If you're starting a business or charging for your products and services, you’ll need to understand the legal requirements for becoming an official business entity. For those starting a limited liability company (LLC), the first step you’ll want to take is filing your articles of organization with the appropriate state agency. As part of this process, you’ll get to complete one of the most exciting steps of starting a business—picking the name. Let’s look at the ins and outs of choosing a name and the other documents you’ll need.

What are articles of organization: How to fill out and file

Articles of organization definition:

The document that officially registers your limited liability company (LLC) with the state.

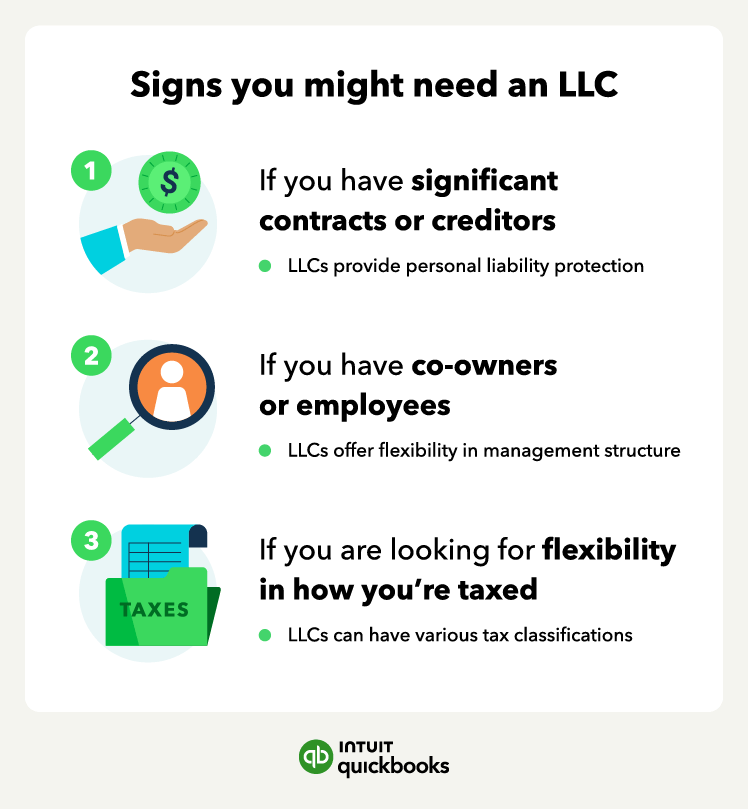

Articles of organization are an official filing with your respective state to create a limited liability company (LLC). Many business owners and entrepreneurs use the LLC structure as it comes with several perks, such as limiting your personal liability exposure. This can protect you in the event of a lawsuit against your company.

A sole proprietorship is different in that it lacks liability protection and leaves you more vulnerable to a personal suit rather than one against your company. There are also tax benefits to LLC formation, including some that carry over from a sole proprietorship, which can help you maximize your tax returns with the IRS.

But first, you need to know how to become an LLC. While becoming an LLC is a big move, it’s surprisingly easy. After a few steps and a filing fee for your articles of organization, you can be the proud owner of an LLC.

What’s needed to file articles of organization?

Each state has different filing requirements. Some states may use an alternate name for the document, such as “certificate of formation” or “certificate of organization.” Although filing requirements differ from state to state, each requires certain information regardless of your state.

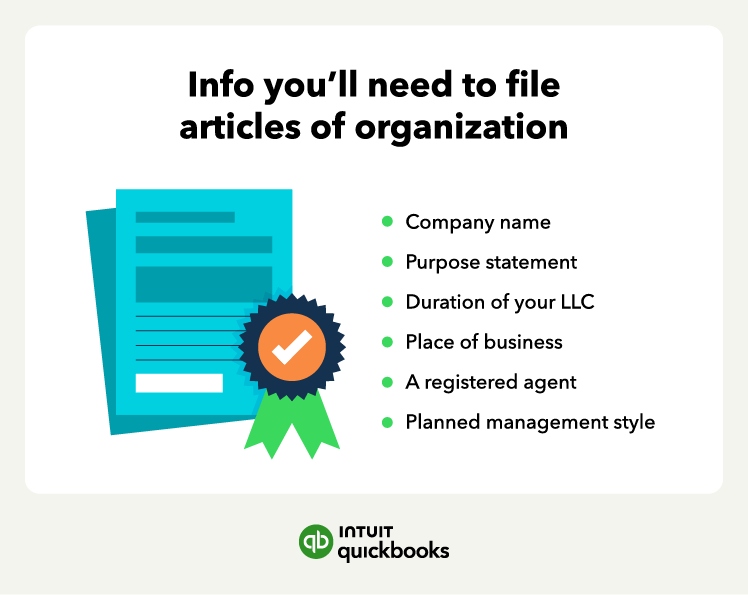

Here’s the information to include when you file articles of organization:

- Company name: You’ll need to include your new company name. But first, run a business entity search in your state for the name you want to use. Check whether it’s available or if another company has already registered that name.

- Statement of purpose: You’ll need to list the purpose of the LLC. Most states do not require a specific statement of purpose. Rather, a general statement of purpose, such as “to engage in any lawful business for profit,” is usually acceptable. This also leaves the door open for future business opportunities you may not have anticipated at the time of formation.

- Duration: If the LLC won't last forever, you can state the specific time period for which the LLC will be operating. However, most LLCs elect a perpetual duration. Many states do not require you to include a specific duration and will likely assume a perpetual duration.

- Principal place of business: This refers to the main location or headquarters of the business. It’s usually the address where the company’s management works and keeps books and records. If you run a business from home, you can list your home office as your principal place of business. You could also qualify for a home office tax deduction.

- Registered agent: You must list the name and address of your LLC’s registered agent. A registered agent receives important documents on behalf of the LLC. You need a registered agent in each state where you register your LLC. The registered agent can be an LLC member (such as yourself) or an outside individual or firm.

- Management style: Most states require you to indicate whether the LLC will be member-managed or manager-managed. Most LLCs are member-managed, where all members share responsibility for running the business. In a manager-managed LLC, the members appoint a manager or a group of managers to handle the company’s daily operations. The manager-managed structure is useful when there are too many members to manage the business efficiently or when some members would prefer to be passive investors.

How to file articles of organization

Filing articles of organization is the key step in establishing your LLC—let’s look at the five steps you’ll need to take:

Step 1: Visit your Secretary of State

When it comes to filing articles of organization the first step is to visit your state's Secretary of State website (or whichever agency handles articles of organization filings in your state). In most states, the Secretary of State is the governing body responsible for overseeing business entities and maintaining official records.

By visiting the agency’s website, you can access all the information and resources you need to understand the specific requirements and guidelines for filing articles of organization.

Step 2: Gather the necessary information

You’ll need all the information above, such as company name and registered agent, but the exact info you’ll need will vary. Every state has its own rules and regulations for filing articles of organization. And while the information on their websites can be comprehensive, it may be outdated, so consider consulting a business attorney who can provide guidance.

When putting the info together, the name search process can easily be the longest part of your journey. Most state laws prohibit two businesses from having the same name, so you should first check to see if any business is using your chosen name in your state.

Step 3: Create an operating agreement

An LLC operating agreement is a legal document laying out how your LLC will, well, operate. In it, you can detail how you'll divvy up responsibilities, the management structure, financial matters, and governance issues.

While not always necessary for registering a business, an LLC operating agreement can help determine many of the things you’ll need when filing your articles of organization. Note that the operating agreement is an internal document, which some states will require and others won’t. Either way, it’s a good idea to have one. Without it, you could find yourself dealing with disagreements as the company grows and questions or concerns over business structure arise.

Step 4: Submit to the state

This step is a big one, but also perhaps the easiest—depending on the state. Once you gather all the info and fill out the necessary forms, you’ll pay a fee and submit them (usually online).

The fee varies by state, as does the waiting time for them to process your paperwork. Some states will have it done in less than a week, while others say the process takes a month or longer.

Step 5: Get your approved articles of organization

After the state approves or rejects—which can happen if your name is too similar to another business—they’ll notify you. You can then view and save or print the document.

What to do after you file your articles of organization

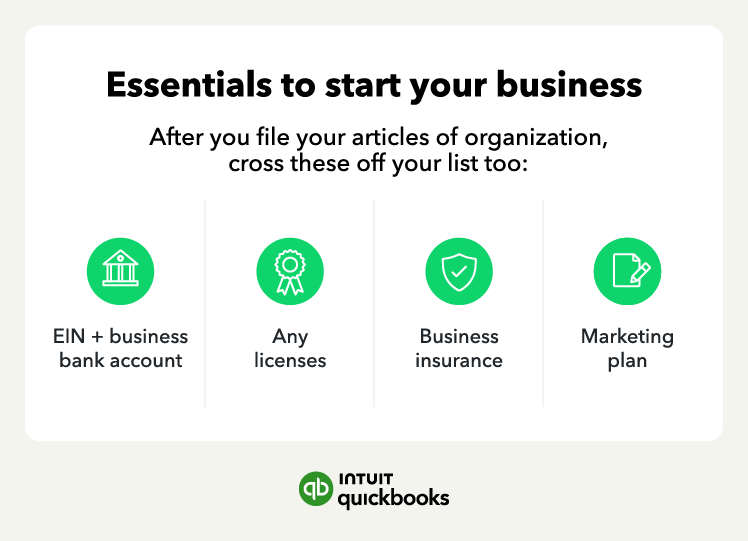

Once you officially register your business as an LLC, you’ll want to keep your momentum by taking the next steps in getting your business up and running.

Here are a few ways to get even more out of your new LLC status:

- Get an EIN: An employer identification number (EIN) is a tax identification number for businesses. You will need an EIN to hire employees, open a business bank account, or file taxes for your LLC.

- Open a business bank account: This will help you keep your business finances separate from your personal finances.

- Get a business license: Depending on your location, you may need to obtain a license from your city or county.

- See if you need business insurance: Your LLC will help protect you from personal lawsuits, but you may want to get business insurance to avoid potential damages, claims, or losses. Key types of business insurance include liability, property, and business interruption insurance.

- Start marketing your business: There are various ways to market your business, such as online marketing, print advertising, and public relations. You could also set up a website and social media accounts if you need an online presence.

Plus: State-by-state reminders

Remember that each state will have different filing requirements, so you’ll want to visit your Secretary of State website. However, note that this department doesn't always handle articles of organization filings. For example, some states have a commission or division that handles such things. In Alaska, the agency you file with is the State of Alaska Corporations Section.

Some key things to keep when filing your documents with the appropriate state agency:

- Processing times for some states can be 4-6 weeks. In many cases, you can pay extra to expedite the process, such as $100 for same-day services. Other states process the filings within days without a surcharge, such as New York, which processes their filings within minutes.

- The filing fee will vary by state. Many states charge $100-$200, but some charge more.

- There might be other requirements beyond just filing your articles of organization. Some states will require you to also publish a notice in the local newspaper or file tax-related registration forms.

It's important to carefully review your state's specific requirements to ensure that you include all necessary information and attachments.

Start your business with confidence

Congratulations on starting your LLC. Like with all things in the business and financial world, it pays to keep good records. Keep copies of all your paperwork, cover all your bases, and when in doubt, speak to a legal expert to make sure you’re making the right decisions.

And after opening a business bank account, you can simplify your business finances with accounting software like QuickBooks that integrates and automates recording your financial transactions.