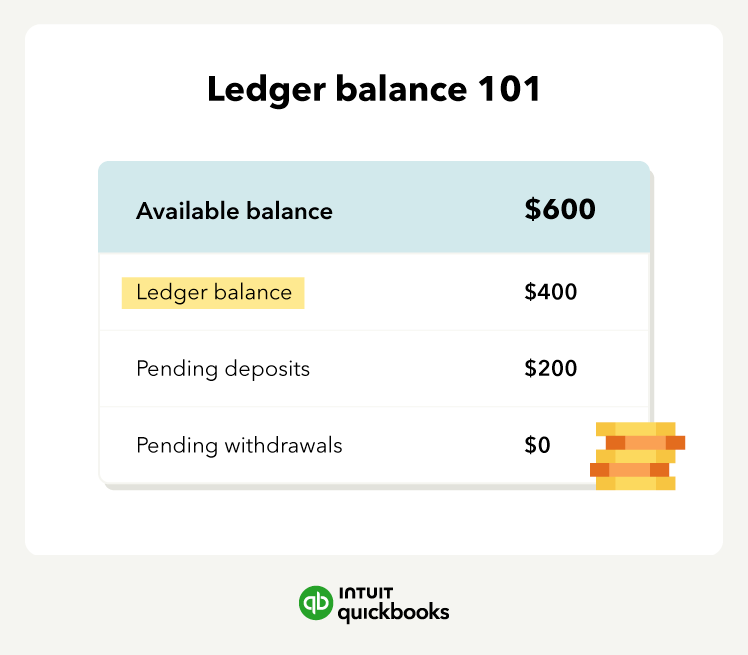

Available balance

The available balance represents the total amount of funds accessible for withdrawal from your account at any given moment. An available balance provides real-time information, accounting for cleared transactions and pending holds, offering a current snapshot of your financial liquidity and enabling informed decision-making regarding withdrawals and expenditures.

Ledger balance

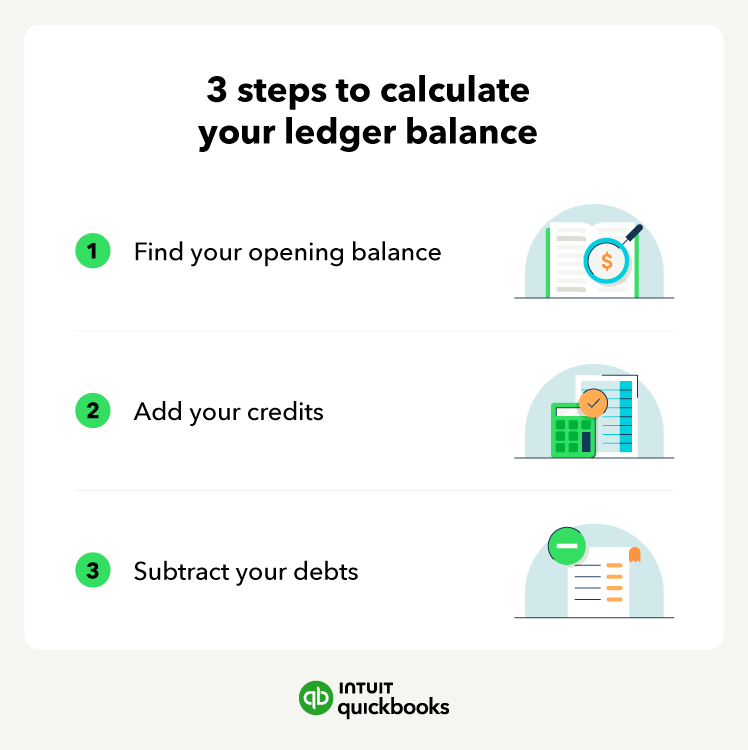

Unlike the available balance, the ledger balance remains constant throughout the day, reflecting the opening balance along with credits and debits but not real-time transactions. It serves as a static representation of your account's financial position, offering a baseline figure to assess your account's overall balance and track changes over time.

Ledger balance example

Imagine a solopreneur, Phoebe, who runs an online boutique selling handmade jewelry. Let's say her ledger balance today is $5,000. Throughout the day, she receives online orders and makes purchases for her business. With each transaction, she updates her ledger to reflect the changes in her account balance.

For instance, if she spends $500 on new materials for her jewelry designs, she subtracts this amount from her ledger balance at the end of the business day, leaving her with $4,500. Phoebe also records pending transactions, such as customer payments that have not yet cleared. By monitoring her ledger balance closely, she ensures she has enough funds to cover upcoming expenses and avoids overdraft fees or bounced checks.

Streamline your accounting and save time

Knowing how your ledger balance can potentially protect you from paying costly overdraft fees and more. That’s why investing in accounting software is so important for your business.

From organizing your financial statements to maintaining your account balances, understanding how a ledger operates is one of the most important steps in being a successful solopreneur.