2. Determine your tax payments

To succeed as a freelancer, you have to be proactive. Just like you have to take the initiative to find work, you need that same mindset to plan ahead for filing small business taxes—like income tax and self-employment tax.

Income tax

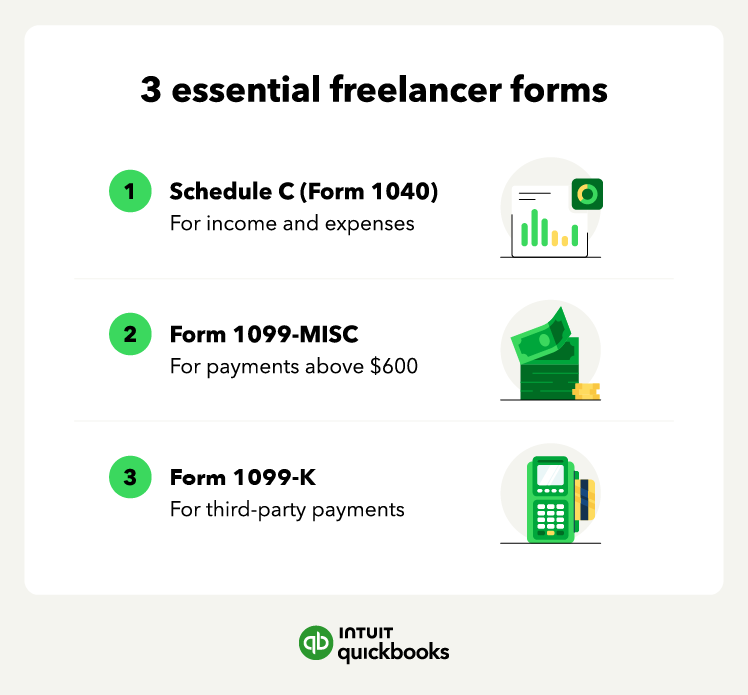

You’re responsible for reporting business income and expenses in a Schedule C form and deducting allowable expenses on your tax return. The record of your profits and losses will determine the amount of income tax you’re responsible for paying.

Meticulously track your earnings and deductible expenses throughout the year with accounting software like QuickBooks to ensure accurate reporting.

Self-employment tax

Employers withhold each employee’s share of FICA and Medicare taxes from gross pay. Freelancers, on the other hand, must pay those taxes using Schedule SE (Self-Employment Tax). Currently, freelancers pay a 15.3% tax rate for FICA and Medicare taxes, with one-half of those taxes posted as a deduction from taxable income on Form 1040.

Sales tax

If your freelance business involves selling physical goods, or even certain digital products, you'll likely need to deal with sales tax. This will involve collecting sales tax from your customers and paying it to the appropriate state and local tax authorities.

Sales tax can be tricky, as the rules vary a lot from place to place. You might even need to collect different rates depending on where your customers are located. It's essential to research the specific sales tax laws in your state and any localities where you make sales.

State tax

Just like you pay federal income tax, you may also need to file a state return. Each state has its own rules and rates, so it's important to check what applies where you live.

Even if you don't end up owing any taxes, you might need to file a state return. And similar to federal taxes, many states require freelancers to make estimated tax payments throughout the year. The good news is that states often have their own tax deductions and credits that can help lower your tax bill.

To find out the specifics for your state, check with your state's Department of Revenue. Tax preparation software or a tax professional can also help you navigate state tax requirements.

Tax liability

Planning ahead also helps you avoid paying penalties, fees, and interest on your tax underpayments. Accurately estimate your tax obligations, make timely estimated tax payments, and maintain thorough records of your income and expenses throughout the year.

Proactively managing tax obligations can help you avoid costly penalties and ensure compliance with tax regulations.

Proactively managing tax obligations can help you avoid costly penalties and ensure compliance with tax regulations.