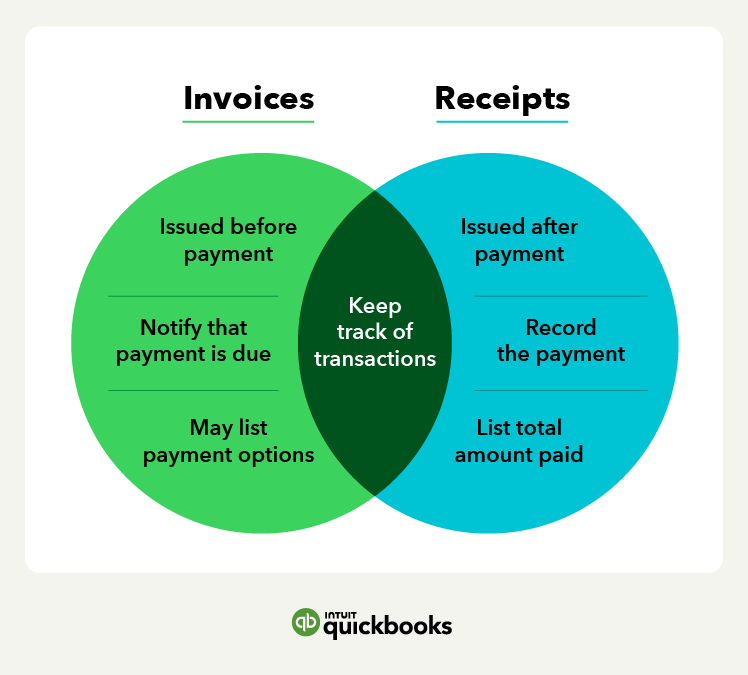

While invoices and receipts have some similarities, they’re used at different stages of the sales process and document different information. The main differences are:

- When they’re issued: Invoices are issued before a business has received payment from a customer, and a receipt is issued after payment has been collected.

- Payment information they contain: Invoices contain information about a future payment, including how to pay for it and due dates. Receipts contain information about a completed payment, including the date and amount paid.

- How they’re used in accounting: Receipts record a completed sale, so you’ll record them as income. Invoices mean the customer still has to pay you, so you’ll record them as accounts receivable.

When they’re issued

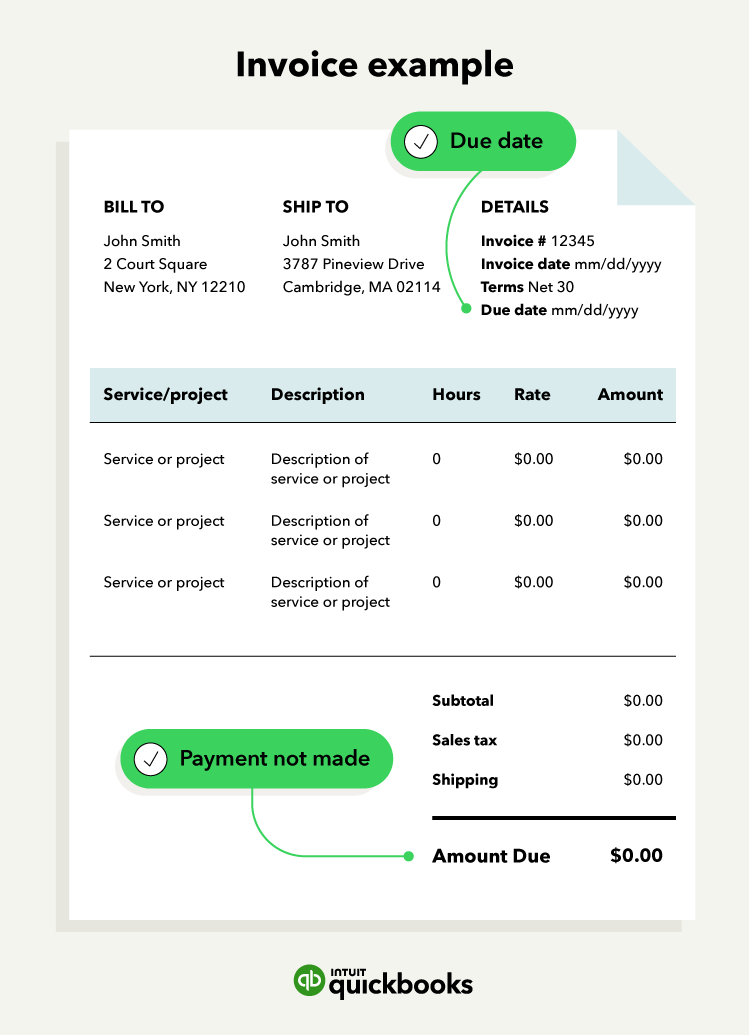

You issue invoices before receiving payment from your customer. Invoices act as a formal request for payment and detail the goods or services you provided along with the payment terms. For example, if you own a graphic design business, you’d send an invoice to your client after completing their project.

Receipts are issued after you’ve collected payment. They serve as proof of the transaction and confirm that the payment has been received. For instance, once your client pays the invoice for the design project, you’d give them a receipt showing the amount they paid and the date of the transaction.

Payment information they contain

Invoices contain information about a future payment. You’ll include details such as the amount due, payment terms, due dates, and acceptable payment methods. For example, an invoice for your design project might show a total of $1,500, due within 30 days, with payment options like bank transfer, credit card, or PayPal.

Receipts focus on completed payments. When you issue a receipt, it includes the payment date, amount paid, payment method (like credit card or cash), and any taxes or discounts applied. For example, a receipt for the $1,500 payment might state that it was paid via credit card on a specific date. This gives both you and your client a clear record of the transaction.

How they’re used in accounting

Invoices help you track the money you’re still owed, so you record them as accounts receivable in your books. This shows the revenue you’re expecting but haven’t yet received. For instance, if you send an invoice for the $1,500 design project, you’ll log it as an outstanding payment in your accounting software until your client pays.

On the flip side, receipts track the money you’ve already collected. Once your client pays the $1,500 invoice, you’ll record the payment as income. In your accounting software, you decrease accounts receivable and increase your cash by the same amount.