Tax season is around the corner, and if you’re self-employed, it pays to prepare early. Whether you’re a freelancer, independent contractor, or solopreneur, you’ll likely receive one or more 1099 forms, and that means extra tax responsibilities.

Unlike W-2 employees, you’re on the hook for tracking income, managing expenses, and paying your own taxes. But with the right approach, you can avoid costly mistakes and keep more of what you earn.

Here are ten smart tax tips for 1099 employees and contractors to help you stay organized and maximize your deductions for the 2026 tax season.

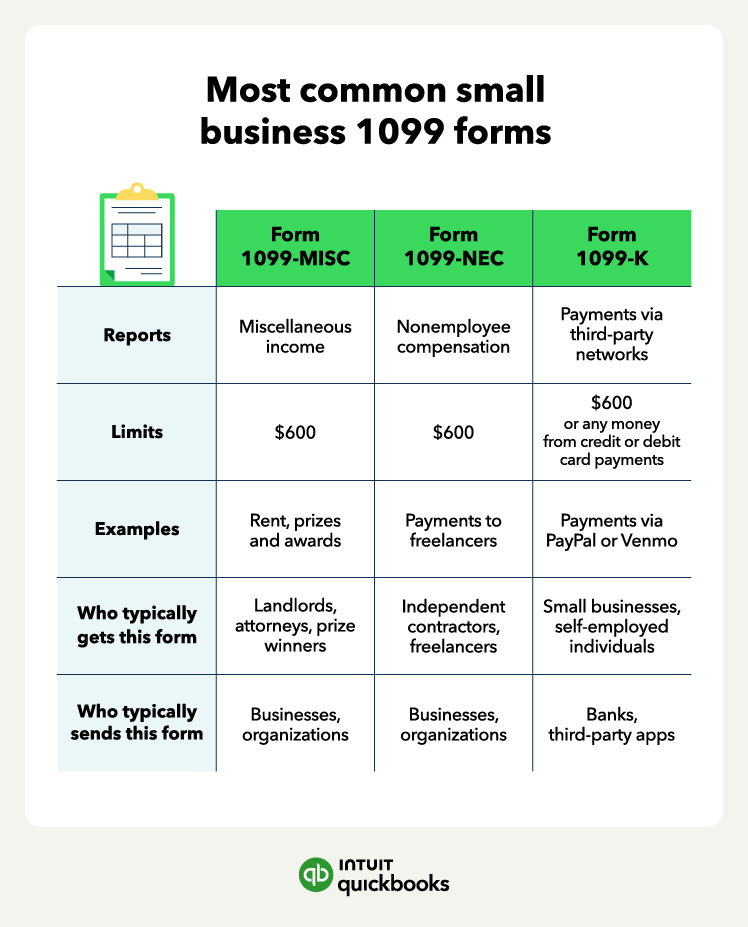

1. Understand your 1099 forms

2. Write off all your business expenses

3. Don’t try to deduct personal expenses

4. Capitalize on vehicle deductions

8. Maximize your retirement contributions

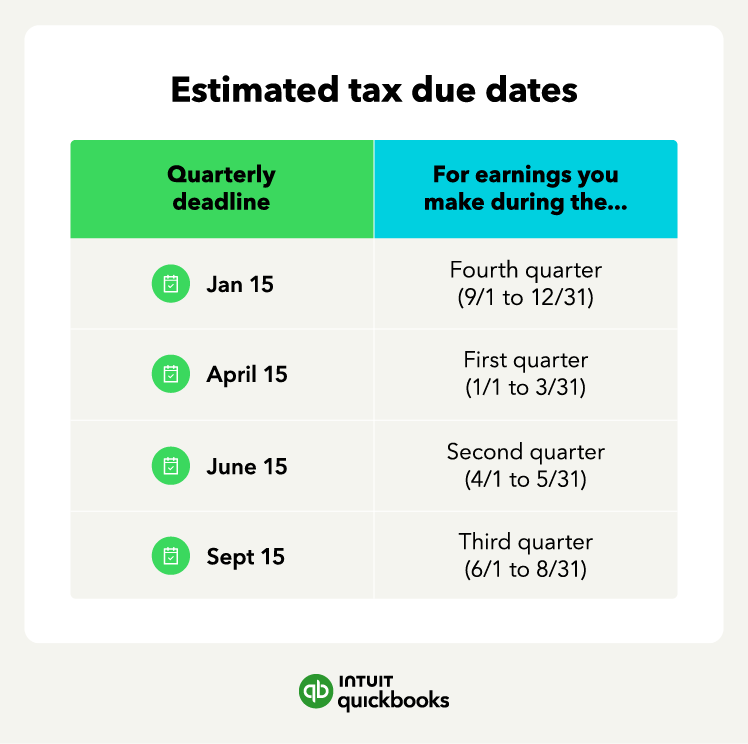

9. Don’t forget your self-employment tax obligations

10. Separate personal and business finances