April is a time for renewal. Winter’s gone to bed and spring is in the air. That makes it a great time to check out this month’s fresh QuickBooks updates.

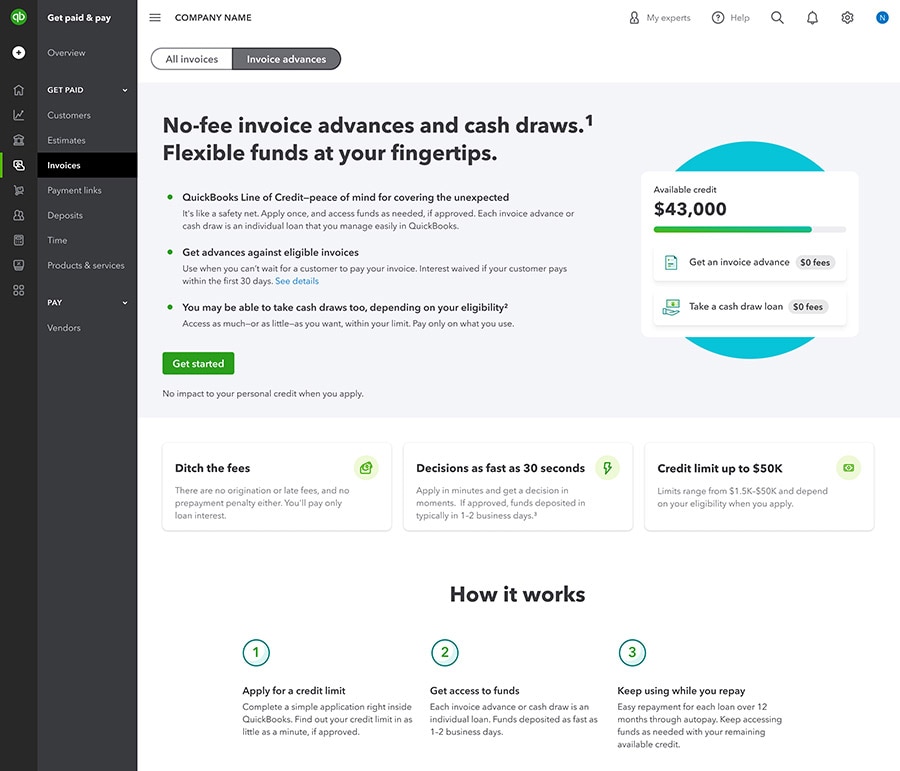

Draw cash from a credit limit with QuickBooks Line of Credit

In a nutshell: For those times when you need extra cash on hand, you can now consider a QuickBooks Line of Credit to meet your short-term cash flow needs.

In addition to receiving advances on eligible invoices, eligible businesses can now use a Line of Credit to draw cash from their available credit limit.1 This can help you cover bills and payroll when you get in a pinch.

Apply for a credit limit from $1,000 to $50,000 in minutes—not days—with a simple application right in QuickBooks. Once approved, you’ll have the flexibility to decide when and how to use it. You’ll only pay for what you borrow, with no additional origination or draw fees and no prepayment penalties. Interest will apply.2

QuickBooks Line of Credit is the flexible funding solution inside QuickBooks for quick, seamless applications and deposits into your linked accounts.

Note: Line of Credit was previously called Get Paid Upfront.