By Ana Bentes

November 25, 2025

By Ana Bentes

November 25, 2025

When it comes to hiring workers, small business owners face a critical decision between a 1099 vs. a W-2 classification, which has significant implications for their payroll process, tax obligations, and overall business operations. These only exacerbate growing concerns over attracting and retaining skilled workers.

Misclassifying workers can lead to serious consequences, including IRS penalties, back taxes, and even lawsuits from affected workers. That’s why it’s crucial to get it right from the start—whether you’re managing payroll manually or using tools like payroll software to streamline the process. With the right knowledge and resources, you can confidently classify your workers and build a team that supports your business goals.

In this guide, we’ll break down everything you need to know about 1099 vs. W-2 workers, including their tax implications, benefits, legal requirements, and how they impact your bottom line. By the end, you’ll have a clear understanding of which classification works best for your needs.

What is a 1099?

A 1099 is a form stating to the Internal Revenue Service (IRS) that a non-employer paid money to an individual or business. There are many types of 1099 forms, but the most common are 1099-NEC and 1099-MISC.

Businesses generally issue these forms to freelancers and independent contractors, and they report wages without taxes withheld to the IRS. Those who earn more than $600 for nonemployee compensation will receive the 1099-NEC form, which replaced Form 1099-MISC.

What is a 1099 form?

A 1099 form is an information return used to report income paid to non-employees. Unlike a W-2, which is for employees, the 1099 is typically issued to freelancers, independent contractors, and other self-employed individuals. The most common type is the 1099-NEC, which stands for Nonemployee Compensation. This form replaced the 1099-MISC for reporting payments specifically related to contractor work. However, the 1099-MISC is still used for other types of miscellaneous income, such as rent or prizes.

The primary purpose of a 1099 form is to report income where no taxes—like Medicare, Social Security, or federal income tax—have been withheld by the payer. For example, if you pay an independent contractor $600 or more for their services in a calendar year, you’re required to issue them a 1099-NEC. This threshold ensures that the IRS can track significant payments made to non-employees and hold them accountable for paying their own taxes.

Who is a 1099 independent contractor?

A 1099 employee operates as a self-employed individual, which subsumes independent contractors, freelancers, gig workers, or consultants. These workers are not considered employees of the business the way they would be under a W-2 contract; instead, they operate independently and are hired to complete specific tasks or projects, often under an agreement outlining specific terms and deliverables.

One of the biggest distinctions of a 1099 worker is their autonomy. They have full control over how, when, and where they perform their work. They also use their own tools, methods, and resources, rather than relying on the hiring business to provide them. This independence allows for flexibility but also comes with added responsibilities, such as the need to pay self-employment taxes to cover Social Security and Medicare.

1099 workers also don’t receive benefits like health insurance, paid time off, or retirement plans from the businesses they work with. Here, too, they must work independently to secure these benefits, which can be both a challenge and an opportunity depending on their preferences and circumstances.

Understanding who qualifies as a 1099 worker and the implications of working with them can help small business owners make smarter decisions about managing their workforce. By leveraging independent contractors effectively, you can tap into specialized skills without the overhead associated with traditional employees.

What is a W-2?

Form W-2 reports all payments an employee receives within a particular year. The employer provides this form to all employees at the end of the calendar year.

What is a W-2 form?

IRS Form W-2 is an annual wage and tax statement that employers must provide to their employees. Its primary purpose is to report how much an employee earned and how much was withheld for taxes during the year, which information is shared with both the IRS and the employee to ensure taxes are accurately filed.

The form includes several key sections, each containing important financial details. For example, it shows taxable wages, which is the total taxable amount the employee earned (it is possible to earn money that isn’t taxed, which wouldn’t show up under taxable wages).

It also lists federal, state, and local taxes withheld and any wages and taxes associated with Social Security and Medicare. Taken together, this information helps employees complete their tax returns and weigh the pros and cons of a 1099 vs. a W-2 (thus avoiding fees, penalties, and tangles with the IRS down the road).

The information on a W-2 form includes:

- State income: The amount withheld for state income tax purposes.

- Medicare and Social Security income: The amount the employer withholds to pay what the federal government calls “FICA” taxes.

- Taxable income: The amount an employee made that year and the amount withheld for federal taxes.

This information on the W-2 form is necessary to file income taxes when tax season rolls around.

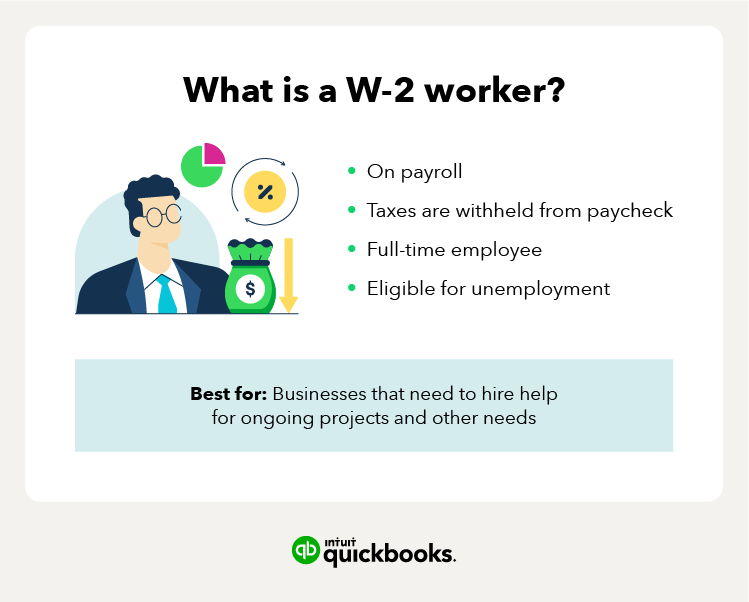

Who is a W-2 employee?

A W-2 worker is a direct employee hired to perform ongoing work in the company’s operations. Unlike independent contractors, W-2 employees are generally more integrated into the business and typically work under the employer’s direction and control.

Under a W-2 contract, employers significantly influence how employees perform their respective jobs by setting work hours, prescribing methods and processes, providing any requisite tools or equipment, and (sometimes) offering training aimed at ensuring tasks are completed to their standards. Supervision is also a key aspect, as employers actively manage and oversee the day-to-day activities of their W-2 employees.

As with most things, this level of control comes with several responsibilities for the employer. For one, they’re required to withhold taxes from the employee’s paycheck, including FICA (Social Security and Medicare) and federal income taxes. Employers must also pay additional payroll taxes, such as unemployment insurance and workers’ compensation premiums, providing financial protection for the W-2 employee and the business.

What’s more, W-2 employees are typically eligible for benefits not received by independent contractors, which can include health insurance, paid time off (like vacation days and holidays), retirement plans (such as 401(k)s), and sick leave. Besides the obvious benefit to employee well-being, this is one way a competitive business might attract and especially retain skilled workers.

Any business considering a W-2 contractor vs. a 1099 contractor should think carefully about the control this offers and the responsibilities it brings. This clarity ensures compliance with labor laws while fostering a positive workplace.

1099 vs. W-2: A detailed comparison

Choosing between hiring an employee under a 1099 vs. a W-2 contract can significantly affect your business. To help you decide what’s best for your circumstances, we’ve broken down the key differences across several categories. Here’s a quick overview in table format, followed by a deeper dive into each area:

1099 vs. W-2 Tax implications

When it comes to taxes, 1099 vs. W-2 employees are treated very differently. For W-2 employees, the employer is responsible for withholding federal, state, and local income taxes from the employee’s paycheck. The employer also pays half of the FICA taxes (Social Security and Medicare), while the employee’s share is withheld from their wages. This system simplifies tax obligations for employees, as most of the heavy lifting is handled by the employer.

1099 workers, for their part, are responsible for paying their own taxes, including the full 15.3% self-employment tax to cover both the employee and employer portions of Social Security and Medicare (which a W-2 employee gets to split with whoever hires them). Additionally, they must pay their own federal, state, and local income taxes.

To maintain compliance, independent contractors often need to make quarterly estimated tax payments throughout the year. This added responsibility can (of course) be burdensome, but it does offer greater control over deductions, tax planning, and related matters.

Control & autonomy

The level of control you have over a worker is one of the most defining factors in determining whether they’re classified as a W-2 employee or a 1099 contractor. With W-2 employees, employers have significant authority over how the work is performed. This includes setting work hours, providing necessary tools and equipment, offering training, and closely supervising tasks.

In contrast, 1099 contractors operate with a high degree of independence. They often use tools and methods to decide how, when, and where to complete their work. While this autonomy can lead to greater creativity and efficiency, it also means the hiring business has less direct oversight. Businesses typically hire contractors for their expertise and ability to deliver results without needing constant direction.

Benefits of 1099 vs. W2

One of the biggest advantages of hiring W-2 employees is the ability to offer a wide range of benefits. These can include health, dental, and vision insurance, paid time off (vacation days, holidays, sick leave), retirement plans like 401(k)s, life insurance, and more. These perks attract top talent and foster long-term loyalty and job satisfaction.

Independent contractors, however, do not receive any employer-provided benefits. Instead, they must cover all their own expenses, including health insurance, retirement savings, and business-related costs like travel or equipment. This arrangement usually allows contractors to negotiate higher rates while shifting the financial burden entirely onto them.

Costs to the business

Hiring W-2 employees comes with additional costs beyond just their salary. Employers are responsible for paying their share of payroll taxes, providing benefits, covering workers’ compensation insurance, and paying unemployment insurance premiums. There are also administrative costs associated with payroll processing and compliance. While these expenses add up, they contribute to building a stable, loyal workforce.

With 1099 contractors, the costs are simpler but can still be significant. Businesses typically pay a flat contract fee or hourly rate, with no payroll taxes, benefits, or workers’ comp required. However, contractors often charge higher rates to account for their own expenses and self-employment taxes. While this model can be cost-effective for short-term needs, it may not always be the best choice for long-term projects.

Legal & compliance

Various labor laws protect W-2 employees, including minimum wage requirements, overtime regulations, anti-discrimination statutes, and the Family and Medical Leave Act (FMLA). While termination is generally “at-will,” businesses must still ensure compliance with these laws to avoid legal issues.

For 1099 contractors, the working relationship is governed by the terms of their contract rather than traditional labor laws. This means the agreement outlines their rights and responsibilities, and termination typically follows those terms. However, contractors have fewer protections under labor laws, making disputes more challenging to navigate.

Business longevity

W-2 employees are usually part of a business’s long-term strategy. Their ongoing employment fosters loyalty, builds institutional knowledge, and strengthens company culture. Over time, they can adapt to changing roles and grow with the organization, making them valuable assets.

In contrast, 1099 contractors are often engaged for specific projects or short-term needs. While they bring specialized skills and focus, their engagement is typically limited to delivering defined outcomes. As a result, contractors tend to have less direct loyalty to the company and may move on once their work is complete.

The risks of worker misclassification

Misclassifying workers as independent contractors when they should be classified as employees can lead to serious financial and legal consequences for your business. Understanding the risks—and how to avoid them—is crucial for staying compliant and protecting your company.

What is misclassification?

Worker misclassification occurs when a business incorrectly treats an employee as an independent contractor to avoid tax obligations and other employer responsibilities. This practice violates labor laws and deprives workers of benefits and protections they’re entitled to, such as minimum wage, overtime pay, and unemployment insurance. Misclassification can happen unintentionally, but the consequences are significant regardless of intent.

Consequences of misclassification

Misclassifying workers can result in severe penalties from multiple government agencies and potential lawsuits from affected workers.

Here’s what you need to know:

- IRS penalties: If the IRS determines that a worker was misclassified, your business could face back taxes for the employer’s share of FICA (Social Security and Medicare), along with interest and fines. Accuracy-related penalties may also apply if the misclassification is deemed careless or intentional.

- Department of Labor (DOL) penalties: The DOL can impose liabilities for unpaid wages, including overtime pay under the Fair Labor Standards Act (FLSA). In some cases, businesses may also face liquidated damages, which can double the amount owed to the worker.

- State agency consequences: State-level penalties can include unpaid unemployment insurance contributions, workers’ compensation liabilities, and state tax penalties. These vary by state but can add up quickly, especially in states with strict labor laws.

- Legal action: Misclassified workers may file lawsuits seeking unpaid wages, benefits, and other damages. These cases can be costly to defend and may result in settlements or judgments against your business.

The financial and reputational risks of misclassification mean that it’s worth the effort to get worker classification right from the start.

When in doubt about classifying a worker, err on the side of caution and consult a professional. Using tools like QuickBooks Payroll can also help you stay compliant by simplifying tax calculations and payroll management, reducing the risk of costly mistakes.

IRS guidelines for classification

To determine whether a worker is an employee or an independent contractor, the IRS evaluates three main categories: behavioral control, financial control, and the type of relationship. No single factor is decisive—the totality of circumstances matters.

Here’s a breakdown of each category:

- Behavioral control: This factor examines whether the company controls how the worker performs their job. For example, does the business provide detailed instructions, training, or supervision? If the company dictates how, when, and where the work is done, the worker is more likely to be classified as an employee.

- Financial control: This factor looks at who controls the business aspects of the worker’s job. Key considerations include whether the worker has unreimbursed expenses, invests in their own equipment, has the opportunity for profit or loss, and is paid a flat fee or hourly rate. Independent contractors typically have more financial independence than employees.

- Type of relationship: This factor focuses on how the parties perceive their relationship. Written contracts, the presence of employee benefits (like health insurance or retirement plans), the permanency of the engagement, and whether the services provided are a key aspect of the business all play a role. A long-term, integral role in the business suggests an employer-employee relationship.

By carefully thinking through these factors, consulting resources like the IRS’s guidelines, or seeking professional advice if you’re still unsure, you can reduce the risk of misclassification and ensure compliance with all applicable labor laws.

Which classification is better for your business?

Choosing between a 1099 contractor and a W-2 employee isn’t a one-size-fits-all decision. The best choice depends on your specific business needs, the nature of the work, and how much control you want to maintain over the process.

When to hire a 1099 contractor

There are several situations where hiring a 1099 contractor makes the most sense:

- Specialized skills for short-term projects: If you need expertise for a specific task—like graphic design, IT support, marketing campaigns, or what have you—a contractor can provide the skills without a long-term commitment.

- One-time tasks or overflow work: Contractors are ideal for handling one-off projects or helping manage busy periods when your team is at capacity.

- Flexibility and scalability: Contractors allow you to quickly scale your workforce up or down based on demand, making them a great option for businesses with fluctuating workloads.

- Lower administrative burden: Since contractors handle their own taxes and benefits, hiring them reduces the administrative responsibilities that come with managing employees.

For businesses looking for cost-effective, flexible solutions, 1099 contractors can be an excellent choice.

When to hire a W-2 employee

In other cases, bringing on a W-2 employee is the better option:

- Ongoing, core business functions: Employees are better suited for roles that are central to your operations and require consistent attention, like customer service or production management.

- Direct control over work processes: If the work requires close supervision, training, or adherence to specific methods, hiring an employee ensures you have the level of control needed.

- Building a long-term team: Employees contribute to company culture, loyalty, and institutional knowledge, which are crucial for sustainable growth.

- Roles requiring significant training: Positions that involve proprietary systems, complex processes, or extensive onboarding are often better filled by employees who will grow with the company.

- Dedicated, integrated team members: Employees are invested in the success of the business and can collaborate more effectively with other team members to achieve shared goals.

For businesses focused on stability, team cohesion, and long-term success, W-2 employees are often the way to go.

Hybrid approaches

These days, many successful businesses choose not to limit themselves to just one type of worker, instead strategically using both W-2 employees and 1099 contractors to meet a diverse array of needs. You might hire employees to handle day-to-day operations, for example, while bringing in contractors for specialized projects or seasonal work.

This hybrid approach allows you to weigh flexibility, cost-efficiency, and control against one another as your circumstances change, ensuring your workforce aligns well with your broader goals.

Next steps for streamlining your payroll process

Understanding the differences between 1099 vs. W-2 workers is just the first step in managing your workforce effectively. By classifying your workers correctly, you can ensure compliance, avoid costly penalties, and build a team that helps your business thrive. For more guidance on managing payroll and taxes, explore our comprehensive payroll software solutions.

If you’re ready to take the stress out of payroll and the different tax situations small businesses find themselves in, QuickBooks Payroll can help. From automatic tax calculations to same-day direct deposit and seamless time tracking, our tools are designed to save you time and give you peace of mind. With QuickBooks, you’ll have everything you need to pay your team accurately, stay compliant, and focus on what matters most—running your business.

1. Additional fees apply.

2. Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

Recommended for you section: