When do you need to issue 1099 forms?

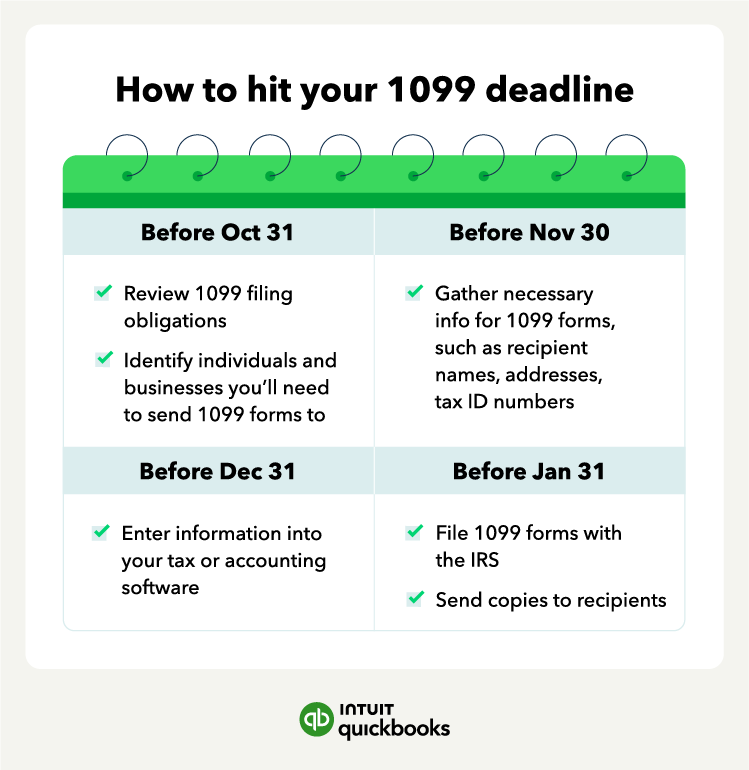

Misunderstanding what 1099 forms are and how to use them is one of the common mistakes made on 1099s. Businesses and individuals who make qualifying payments are responsible for issuing 1099 forms. Recipients must also get a copy for their own tax reporting.

- Threshold: You must generally issue a 1099 if you’ve paid $600 or more in a calendar year for services, rent, or other reportable income.

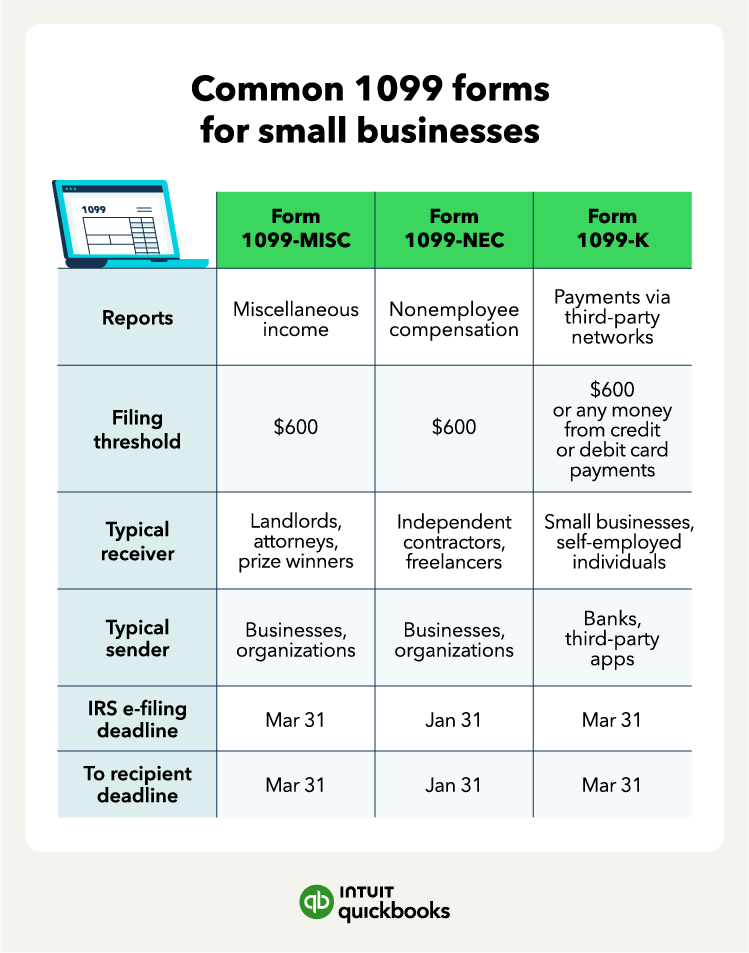

- 1099-NEC: For contractor or freelancer services.

- 1099-MISC: For rent, legal fees, and certain miscellaneous payments.

- 1099-K: For businesses receiving payments through platforms like PayPal, Venmo, or online marketplaces.

If you paid $600 or more to an individual or unincorporated business for services during the past year, you’ll likely need to issue a 1099 in January.

For example, if you pay a contractor or a freelancer for services, you would issue a 1099-NEC form to report their nonemployee compensation. However, if you need to report rent or attorney fee payments, you’ll need to file Form 1099-MISC.

Form 1099-K is a tax form that small businesses receive if they use an online marketplace like eBay or if they use third-party payment applications such as PayPal.

Here is a recap and filing deadlines of the common 1099 forms small businesses either send or receive: