What is pipeline stock?

Pipeline stock, also called transit inventory or goods-in-transit stock, is often shipped by truck, rail, or air. Pipeline stock is common with manufacturing companies managing supply chains with multiple suppliers and factories, or retail locations with inventory in transit from warehouses.

With complex supply chains that include overseas shipments, materials can be considered pipeline inventory for days or weeks. If the business has paid for the items, it’s considered pipeline inventory until they receive it. Pipeline inventory tracking is helpful because it tells how much capital they have tied up in inventory that they can’t use or sell yet.

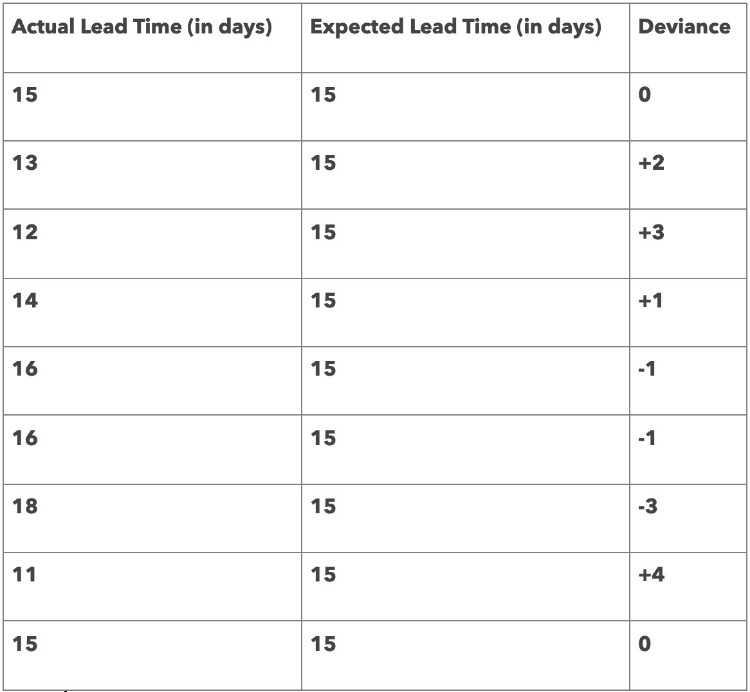

There are two concepts to know for calculating your pipeline stock. The first is lead time, which is how long it takes to receive stock after ordering it. Second is the demand rate, which is how many items you sell in between orders for that item. Your pipeline inventory can be calculated by multiplying your lead time by your demand rate.

For example, let’s say the lead time for an item is three weeks, and you order 50 units per week — your pipeline inventory would be 150 units.

Another use formula, called Economic Order Quantity (EOQ), tells you the ideal amount of stock you should order given a few variables. It helps minimize both inventory and carrying costs. Here’s the formula:

EOQ = square root of (2 x demand x ordering costs) / carrying costs)

Demand (D) is the number of units a business orders for a specific period, usually annually. Ordering costs (S) are the ordering costs per order. Holding cost (H) is the carrying cost per unit.

Let’s say you own a furniture store that sells a high volume of a certain type of chair, and you want to figure out your EOQ. Each chair costs $200, and you sell 1,000 per year. You figure out it takes about an hour to process an order and based on your employee compensation, you estimate your order cost is $50 per order.

Based on your warehouse costs and insurance, your carrying cost per unit is $5. Based on these numbers, your EOQ looks like this:

EOQ = square root of ((2 x 1000 x $50) / 3)

EOQ = 182

So next year, your optimal order for those chairs is 182.