December 12, 2024

December 12, 2024

No matter how much you love your business, you can’t afford to work for free.

Yet figuring out how to pay yourself as a business owner can be complicated. Depending on your business type, you may be able to pay yourself using an owner's draw or salary.

To help you decide what’s best for you, we created this small business guide that breaks down the differences between an owner’s draw vs. salary. Now, let’s dive into the nitty-gritty details, including what payment method is best for you and how much to pay yourself as a self-employed business owner.

Understanding the difference between an owner’s draw vs. salary

Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. But how do you know which one (or both) is an option for your business?

To help answer this question, we’ve broken down the differences between an owner’s draw and a salary, using Patty as an example. She's a sole proprietor who owns a catering company called Riverside Catering.

What is an owner’s draw?

An owner’s draw refers to an owner taking funds out of the business for personal use. Many small business owners compensate themselves using a draw rather than paying themselves a salary.

Patty could withdraw profits from her business or take out funds that she previously contributed to her company. She may also use a combination of profits and capital she previously contributed.

Because Patty is a sole proprietor, all of the income earned by her business will show up on her personal tax return, and she’ll need to pay estimated tax payments and self-employment taxes on those earnings.

She doesn’t pay separate taxes on the owner’s draw payment because she’s simply taking out money that has been taxed in the past (which reduces equity) or money that will be taxed in the current year.

What is a salary?

A salary is when a business owner is paid a set amount every pay period. It works similarly when you’re the business owner. You determine your reasonable compensation and give yourself a paycheck every pay period.

For example, maybe instead of being a sole proprietor, Patty set up Riverside Catering as an S Corp. She has decided to give herself a salary of $50,000 out of her catering business. From there, she could do the math to determine what her paycheck should be given her current pay schedule.

Owner’s draw vs. salary: Advantages and disadvantages

Each approach has its benefits and drawbacks. Let’s take a look at the advantages and disadvantages of each option to help you decide what may work best for your business.

Advantages of owner’s draw

- Draws offer more flexibility. You can withdraw money as needed without sticking to a fixed payment schedule.

- You can manage cash flow more easily by adjusting your draws based on business performance — i.e., profitable months = more money, less profitable months = less money.

Disadvantages of owner’s draw

- Draws reduce the owner’s equity because you’re taking money out of the business. In other words, you’re withdrawing part of your ownership stake, so the business has fewer resources to reinvest, grow, or handle unexpected expenses.

- Draws aren’t taxed immediately, meaning you’ll have to factor in estimated quarterly payments and self-employment taxes to avoid penalties or a large tax bill at the end of the year.

- Unlike salaries, the income from an owner’s draw can be inconsistent, which makes it harder to plan for personal finances or stick to a budget.

Advantages of salary

- A salary provides a predictable, regular income so you can easily plan and budget your finances.

- When you use payroll software, taxes are automatically deducted from your paycheck, so you don’t have to worry about estimated quarterly payments.

Disadvantages of salary

- If your business hits a rough patch, it can be tough to lower or pause your salary without making changes to payroll systems or raising red flags about the business's stability.

- Paying yourself a salary means your business must have a consistent income to cover it. If cash flow is unpredictable, it can put extra pressure on you to find the money, which could lead to financial stress or even debt.

- You must pay yourself “reasonable compensation” according to the IRS, which can be tricky to determine (more on this later).

How to pay yourself based on your business type

When it comes to deciding between paying yourself with an owner’s draw and a salary, the biggest thing you need to consider is your business classification.

Why does this matter? Many business entities don’t allow you to take a salary. Let’s look at each type of business entity and how this impacts the draw vs. salary decision.

Paying yourself as a sole proprietor

Payment method: Owner’s draw

A sole proprietor’s equity balance is increased by capital contributions and business profits and is reduced by owner’s draws and business losses.

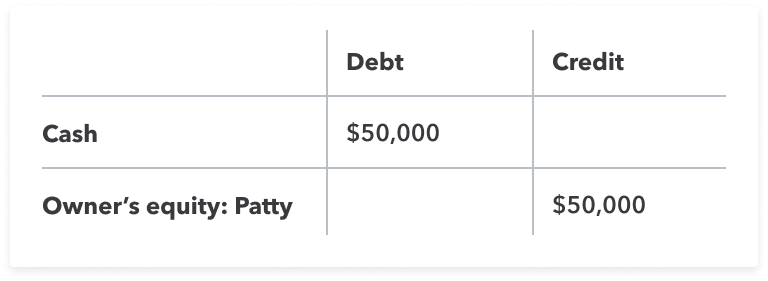

Let’s go back to Patty and her Riverside Catering business. In this example, Patty is a sole proprietor, and she contributed $50,000 when the business was formed at the beginning of the year.

Riverside Catering posts this entry to record Patty’s capital contribution:

A normal balance for an equity account is a credit balance, so Patty’s owner equity account has a beginning balance of $50,000. During the year, Riverside Catering generates $30,000 in profits.

Since Patty is the only owner, her owner’s equity account increases by $30,000 to $80,000. The $30,000 profit is also posted as income on Patty’s personal income tax return.

Patty can choose to take an owner’s draw at any time. She could take some or even all of her $80,000 owner’s equity balance out of the business, and the draw amount would reduce her equity balance. So, if she chose to draw $40,000, her owner’s equity would now be $40,000.

Keep in mind that Patty pays taxes on the $30,000 profit, regardless of how much of a draw she takes out of the business.

Paying yourself in a partnership

Payment method: Owner’s draw

A partner’s equity balance is increased by capital contributions and business profits and reduced by partner (owner) draws and business losses.

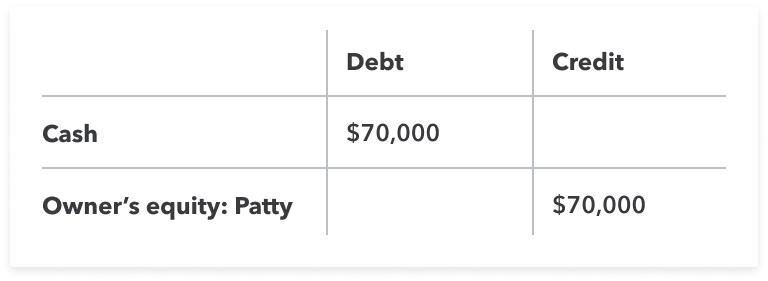

Patty owns her catering business and is also a partner in Alpine Wines, a wine and liquor distributor. Patty and Susie each own 50% of Alpine Wines, and their partnership agreement dictates that partnership profits are shared equally.

Patty contributes $70,000 to the partnership when the business forms, and Alpine Wines posts this owner’s draw journal entry:

The partnership generates $60,000 profit in year one and reports $30,000 of the profit to Patty on Schedule K-1. Patty includes the K-1 on her personal tax return and pays income taxes on the $30,000 share of partnership profits. Assume that Patty decides to take a draw of $15,000 at the end of the year.

Here is her partner equity balance after these transactions:

- $70,000 contributions + $30,000 share of profits - $15,000 owner’s draw = $85,000 partner equity balance

Remember that a partner can’t be paid a salary, but they may receive a guaranteed payment for their services rendered to the partnership.

Like salaries, guaranteed payments are reported to the partner for them to pay income tax. The partnership's profit is then lowered by the dollar amount of any guaranteed payments.

Paying yourself from a Limited Liability Company (LLC)

Payment method: Owner’s draw

You must form an LLC according to your state’s laws, and the rules for LLCs differ slightly by state.

In the eyes of the IRS, an LLC can be taxed as a sole proprietorship, a partnership, or a corporation. The rules above will apply to how Patty should pay herself as an LLC if taxed as a sole proprietor or partnership.

Paying yourself as an S Corp

Payment method: Salary and distributions

If Patty’s catering company was an S Corp, she would figure out a reasonable compensation for the work she does and pay herself a salary. To not raise any red flags with the IRS, her salary should be similar to what people in similar positions at other businesses earn. She’ll also need to withhold taxes from her paychecks.

However, to avoid withholding self-employment taxes on the whole amount, Patty could also take a portion of her owner's compensation as a distribution. Distributions are from earnings taxed at her personal rate. Keep in mind that Patty also needs to have enough equity to take distributions.

For example, if Patty wishes to be paid $75,000 from her business, she might take $50,000 as a salary and distributions of $25,000.

Paying yourself from a C Corp

Payment method: Salary and dividends

Owners of a C Corp are called shareholders. Let’s say that Patty’s catering company is a corporation, but she’s the only shareholder. She must pay herself a salary based on her reasonable compensation.

However, she can also receive a dividend, or a distribution, of her company’s profits. That dividend would be taxed on her personal tax return.

Keep in mind that her business doesn’t have to pay a dividend. She could choose to have the business retain some or all of the earnings and not pay a dividend at all.

Owner’s draw or salary: How to pay yourself

Are you ready to pay yourself? Whether you decide on an owner’s draw or salary, follow these six steps to pay yourself as a small business owner.

Step #1: Understand the difference between draw vs. salary

Before deciding which method is best for you, you must first understand the basics. As a refresher, here’s a high-level look at the difference between a salary and an owner’s draw (or simply a draw):

- Owner’s draw: The business owner takes funds out of the business for personal use. Draws can happen at regular intervals or when needed.

- Salary: The business owner determines a set wage or amount of money for themselves and then calculates a paycheck and cuts the payment for themselves every pay period.

Step #2: Understand how business classification impacts your decision

Many factors that will influence your choice between a salary, draw, or another payment method (like dividends), but your business classification is the biggest one. The main types of business entities include:

- C Corporation (C Corp)

- S Corporation (S Corp)

- Sole Proprietorship

- Limited Liability Company (LLC)

- Partnership

Why does this matter? Because different business structures have different rules for the business owner’s compensation. For example, if your business is a partnership, you can’t earn a salary because the IRS says you can’t be both a partner and an employee.

Step #3: Understand how owner’s equity factors into your decision

“Owner’s equity” is a term you’ll hear frequently when considering whether to take a salary or a draw from your business. Accountants define equity as the remaining value invested into a business after deducting all liabilities. You can calculate your owner’s equity using the following formula:

- Assets - liabilities = Owner’s equity

When you contribute cash, equipment, and assets to your business, you’re given equity—another term for ownership—in your business entity, which means you’re able to take money out of the business each year.

Understanding your equity is important because if you choose to take a draw, your total draw can’t exceed your total owner’s equity.

Step #4: Understand tax and compliance implications

In addition to the different rules for how various business entities allow business owners to pay themselves, there are also several tax implications to consider.

Concerning taxes, C Corps are different from other business entities. Here’s how:

- C Corporations: C Corps are subject to double taxation. The C Corp files a tax return and pays taxes on net income (profit).

- Pass-through entities: Generally, all other business structures pass the company profits and losses directly to the owners. That’s why they’re referred to as pass-through entities.

Another consideration is Social Security and Medicare taxes. Social Security and Medicare taxes (known together as FICA taxes) are collected from salaries and draws.

Both sole proprietorships and partnerships require paying self-employment taxes on company-earned profits. The self-employment tax collects Social Security and Medicare contributions from these business owners. If, instead, a salary is paid, the owner receives a W-2 and pays Social Security and Medicare taxes through payroll withholdings.

In contrast, S Corp shareholders do not pay self-employment taxes on distributions to owners, but each owner who works as an employee must be paid a reasonable salary before profits are paid.

Step #5: Determine how much to pay yourself

A lot goes into figuring out how to pay yourself. But here’s your next question: How much should you pay yourself?

There’s not one answer or formula that applies across the board. You’ll need to take the following factors into account:

- Business structure

- Business performance

- Business growth

- Reasonable compensation

- Personal needs

It’s possible to take a very large draw as the business owner. You may pay taxes on your share of company earnings and then take a larger draw than the current year’s earning share. In fact, you can even take a draw of all contributions and earnings from prior years.

However, that isn’t without its risks. If you take too large of a draw, your business may not have sufficient capital to operate going forward.

Step #6: Choose salary vs. draw to pay yourself

Once you’ve considered all of the above factors, you’re ready to determine whether to pay yourself with a salary, draw, or a combination of both.

Owner’s draw vs salary: Tax considerations

When it comes to owner’s draws, they’re not taxed at the time of withdrawal but are subject to federal, state, and local income taxes. To avoid penalties or a hefty tax bill, you’ll want to prepare before filing your taxes. This means budgeting for estimated quarterly payments to cover your income and self-employment taxes, which include Social Security and Medicare.

On the other hand, salaries are treated differently. If you pay yourself a salary, you can automatically deduct payroll taxes from each paycheck using payroll software like Quickbooks. This makes it easier to stay on top of your taxes throughout the year.

What are the tax considerations for corporations?

In a corporation, the C corp files a tax return and pays taxes on net income (profit). The owners can retain the after-tax earnings for use in the business or pay shareholders a cash dividend. If an owner receives a dividend, the dividend income is added to other sources of income on the shareholder’s personal tax return.

For example, if a corporation earns $100,000 in profit and pays 21% in corporate taxes, that’s $21,000 in taxes, leaving $79,000. If the company then pays a shareholder a $10,000 dividend, the shareholder has to report that as income and pay taxes on it, too. This is called “double taxation” because the same money is taxed at the corporate level and again when it’s paid to the shareholder.

What are the tax considerations for pass-through entities?

Sole proprietorships, partnerships, S corps, and several other businesses are referred to as pass-through entities. Generally, these business types pass the company profits and losses directly to the owners.

For example, let’s say you are in a partnership, and your share of income is $10,000. The partnership would file a tax return and issue you a Schedule K-1, which reports your $10,000 income.

The $10,000 is then reported on your personal tax return as income from your partnership. The partnership tax return documents the partners, the percentages of ownership, and the partnership’s profit—but no taxes are calculated on the partnership tax return.

How to determine how much to pay yourself as a business owner

Now that you understand how to pay yourself, you may wonder how much you should be taking out of the business for yourself. If you’re paying yourself a salary, you need to give yourself “reasonable compensation.” According to the IRS, reasonable compensation is “the value that would ordinarily be paid for like services by like enterprises under like circumstances. Reasonableness is determined based on all the facts and circumstances.”

As we mentioned earlier, there isn’t one answer that applies to all business owners. But, many business owners don’t take a salary in the first few years.

According to recent data from ZipRecruiter, a small business owner in the U.S. makes an average of $127,973 per year. Of course, this figure can widely vary depending on factors like location, industry, and years in business.

Here are a few things you should consider as you’re crunching the numbers:

- Business structure: Your business entity impacts many of your decisions. Many entities don’t allow you to take a salary, meaning you’ll need to take an owner’s draw.

- Business performance: Regardless of how you pay yourself, it’s important to remember that your compensation as the business owner isn’t set in stone. You can make some changes as you consider your business’s performance. You should only pay yourself from your profits and not overall revenue. So, if your business is doing well, you might be able to increase your compensation.

- Business funding: You need to leave enough capital in the business to operate, so consider that before you take a draw.

- Business growth: While performance is an important consideration, so is the current stage of your business. For example, if your business is a relatively new startup and in a stage of high growth, you’ll likely want to reinvest a lot of the profits back into the business, rather than pocketing them as compensation for yourself.

- Reasonable compensation: Only taking a $10,000 salary from your company each year will raise some red flags with the IRS. Make sure you familiarize yourself with IRS’ guidelines and ask around to determine a reasonable salary for your type of work.

- Personal expenses: That reasonable compensation will give you a starting point, but it doesn’t need to be your only answer. You have personal expenses—from your mortgage or rent to your savings account—that you need to fund. Get a good grasp on those expenses, so you can make sure you’re taking home enough to cover them.

- Tax liability: A business owner needs to be very clear about the tax liability incurred, whether the distribution is a salary or a draw. Work with a CPA to plan for your tax liability and any required estimated payments.

- Your level of education: Look into the average market rate for someone with your level of education to get an idea of how much to pay yourself. The U.S. Bureau of Labor Statistics is an excellent resource for reference.

- Your work experience: You may also want to see what someone with your level of experience in your field earns on average. Sites like Glassdoor, Payscale, and Indeed can help you research salary benchmarks.

- The cost of living where you live: Consider how much you need to earn to meet personal expenses in your location. MIT offers a living wage calculator you can use to help determine how much income you need to cover basic expenses like housing, food, transportation, and healthcare in your area.

- Each method generates a tax bill: You’ll pay Social Security, Medicare, and income taxes through each type of business entity. Your decision about a salary or personal draw should be based on the capital your business needs and your ability to perform accurate tax planning.

Those considerations will help you land on a suitable number to pay yourself, whether you take it as a salary or a draw. You may also lean on data, including the Occupational Employment and Wage Statistics by the U.S. Bureau of Labor Statistics, to help you determine the average salary of those in a similar position.

Can an owner take a draw and a salary?

In short, it depends. You may be able to pay yourself a salary and take an additional payment as a draw based on profit for the previous year. Remember that if you have an S or C Corp, you're only eligible to take a salary.

For example, if you run an LLC taxed as a sole proprietorship, you can pay yourself a salary for the work you perform and also take an owner's draw from the profits. Let’s say your LLC earns $100,000 in profit after expenses. You could pay yourself a $50,000 salary and take an additional $20,000 draw from the remaining profit, keeping $30,000 in the business for growth and expenses.

However, it’s highly recommended that you speak with a Certified Public Accountant (CPA) or tax professional to determine the most tax-efficient and compliant way of paying yourself.

Next steps for streamlining your payroll process

Now that you understand the owner’s draw vs. salary differences, it’s time to get yourself paid. Consider using payroll software to help simplify the payment process and your entire payroll experience. After all, automating the payroll process can help save you time and reduce human error.