Beyond double-entry accounting, GAAP consists of four principles:

Historical cost principle

Businesses report assets and liabilities at the cost they paid to acquire them. On one hand, businesses may prefer to report at the market rate because that reflects current value. However, market rate can change and make an unreliable record. So, this principle ensures a consistent financial record.

Revenue recognition principle

Businesses record revenue upon earning it, not receiving it. In many cases, an exchange of money and services won't occur at once. Revenue recognition organizes transactions to avoid confusion over this.

For example, a supplier records revenue after sending goods and invoices to clients. This way, even if they aren’t paid at once, they can plan around incoming revenue. This principle forms the basis of accrual accounting, which involves:

- Accrued revenue: Income you earned but haven’t received.

- Accrued expenses: Money you owe but still need to pay.

In reporting, expenses match the revenue they generate. Instead of tying expenses to a product or service you offered, tie them into their return on investment. This principle highlights profitability over the rate of production.

Note: If you can’t connect expenses with any revenue, you can charge costs to the current accounting period.

Full disclosure principle

You must report all relevant information about your financial statements when sharing them. This way, readers aren’t misled by a lack of context. The full disclosure principle builds trust between a business and its shareholders, lenders, and partners.

Other accounting guidelines

While GAAP covers most transactions in the US, it isn't the only rule set. Depending on their specialization, accountants may follow the:

- Internal Revenue Code (IRC): Federal tax guidelines issued by the IRS. Tax accountants follow these rules when managing federal returns.

- International Financial Reporting Standards (IFRS): Accounting rules set by the International Accounting Standards Board. US businesses working overseas follow these guidelines.

2. Follow the standard accounting cycle

Accountants follow a standardized accounting cycle. This cycle organizes tasks into repeatable steps. This way, if you hire a new accountant, they’re familiar with their core tasks and workflow. The accounting cycle includes eight steps:

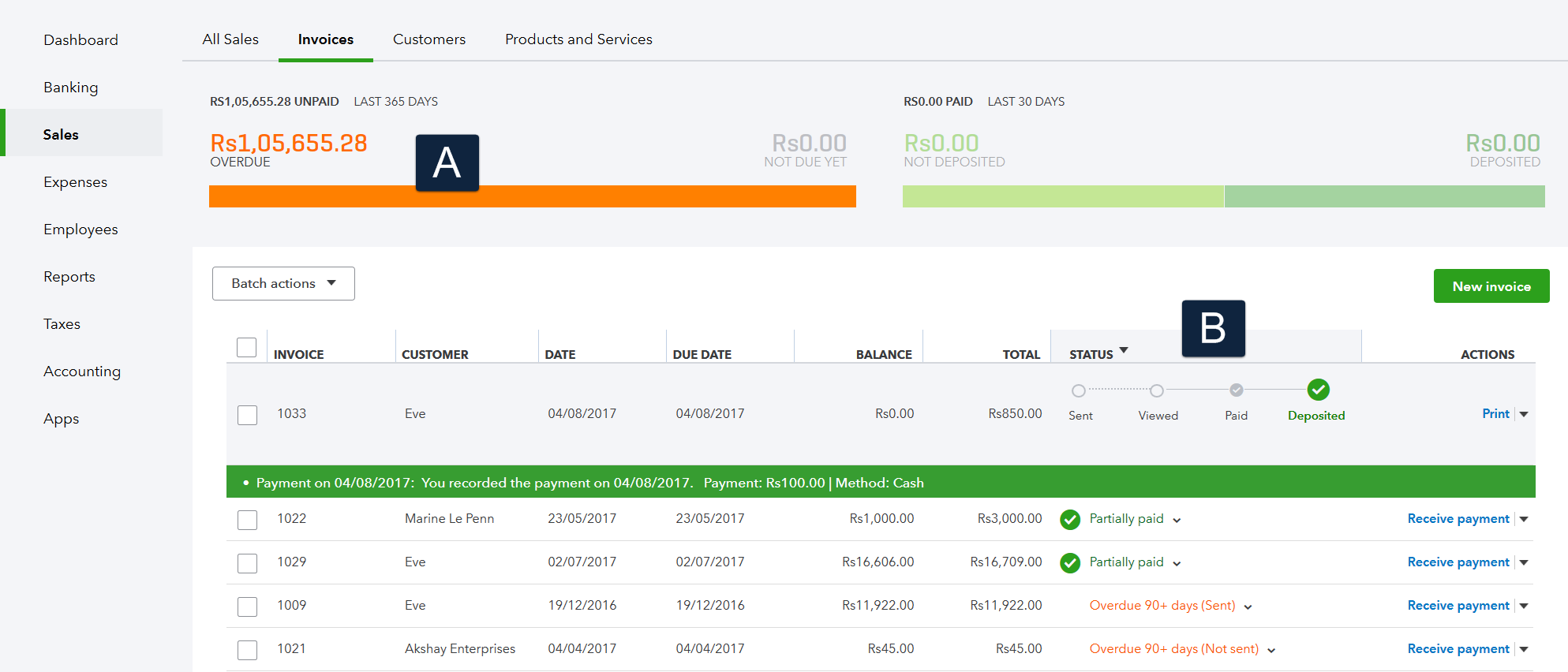

- Identifying transactions: Collect details about the transactions in an accounting period. Note sales, payments, refunds, and other bookkeeping events.

- Recording transactions: Record your transactions as journal entries. You record entries after making a sale or receiving an invoice.

- Posting transactions: Post journal entries to your general ledger. This ledger will break down all activities by account.

- Listing an unadjusted trial balance: Calculate a trial balance to ensure your credit and debit equal one another.

- Analyzing worksheets: Identify journal entries on your worksheet to find errors. If debits and credits aren’t equal, find the source of the mismatch.

- Adjusting journal entries: Adjust your journal entries to remove errors and balance accounts.

- Generating financial statements: Create balance sheets, income statements, and cash flow reports based on the corrected ledger.

- Closing the books: Finalize revenue, expenses, and temporary accounts at the end of the period.

3. Keep accounting documents up to date

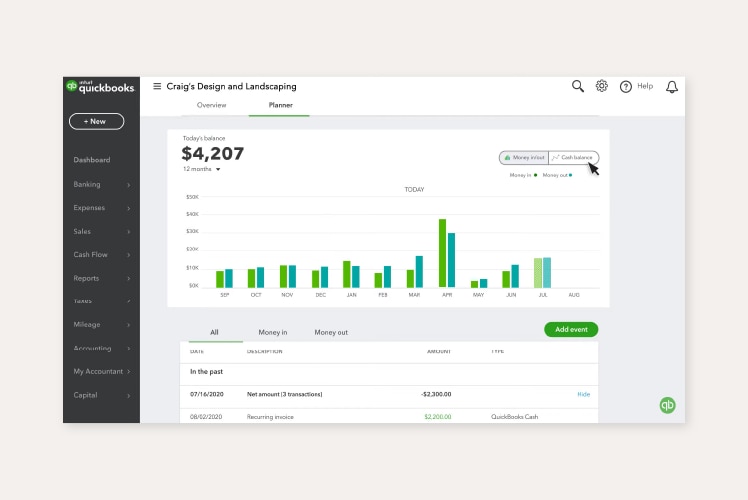

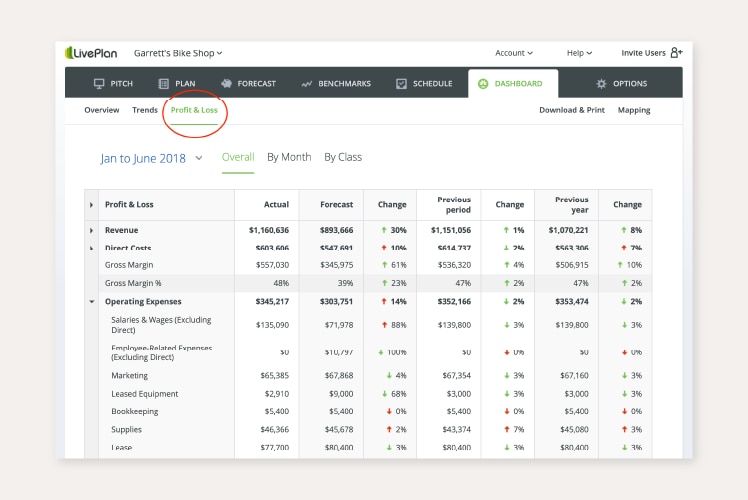

Financial statements record your business's performance over time. Accountants update these forms to measure profitability or predict budgetary issues. Accurate reports let leadership and investors gauge a company's financial health. The main accounting documents include:

- Balance sheets

- Income statements

- Cash flow statements

- Aging reports