Analysis from Ufuk Akcigit, Arnold C. Harberger Professor of Economics at the University of Chicago

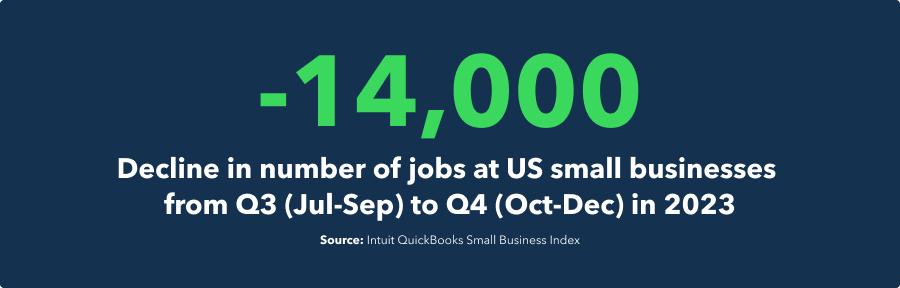

“Major macroeconomic factors have subjected the US economy to periods of volatility, with small businesses bearing the brunt of these fluctuations. Even though COVID initially had a positive impact on new business registrations and small business employment, the landscape began to shift in 2021, with rising inflation coupled with interest rate hikes commencing in March 2022. These events placed a disproportionate strain on small businesses. Consequently, small business employment declined, and the employment share of small businesses as a proportion of overall jobs in the economy began to dwindle after April 2021. The decline in small businesses’ share of overall employment accelerated a year later, beginning in April 2022. During the past summer, however, we saw a notable rebound for small businesses, especially in Q3 of 2023. Unfortunately, this resurgence proved short-lived, as small business employment dropped by 14,000 in Q4, translating to a 0.11% reduction compared to Q3. Despite the negative quarterly growth, yearly growth in Q4 remains positive at 1.56%, thanks to strong growth in the summer of 2023.

“The strongest small business employment expansion, both on quarterly and yearly scales, has occurred in the agriculture, natural resources, and mining sector. This is unsurprising, considering the exceptionally strong performance of the oil and natural gas industry in the US in 2023. Despite ongoing political discussions advocating for greener energy sources, the US economy achieved record-breaking levels of crude oil and natural gas production. This propelled end-of-year production figures to more than double the levels seen a decade ago.

“In general, the fluctuations observed both quarterly and within Q4 on a monthly basis serve as a reminder of the vulnerability of small businesses, and the challenging macroeconomic forces exert an outsized influence on the fate of small businesses. When discussing major industrial policies, we should pay attention to small business trends.”

Tougher-than-expected holiday season for small retailers

Retail (NAICS 44-45) has a large share of small business jobs and was among the better-performing sectors in the US over the course of Q4-2023—but still ended the quarter with 3,300 fewer jobs at small businesses (seasonally adjusted) than the previous quarter. Employment declined in October and November but ended the year with a small monthly increase of 0.08% in December.

Despite the headwinds from high inflation and increased household debt, the National Retail Federation predicted a strong 2023 holiday shopping season in early November. For the smallest retailer employers, Q4-2023 may not have lived up to those predictions. The ramifications of a disappointing peak season could follow small businesses into Q1/2024, especially for small retailers who might depend on strong holiday sales for a large portion of their annual revenue. Overall, it seems small business retailers had a tougher holiday season than anticipated.