An invoice number is a number assigned to uniquely identify invoices. It generally appears near the top of the invoice document so it can be easily noted by both the recipient of the invoice and the business providing it. Invoice numbers allow business owners to organize, categorize, and systematize payment processing in a clear and intuitive way.

How to assign invoice numbers: Definition & examples

When you help run a small business and work regularly with other businesses, you’ll likely have many expenses to keep track of. That’s where invoices, and invoice numbers, can help. When it follows invoice number format best practices, discussed in detail below, your invoicing system can become one of your best assets for managing the money coming in.

Businesses use invoices to inform clients of the various expenses they’ve incurred and to request payments. Along with a unique invoice number, each invoice should include:

- The products and services provided

- The cost of each item

- The total amount due, along with the due date

- Payment terms and conditions

- Your company name and contact information, including your business phone number and email address

- Part of keeping tabs on your money involves employing a smart system for tracking invoices. By creating a smart, intuitive, and scalable system for your invoices, you can make sure you get paid by all the clients who owe you—and that you’re paid up on all your incoming expenses.

Why are invoice numbers important?

Unique invoice numbers are important because they help you track a variety of factors that are critical for keeping your business running smoothly and profitably.;

Track how much money you’re currently owed

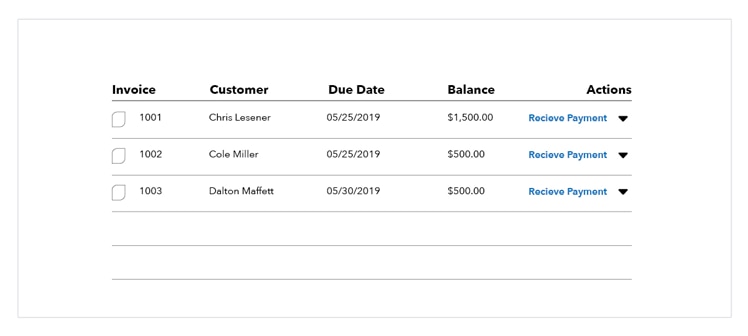

By quickly identifying which invoices haven’t been paid yet, you can see how much money you’re waiting on. This can help you plan your monthly budget, see how much cash you can expect in the near future, and assess how quickly you can expect turnaround on invoicing and payment processing.

See which clients have paid

You can use invoice numbers to track the invoices you’ve sent out, carefully noting which ones have been paid and which ones haven’t. If you notice that a particular client currently has one or multiple invoices unpaid and past due, you know who to reach out to.

Review client payment history

Sometimes, a client may request information about past transactions they made with you—or you might be curious about them yourself. By having well-organized financial records and invoices, cataloged thoroughly using your invoice number system, you can quickly and efficiently find any past payment in your system.

An invoicing system lets your business maintain a record of all its transactions. So, if something comes up in the future, it’s easy to look through old invoices to find the source of the issue. No organizational system is complete without a thorough way to catalog items, however. That’s why invoice numbering systems are critical to keeping your business productive.

Now that you have a good idea why invoicing and invoice numbers are important, you’re probably curious about the best ways to assign them. In the next section, we’ll explain how to assign invoice numbers, what the best practices are, and how QuickBooks can help with managing invoices.

How to assign alphanumeric invoice numbers

Invoices help businesses keep track of the various payments they can expect, while also informing clients about how much they owe. However, to organize this information so it’s user-friendly, effective, and productive, there are a few invoice number format best practices you should keep in mind.

QuickBooks automatically assigns new invoice numbers to your invoices, starting from 1001. However, you can change the invoice number to better suit your company’s invoicing practices. Ultimately, it’s always wise to do what’s best for your business—that’s why we’ve built QuickBooks invoicing software to be intuitive and customizable.

If you’re just starting out using invoices to bill clients, here are a few simple tricks you can use to ensure that your invoices are well-organized and easily searchable.

1. Start with longer numbers

Simply ordering invoices from “1” can get confusing as you scale up your operation. Start by using a longer number, like 1001, for your first invoice. The next invoice number should be a sequential number that’s easy to keep track of.

2. Use identifying numbers

As you sign new clients, assign them a client number in your internal database. Then, on each invoice sent to that client, append sequential invoice numbers. For example, your first client’s third invoice might be 1003, and your fifth client’s first invoice might be 5001.

3. Add letters

You can also use letters as identifiers for invoice numbers. Try assigning each client an abbreviation. Let’s say you have a client called Smith Air Conditioning. The first invoice might be SA0001, and future invoices with alphanumeric invoice numbers will continue from there. You can also give new businesses and clients you work with their own abbreviations.

Not quite sure how this works in practice? Don’t worry—here’s a simple example.

How to use invoice numbers: a step-by-step example

Say you own a business that does contract work for other companies. A client hires you for a new project that will span over the course of three months.

Because the project takes three months, you end up sending your client three separate invoices for payment. To keep your personal records clear and understandable, you create a numbering system for your invoices that lets you quickly search them if questions later arise.

Here’s an invoice number example of how you might label each invoice for each month of billing:

- First invoice: SA0001

- Second invoice: SA0002

- Third invoice: SA0003

Now let’s imagine that about six months after you’ve completed these projects, the client reaches out to request some additional work. Last time, you charged them $2,000 for the project. However, this time, your client insists that they paid only $1,500.

Because of your well-organized invoicing system, you can quickly check your records for the particular invoices previously billed to your client. Quickly finding the last invoice, SA0003, you are able to provide concrete evidence for the cost of the last project.

Invoicing with QuickBooks Payments

QuickBooks Payments makes invoicing easy, so you can keep tabs on the money going out and the money coming in without any hassle. While you could use a simple program like Microsoft Excel to track invoice numbers, with advanced accounting software, your business can be much more productive.

QuickBooks automatically assigns simple and intuitive invoice numbers, making your payment history easy to search. If you’ve already got a system in place that you don’t want to part with, don’t worry—you can fully personalize your invoices, including the invoice number, to best suit your own business practices.

Get started invoicing with QuickBooks today and create professional invoices 37 percent faster—and get paid two times faster.

The right invoice numbering system is just the beginning, however. With a full suite of business solutions oriented toward busy and productive business owners, QuickBooks can also help your business thrive with online invoicing, bookkeeping, accounting, and payroll solutions.

Actionable takeaways

We know there’s a lot to process. Before you go, be sure to remember these actionable takeaways to help your business’s invoicing system run more smoothly, effectively, and productively:

- An invoice number is a number that appears on an invoice and uniquely identifies it for easy organization and identification later.

- Invoice numbers allow small business owners to keep track of their invoice sequence and completed payments, as well as payments that may still be pending completion.

- Using smart invoice number formats can make it easier to find old invoices. Try using sequential numbering, alphanumeric invoice numbers, or professional invoice software to better organize your payment history

- Invoice numbers help you quickly assess how much money you’re owed, which clients have paid, and the full payment history for a given client.

When it comes time to create an invoice, you can either use a free invoice template or invoice generator, or you can use accounting software to create and track your invoices.

QuickBooks invoicing allows you to create professional and intuitive invoices quickly and makes it easier for clients to complete payments in a timely manner thanks to multiple payment options, including credit card, debit card, and ACH bank transfers.

Start invoicing with QuickBooks accounting software today, and use our suite of tools to elevate your business.