It’s true—accounting may be the least fun part of running a small business. Despite its reputation, accounting remains to be one of the most vital ways to keep a business financially healthy.

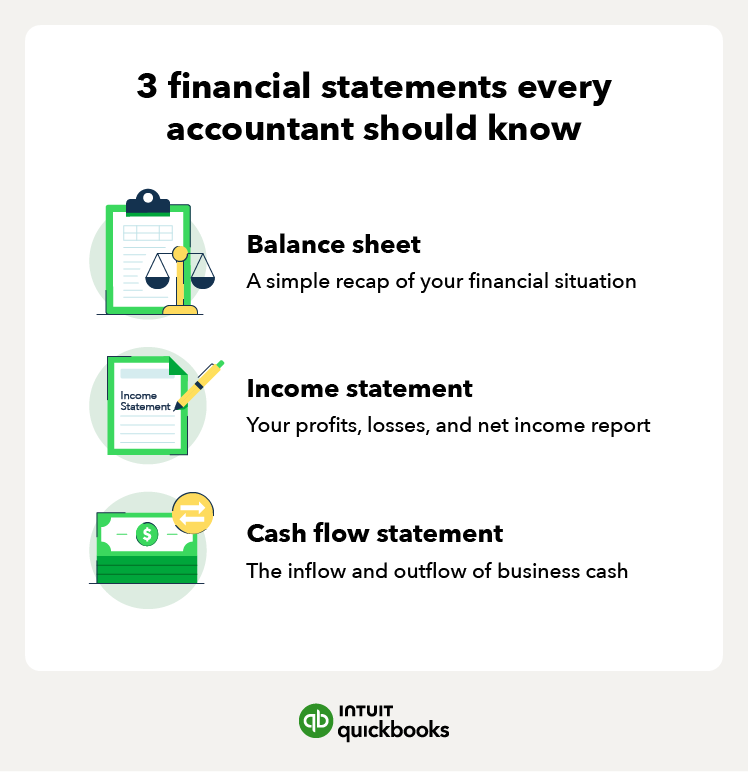

But why is accounting important, really? Accounting is the process of recording financial information indicative of business performance. It’s kind of difficult to know if your business is surviving or thriving without it.

From creating a budget to preparing for tax season, we’ll show you all eight ways accounting best practices can benefit your business.