The order in which they are prepared

The three financial statements work coherently together to create a fully holistic view of the company and its financial position. They have to be prepared in a particular order since the information from one affects the others.

The order goes like this:

- The profit and loss statement: All income and expenses are added together to gather the net income, which you'll report as retained earnings.

- The balance sheet: That net income becomes a retained earnings line item on the balance sheet, which is used to locate the ending cash balance.

- Cash flow statement: The cash balance from the balance sheet then appears on the cash flow statement.

This sequential relationship ensures accuracy and consistency across all financial reports.

The information they contain

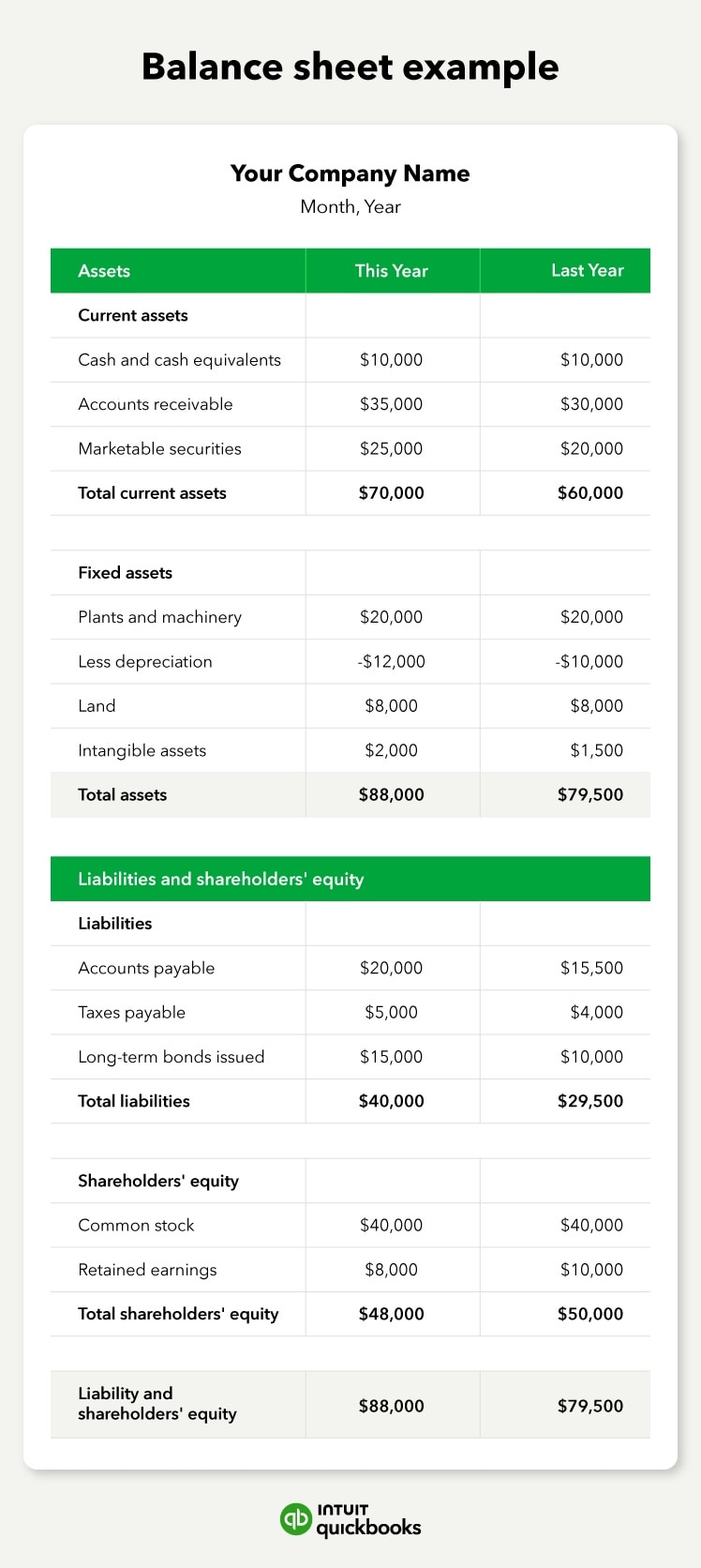

As we mentioned earlier, the balance sheet and profit and loss statement yield very different information. One contains what belongs to the company, while the other shows how earnings were spent. The categories are broken out this way:

Balance sheet:

- Accounts payable

- Loans

- Variable debts

- Assets

- Dividends

The profit and loss statement:

- Admin expenses

- Cost of goods sold

- Research and development

- Total revenue

Examining the balance sheet and profit and loss statement will give stakeholders a comprehensive understanding of both the company's assets and liabilities, as well as its revenue generation and expense management.

Insight into the company’s financial position

Say someone is interested in investing in your company and is curious about how the company is being run. A serious potential investor would likely ask to see your company’s financials to ensure the investment is a smart financial decision. Here’s what they’d gather from looking at each statement:

- Balance sheet: They could gather how company revenue has grown in the past as well as what assets the company currently possesses and what debt has been incurred. They could piece together your company’s financial position based on the liquidity of the business as it is.

- Profit and loss statement: They could figure out your company’s ability to increase profits based on growth in sales as opposed to your cost of production. They could gauge your company’s overall financial performance.

Essentially, the balance sheet provides a snapshot of the company's financial health at a specific moment, while the profit and loss statement reveals its performance over a period of time. Together, these statements offer a comprehensive view of the company's financial viability and potential for future growth.

When the statements are created

Statement creation largely depends on your accounting period, as well as if you are seeking investors or creating a financial forecast to present. While these statements can both be drawn up at any time if your books are in the proper order, it’s more beneficial to wait until the end of a period for a full view.

Traditional intervals for each statement:

- At the end of the accounting period (usually monthly or quarterly)

- At the end of the fiscal year

- When a company is being audited

- Consistent and timely preparation of these statements is crucial for effective financial management and reporting.

Don't just list your assets—actively manage them. Regularly analyze your

Don't just list your assets—actively manage them. Regularly analyze your  Analyze your liabilities to identify opportunities for improvement. For example, could you negotiate longer payment terms with suppliers to improve cash flow? Are there less expensive financing options available to reduce your interest expense?

Analyze your liabilities to identify opportunities for improvement. For example, could you negotiate longer payment terms with suppliers to improve cash flow? Are there less expensive financing options available to reduce your interest expense?