Key operating cost ratios

Key operating cost ratios are invaluable to measuring a company’s efficiency and profitability. Understanding and using these ratios can help businesses make informed decisions to optimize operations and enhance overall performance.

Operating expense ratio (OER)

This ratio measures the percentage of a company's revenue that is consumed by operating expenses. It is calculated by dividing operating expenses (excluding depreciation and amortization) by total revenue. A lower OER indicates greater efficiency, as it means the company is spending less to generate each dollar of revenue.

Operating expense ratio = (Operating expenses (excluding depreciation and amortization)) / Total revenue

- Operating expenses: The total expenses incurred during normal business operations, excluding depreciation and amortization.

- Total revenue: The total income generated from the company's core business operations.

Example calculation: If a company has operating expenses of $500,000 (excluding depreciation and amortization) and total revenue of $2,000,000, the OER would be calculated as follows:

OER = $500,000 / $2,000,000 = 0.25 or 25%

This means that 25% of the company's revenue is consumed by its operating expenses. A lower OER indicates greater efficiency, as it signifies the company is spending less to generate each dollar of revenue.

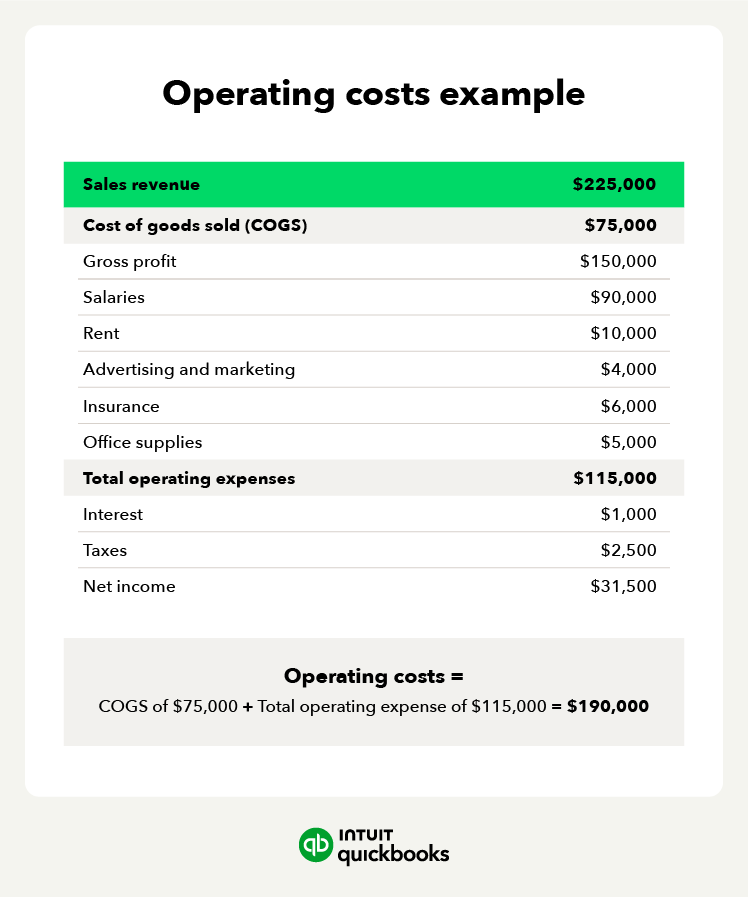

Gross profit margin

This ratio reveals the percentage of revenue that remains after deducting the cost of goods sold (COGS). It is calculated by dividing gross profit (revenue minus COGS) by total revenue. A higher gross profit margin suggests that the company is effectively managing its direct production costs.

Gross profit margin = (Gross profit / Total revenue) x 100

- Gross profit: Total Revenue - Cost of Goods Sold (COGS)

- Total revenue: The total income generated from the company's core business operations.

Example calculation: If a company has total revenue of $2,000,000 and the cost of goods sold (COGS) is $1,200,000, the gross profit would be calculated as follows:

Gross profit = Total revenue - COGS = $2,000,000 - $1,200,000 = $800,000

Then, the Gross profit margin would be calculated as follows:

Gross profit margin = (Gross profit / Total revenue) x 100 Gross profit margin = ($800,000 / $2,000,000) x 100 = 0.4 x 100 = 40%

This means that 40% of the company's revenue remains after deducting the cost of goods sold, indicating that the company is effectively managing its direct production costs.

Net profit margin

This ratio represents the percentage of revenue that remains as profit after deducting all expenses, including operating expenses, taxes, and interest. It is calculated by dividing net profit by total revenue. A higher net profit margin indicates greater profitability.

Net profit margin = (Net profit / Total revenue) x 100

- Net profit: Total revenue - Total expenses (including operating expenses, taxes, and interest)

- Total revenue: The total income generated from the company's core business operations.

Example calculation: If a company has total revenue of $2,000,000 and total expenses (including operating expenses, taxes, and interest) of $1,600,000, the net profit would be calculated as follows:

- Net profit = Total revenue - Total expenses

- Net profit = $2,000,000 - $1,600,000 = $400,000

Then, the Net Profit Margin would be calculated as follows:

Net profit margin = (Net Profit / Total Revenue) x 100 Net Profit Margin = ($400,000 / $2,000,000) x 100 = 0.2 x 100 = 20%

This means that 20% of the company's revenue remains as profit after deducting all expenses, indicating greater profitability.