Things to keep in mind about the 1040 form

Before you file, it helps to understand a few of the most common questions taxpayers have about Form 1040. Here’s a closer look at what information you’ll need, what key lines mean, and whether you should file if you have little or no income.

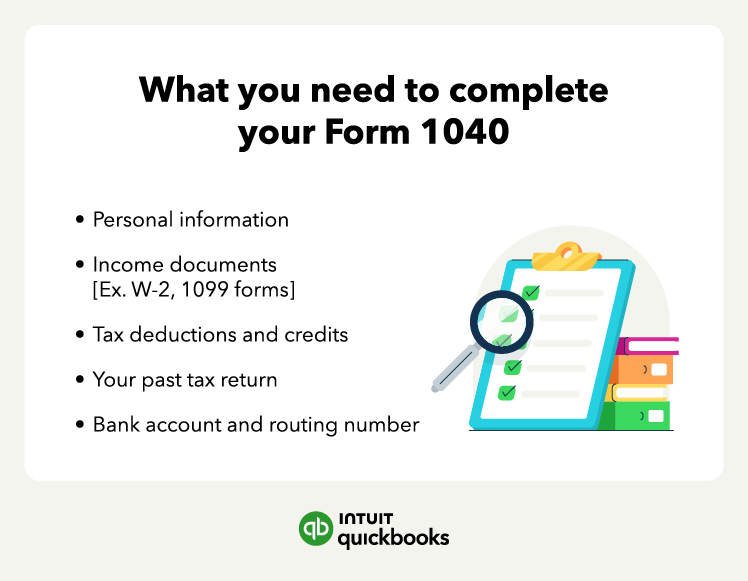

You need key personal and income details to complete Form 1040

To file Form 1040, gather your personal information, including your name, Social Security number, and the same for any dependents. You’ll also need documents that show your income, like W-2s for wages, 1099s for contract or freelance work, and records of dividends or Social Security benefits. Having everything ready makes filling out your return faster and easier.

Line 16 shows your total tax owed

Line 16 is one of the most important numbers on your Form 1040; it shows your total tax due for the year. This figure includes the tax on your taxable income and any additional taxes from forms like 8814 (child’s interest and dividends) or 4972 (lump-sum distributions). Double-check this line to ensure it matches your calculations or software output.

You might not need to file if you have no income

You generally don’t have to file Form 1040, if you earned no income during the year, but some exceptions apply. For example, if you qualify for certain tax credits, owe special taxes, or need to report health coverage.

Checking the IRS filing requirements each year ensures you stay compliant and don’t miss out on potential refunds or credits.

Also, you may benefit from the Qualified Business Income (QBI) deduction, aka

Also, you may benefit from the Qualified Business Income (QBI) deduction, aka