Starting a business can be a rewarding opportunity and a chance to pursue your passion. Whether you’re starting a business on your own or partnering up with someone to bring your ideas to life, this journey will require a blend of determination, creativity, and strategic planning.

From determining the ideal business structure to setting up payment systems, there’s much to accomplish before flipping the “Open” sign. If you want to know how to start a business from scratch, this guide will help you learn the important steps to get your business idea up and running.

- Define your vision

- Research your market opportunity

- Write a business plan

- Perfect your sales pitch

- Understand your start-up cost

- Plan your starting finances

- Determine your business structure

- Investigate your legal requirements

- Apply for permits and business licenses

- Create and register a business name

- Open a small business bank account

- Set up accounting and payment systems

- Outsource essential functions

- Learn how to pay employees

- Find a business location

- Market your business and launch a website

- Explore business partnerships

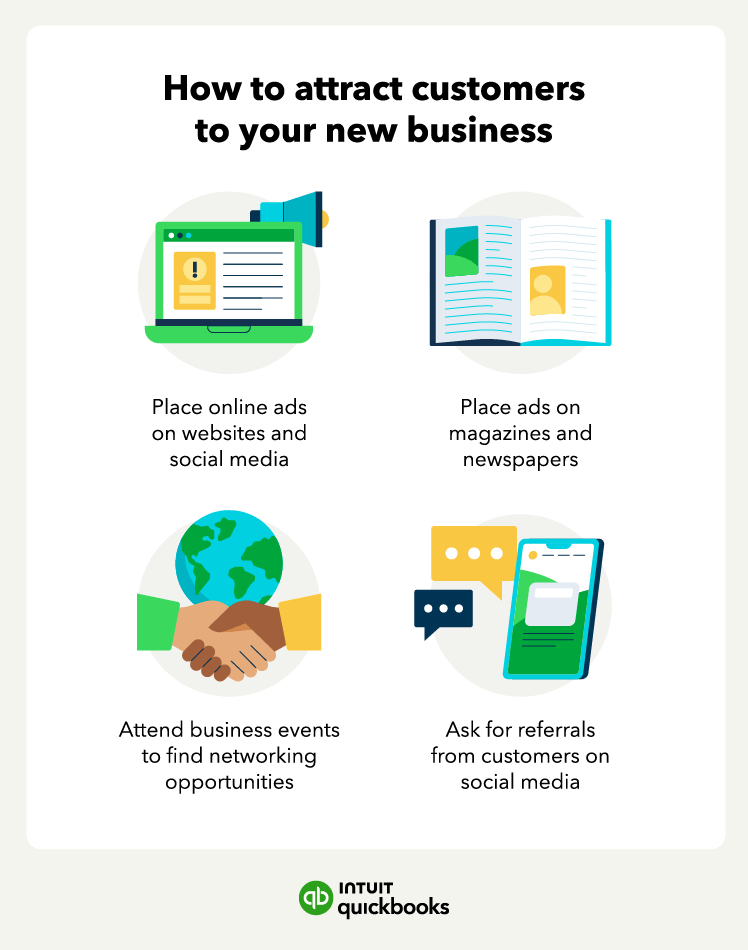

- Drive customers to your business

- Don’t be afraid to ask questions