Happy 2023 to all our readers. We hope you all had a wonderful holiday season and are ready to take on this new beginning. Whether you’ve set a new year’s resolution or not, you can always count on kicking off the new year with fresh updates.

What’s new in QuickBooks Online: January 2023

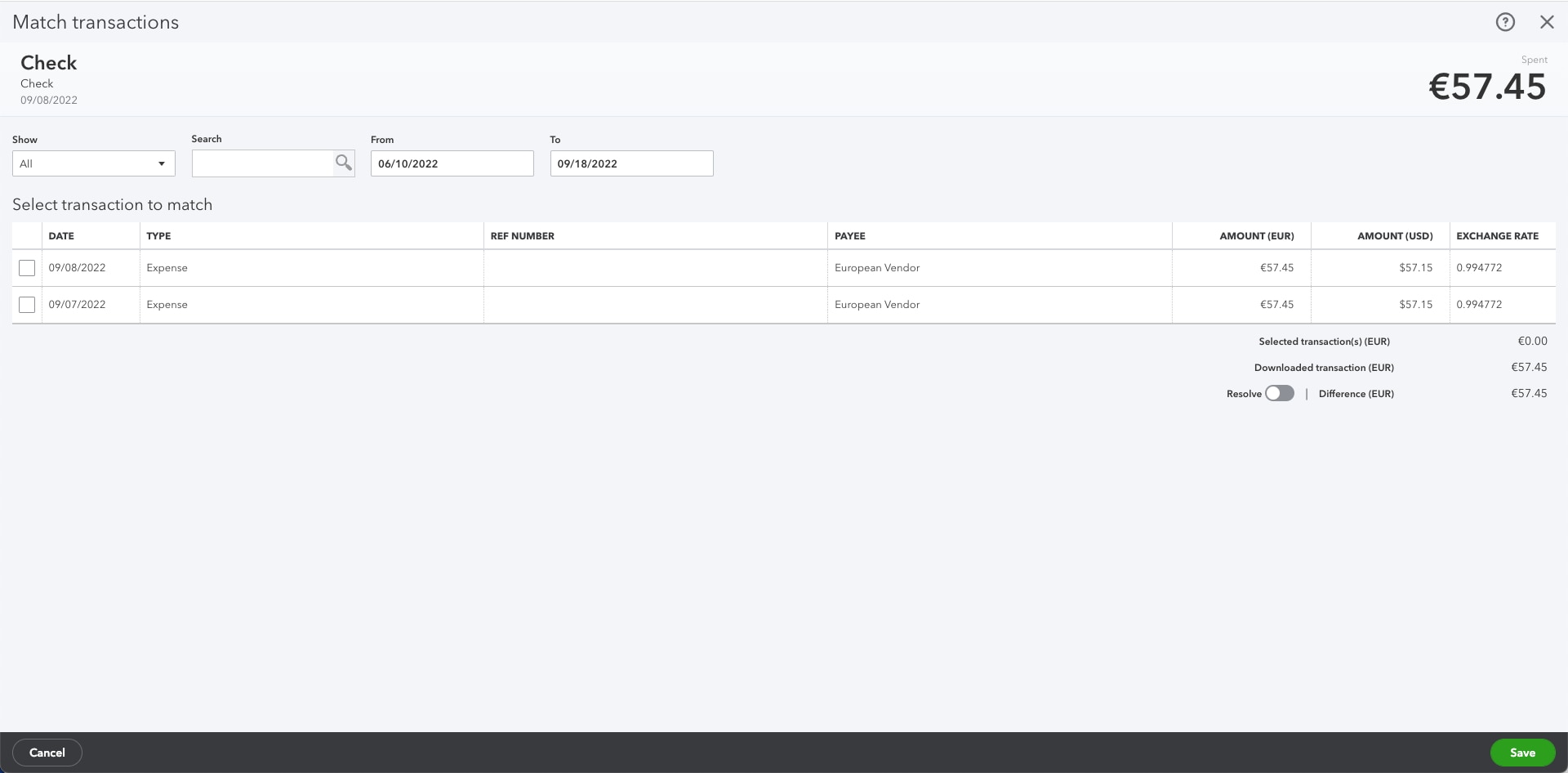

Match transactions from foreign currency bank accounts in QuickBooks Online Banking

In a nutshell: The “find match” feature in QuickBooks Online Banking can now be used for foreign currency bank accounts. If you operate on a multicurrency basis, you can now match your transactions in QuickBooks with your foreign currency bank account transactions.

With this update, multicurrency businesses no longer need to rely on a manual workaround. You can access the same features in foreign currency bank accounts that have always been available in home currency bank accounts. It’s as simple as clicking “Find Match” in a foreign currency bank and choosing from a list of same-currency transactions to match against.

QuickBooks now automates matching for thousands of multicurrency transactions per day, saving you valuable time and letting you get back to running the business you’re passionate about.

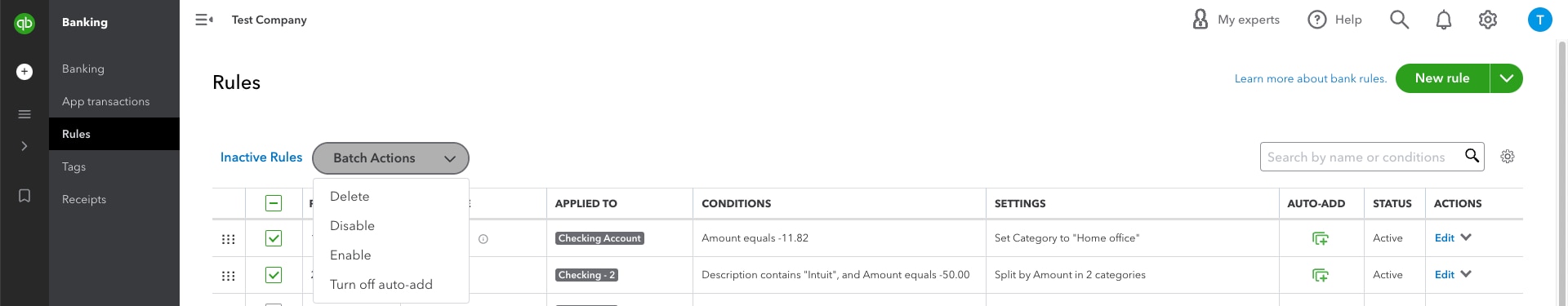

Batch-edit your auto-add bank rules

In a nutshell: Now, if you want to revise the auto-add preference on a list of your bank rules, you can do so all at once. In Banking, select multiple rules and turn off auto-add for all of them.

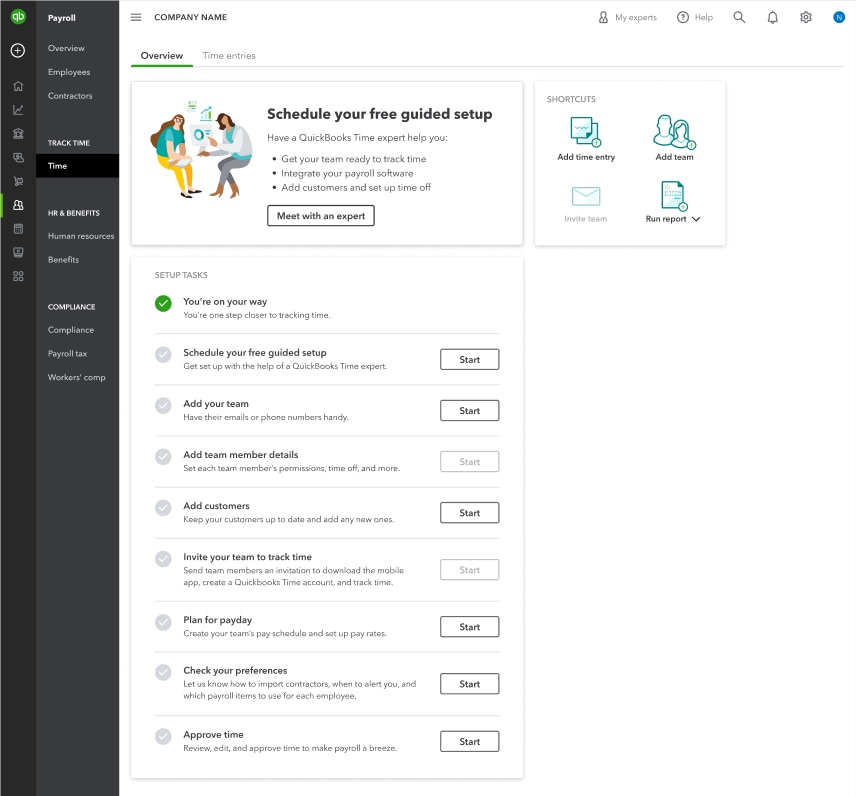

Guided QuickBooks Time setup for QuickBooks Online Payroll customers

In a nutshell: Starting this month, businesses using QuickBooks Online Payroll Premium or QuickBooks Online Payroll Elite will have a refreshed setup experience for QuickBooks Time.

To help get your teams quickly up to speed, this new experience will guide you through the critical steps of setting up your team to successfully start tracking time for invoicing and/or payroll.

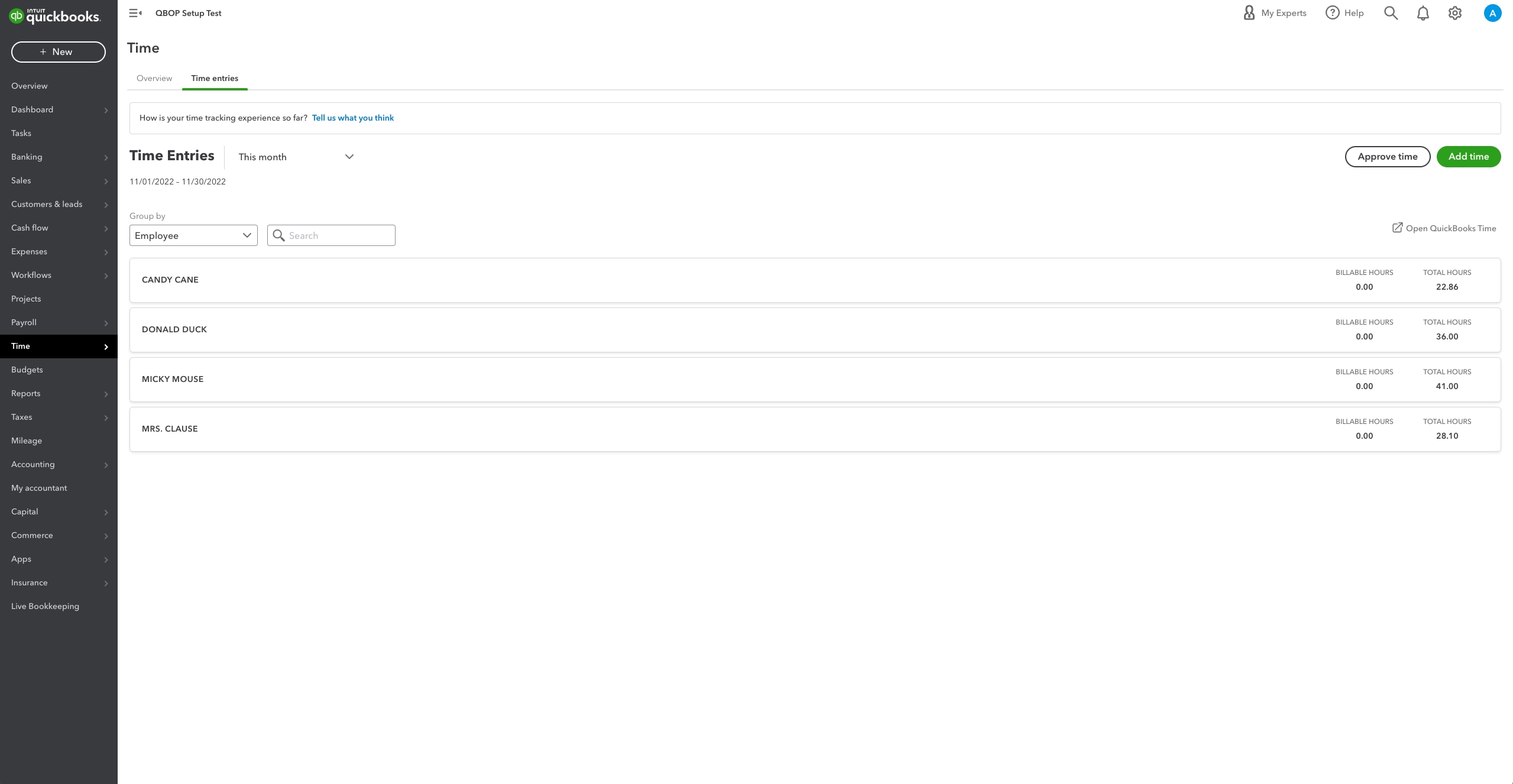

Administrators using eligible accounts will see the Time overview and Time entries pages in QuickBooks Online Payroll. From the Overview tab, you’ll see a list of setup tasks designed just for QuickBooks Time. From here, you can also schedule a call with an expert to set up QuickBooks Time. Directly from the Time entries page, your team leads can edit and approve time-tracking records.

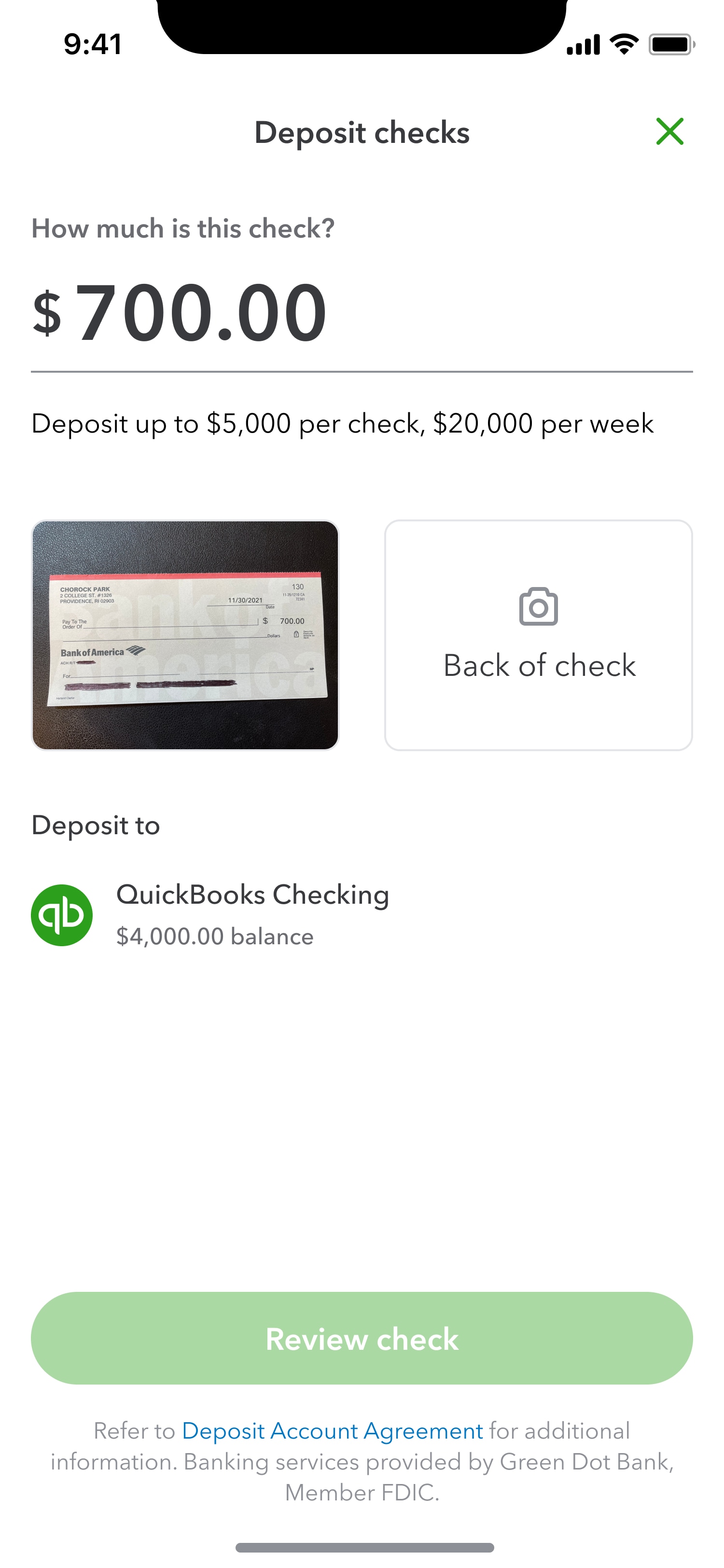

Mobile check deposit is now available for Android Users in QuickBooks Checking

In a nutshell: To make banking in QuickBooks Checking even easier, you can now deposit checks using their Android and iOS mobile apps. (This feature is new to the Android app.)

In addition, for seamless accounting and banking, you and your accountant can see check images from bank feed transactions in the merchant and accountant view on the web.

Note: Customers will not be eligible to deposit checks until 30 days after signing up for QuickBooks Checking.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

_________________________

**Product Information

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation.

**Features

Mobile Remote Deposit Capture: Limited availability to existing customers on iOS and Android. Features may be more broadly available soon, but represents no obligation and should not be relied on in making a purchasing decision. Mobile deposits may take up to 5 business days. Limits on the dollar amount(s) and/or number of checks that may be deposited may apply. QuickBooks Checking account’s Deposit Account Agreement applies.

©2022 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.