As we look back on 2023, we’re happy to have shared it with all of the accounting professionals in the QuickBooks community. Thank you for the insightful feedback that led to all of this year’s updates.

What’s new in December

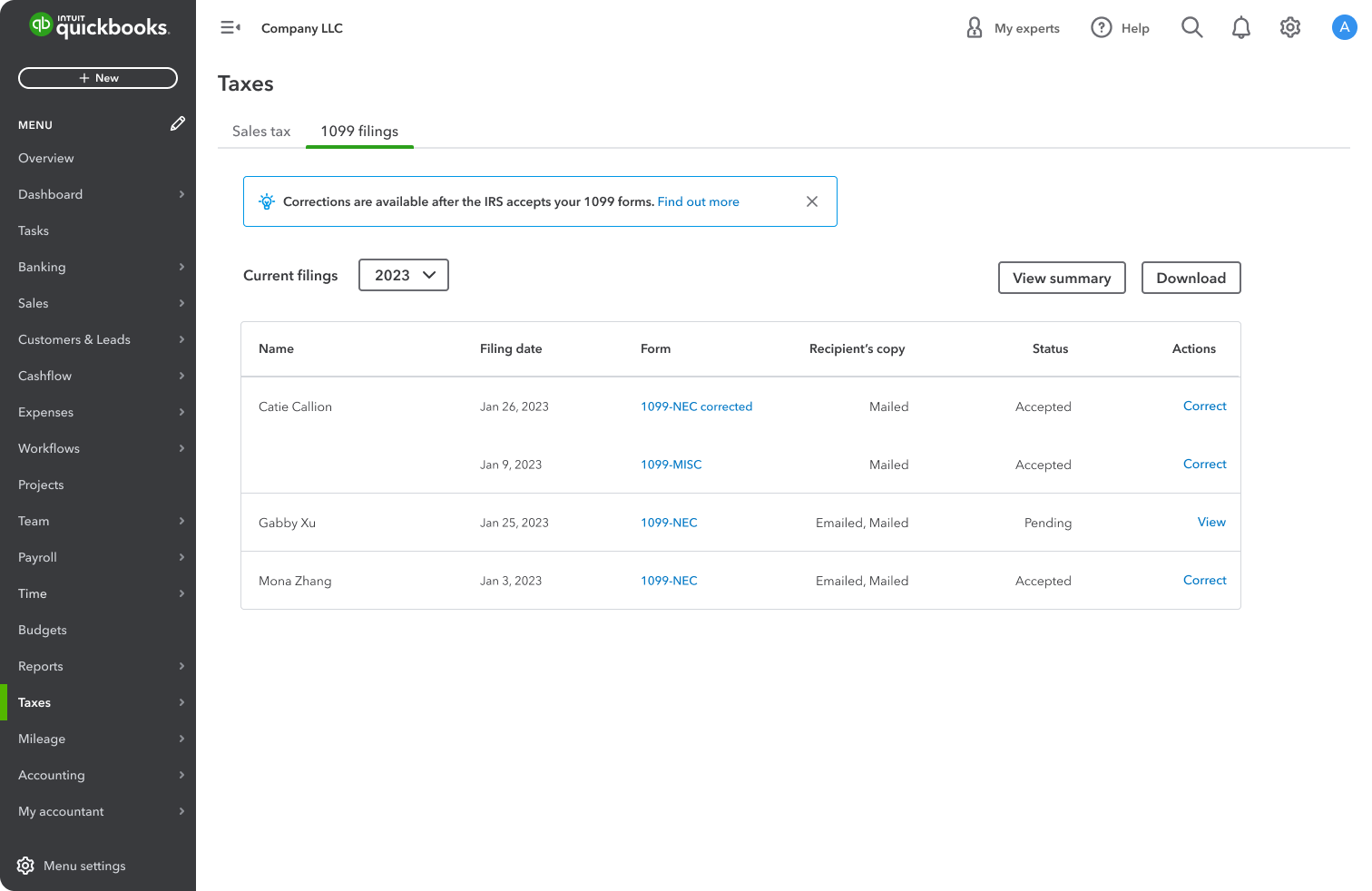

An easier, smarter 1099 experience

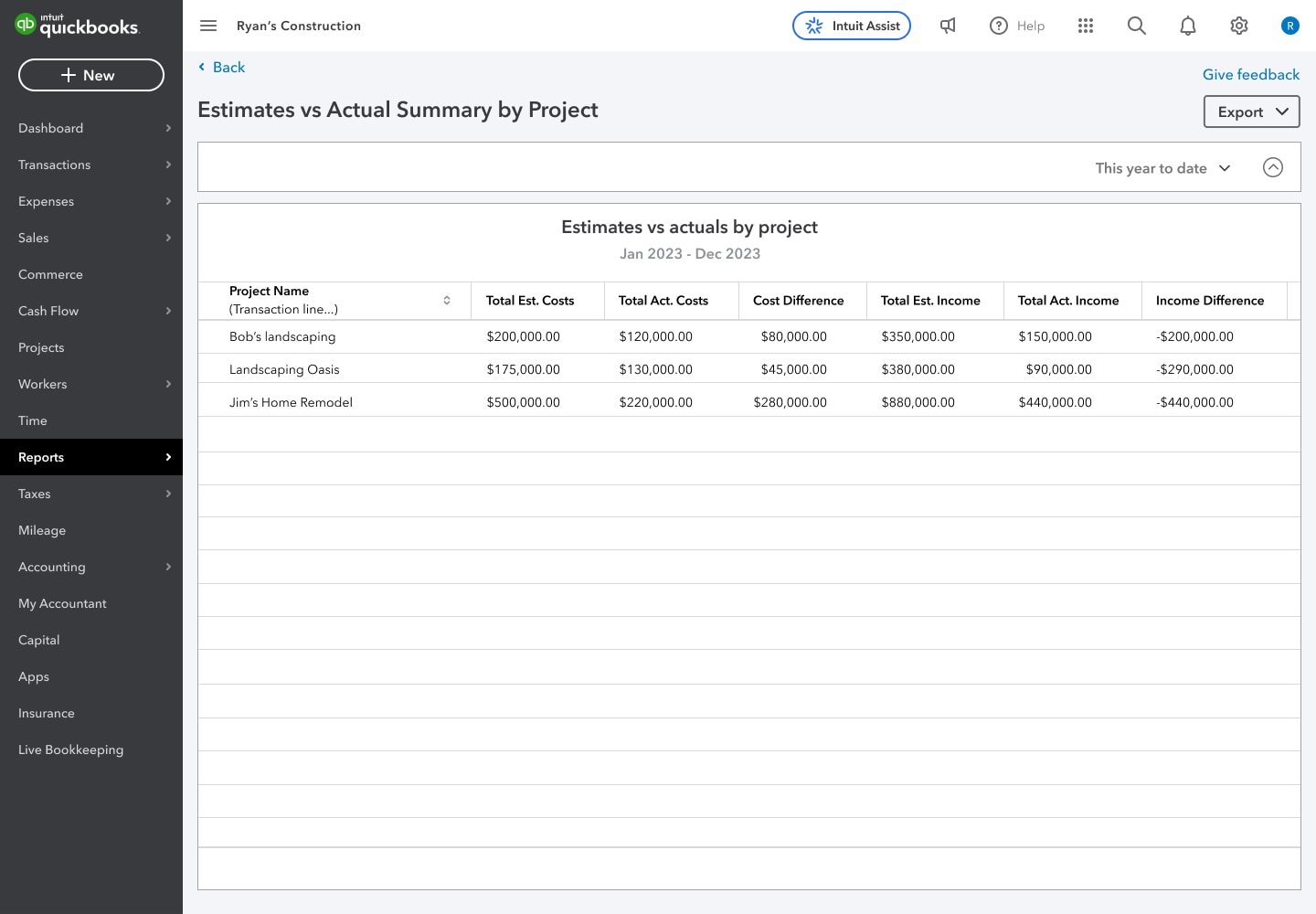

New project-based reports provide more insights to clients

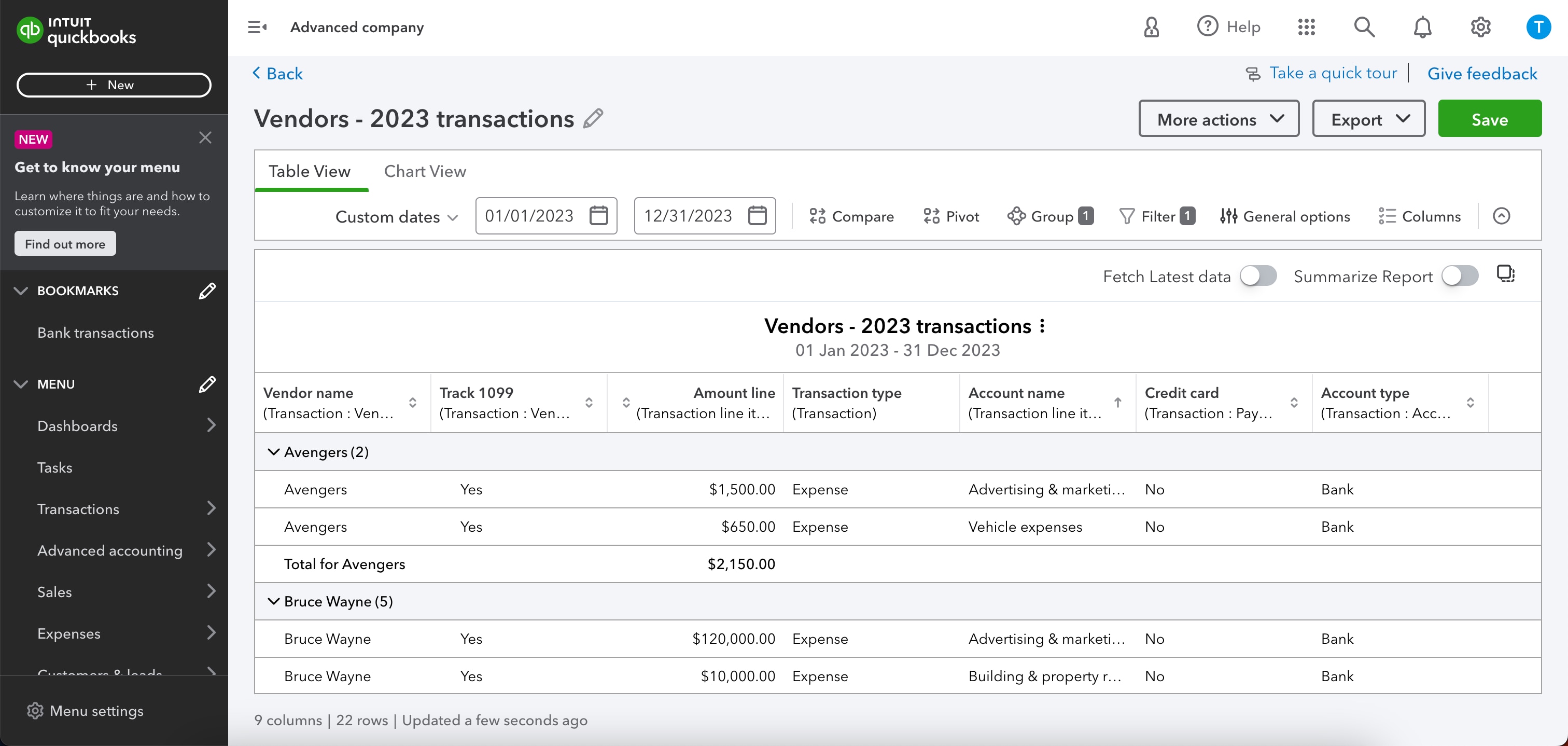

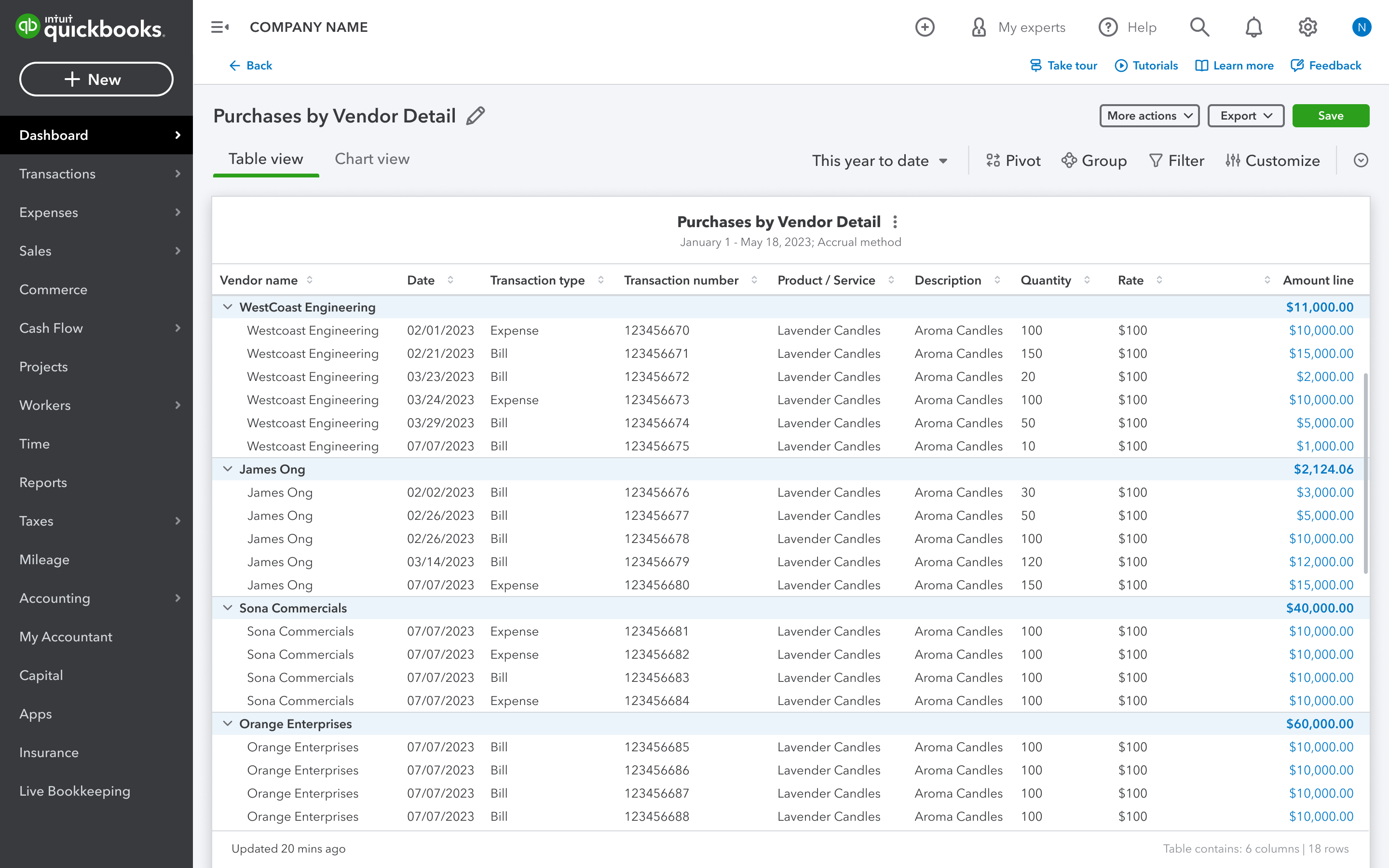

A simplified and more flexible view of expense reports

Import subdivided budgets in QuickBooks Online Plus and Advanced

Improved ACH payment speed for QuickBooks Bill Pay, or opt for next-day delivery with Faster ACH

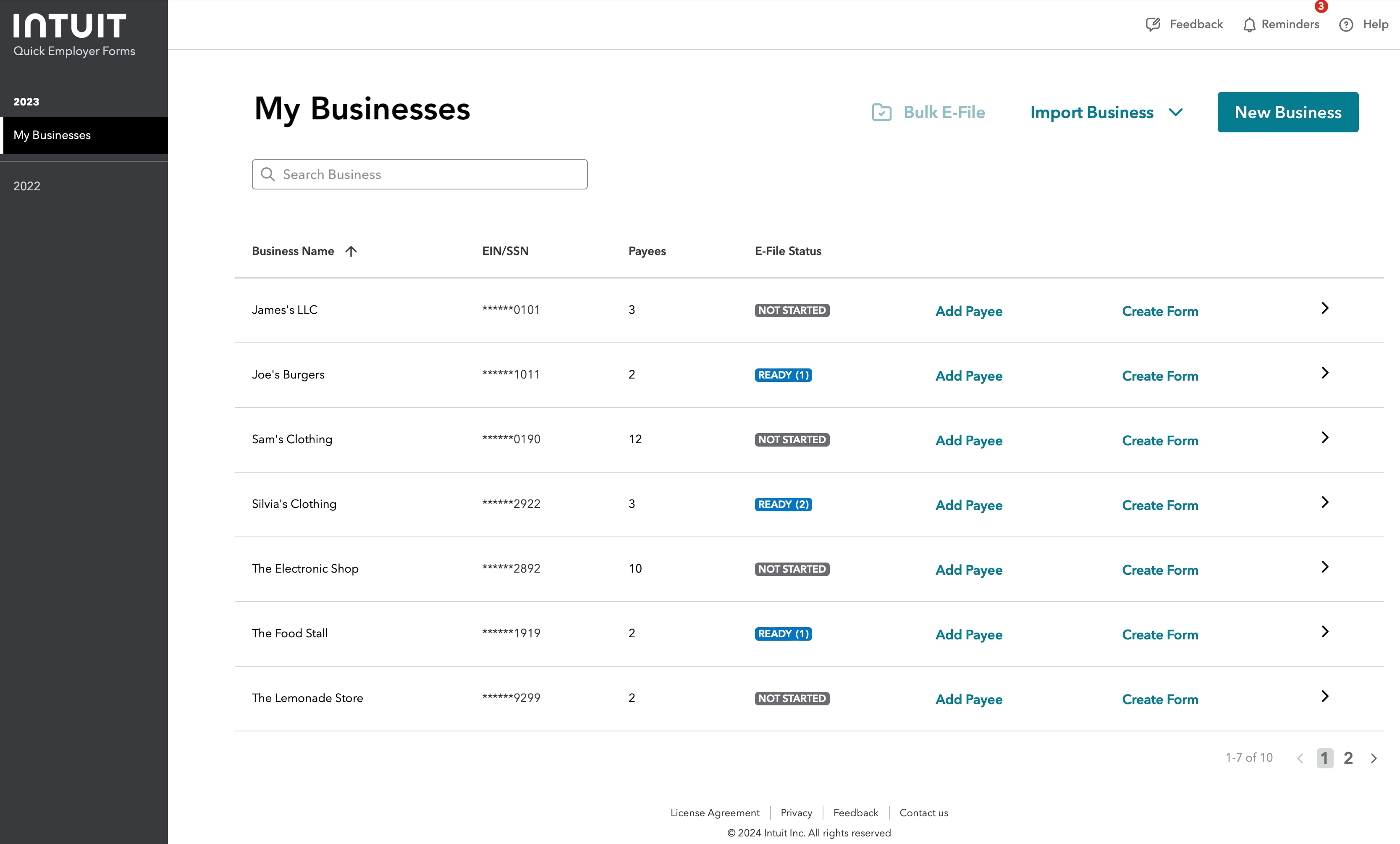

Create and e-file unlimited W-2s and 1099s quickly with Quick Employer Forms Accountant

Coming soon: Expert support for claiming tax credits