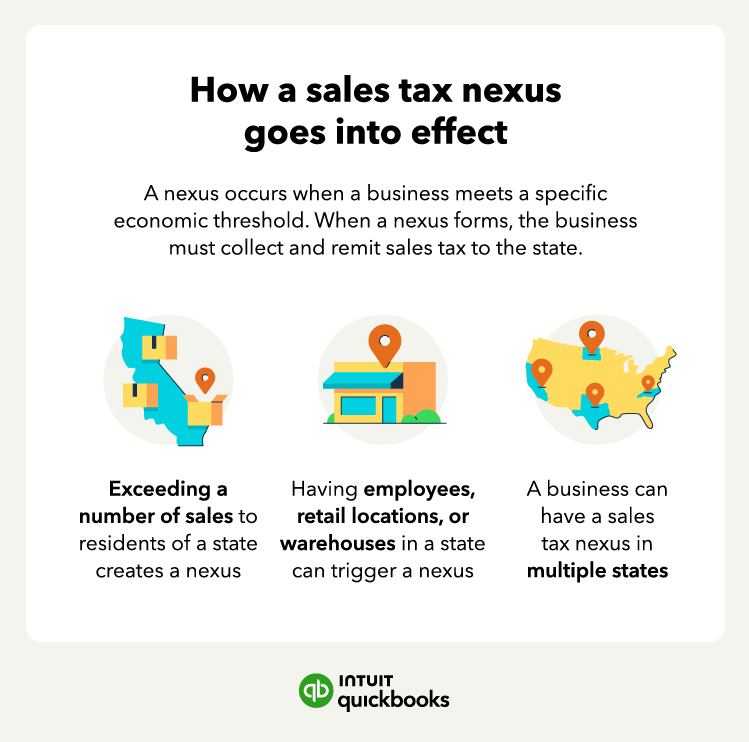

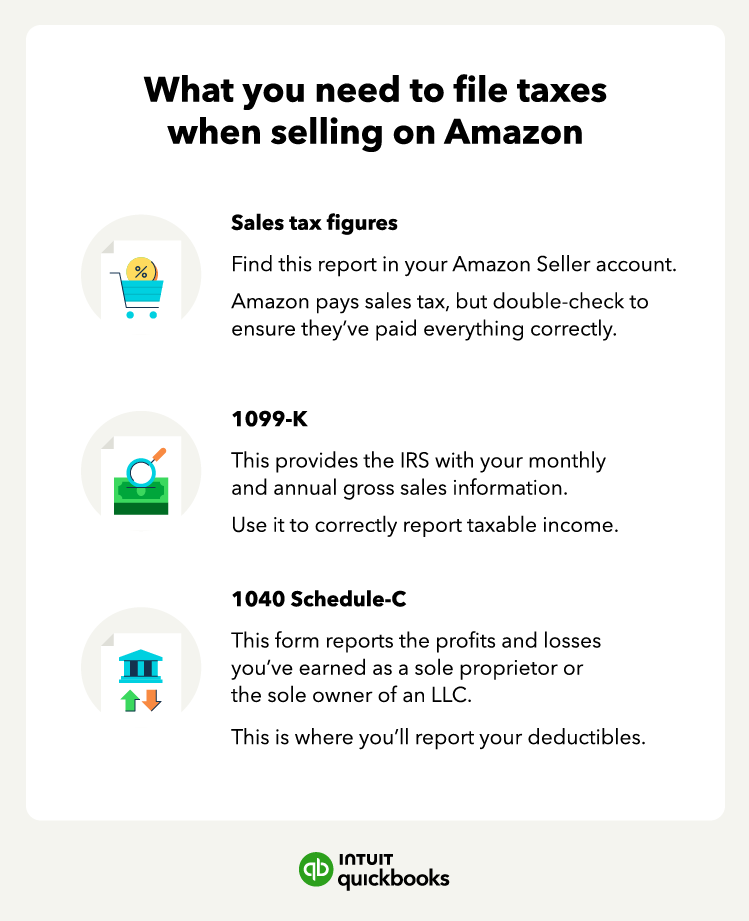

The landscape for online sellers has shifted dramatically since the landmark 2018 South Dakota v. Wayfair decision. While marketplace facilitator (MF) laws have shifted the burden of collection to Amazon, business owners must still navigate registration requirements, income tax filings, and changing IRS thresholds.

Whether you’re new or a seasoned Fulfilled By Amazon (FBA) seller, understanding your tax obligations is key to growing your business. This guide covers how to manage sales tax, what forms you need for the 2026 tax season, and how to maximize your deductions.