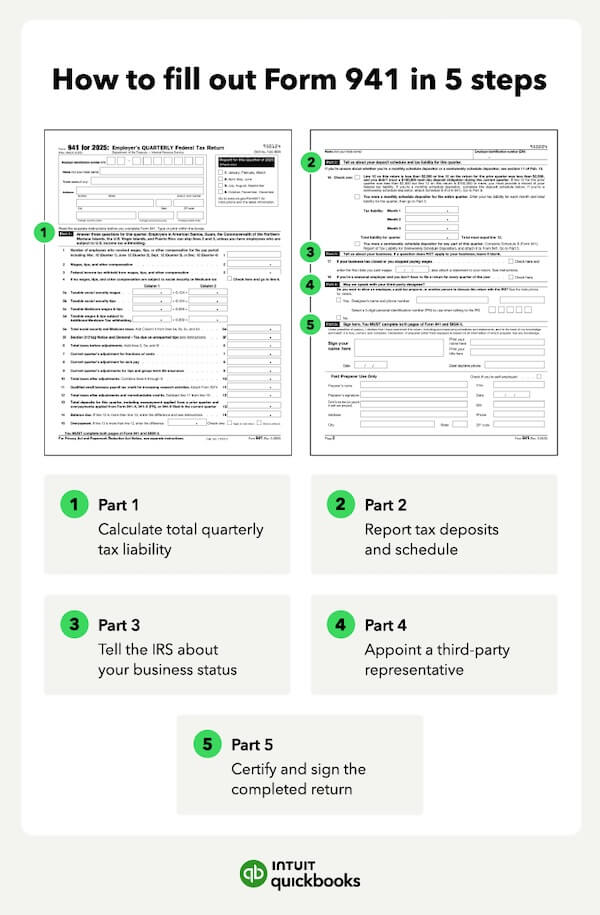

Part 1: Quarterly tax information

Part 1 is where your tax liability is calculated. And perhaps more importantly, this section will tell you whether or not your withholdings are accurate.

In this section, you’ll need to report wages paid, tips paid, and taxes withheld. You’ll also need to perform detailed calculations on your tax liability. Let’s look at an example scenario.

Example

A small marketing agency has five employees, and for quarter 1, these employees were paid a total of $70,000. The employees did not earn tips.

The Social Security income tax calculation would be $70,000 × 0.124 = $8,680. The Medicare tax valuation would be $70,000 × 0.029 = $2,030. The business owner would then add these two results to the federal income tax withheld to determine their total tax liability minus any adjustments.

If the final tax liability is lower than the total tax the marketing agency deposited, then they would be owed a refund. But if the liability is higher, they would need to pay the outstanding total immediately.

Part 2: Deposit schedule and tax liability

The next section of Form 941 looks at your deposit schedule as well as the dollar total of your tax liability. As a business, you’ll need to select whether you deposit monthly or semiweekly and record your tax liability. How this is reported will depend on your deposit schedule. Let’s look at an example.

Example:

Susie owns a donut shop employing one baker and one counter clerk. For the 2nd quarter, she paid $20,000 in wages. Her tax liability for this quarter comes to $3,050. Per the IRS lookback period, she was assigned to the monthly schedule.

In part II, Susie would check the second box and enter her tax liability for April, May, and June individually, along with the total.

If Susie’s total liability was less than $2,500, she could check the first box. In contrast, if Susie owned several successful donut shops and were assigned the semiweekly deposit schedule, she would check the third box. She would need to attach a separate Schedule B to show a breakdown of her tax liability.

If your 941 return shows you overpaid taxes, you can apply the funds to next quarter’s return or request a refund. If you underpaid, you’ll need to pay immediately.

If your 941 return shows you overpaid taxes, you can apply the funds to next quarter’s return or request a refund. If you underpaid, you’ll need to pay immediately.