or regulations change. Updating your business plan helps you stay competitive and responsive to industry trends.

4. You’ve had a significant financial change

Big wins (e.g., landing a major client) or setbacks (e.g., loss of revenue or rising costs) should trigger an update since these financial changes can throw your business off balance. Updating your business plan can help you realign your budget, cash flow, and growth plans based on your current numbers, not outdated projections.

5. Your company has grown

What worked when you were a small team might not make sense once you’ve hired more employees, opened new locations, or expanded into new markets. If your company feels different than it did a year ago, a business plan refresh will help redefine your leadership roles, operational strategies, and long-term goals.

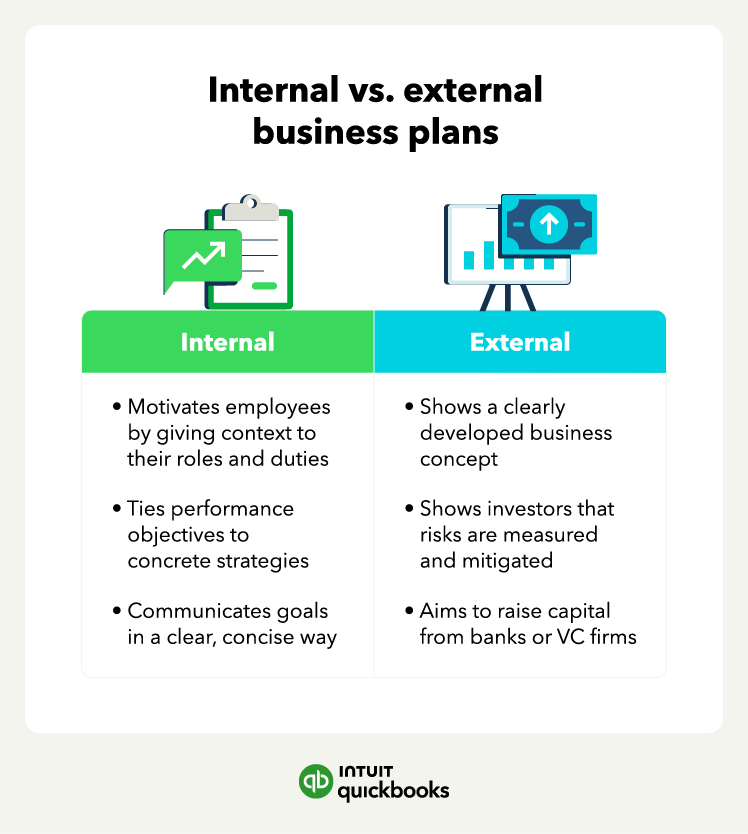

6. You’re seeking funding

Lenders and investors want to see an up-to-date business plan before providing funding. If you’re planning to apply for a loan, pitch to investors, or secure a grant, make sure your plan reflects your most recent financials and market strategies.

7. You’ve made major internal changes

Major internal changes, like switching to a new technology, changing suppliers, or restructuring your leadership team, can all impact how your business runs. If any of these types of shifts happen, update your business plan so your goals, operations, and financial projections stay aligned.

8. You’re not meeting your goals

If sales are consistently falling short, expenses are higher than expected, or growth isn’t happening as planned, it’s time for a strategy adjustment. Updating your plan can help you identify weaknesses and make necessary adjustments before small problems turn into big ones.

You can even map your customers’ journey to better understand their needs and preferences.

You can even map your customers’ journey to better understand their needs and preferences.