Square

Square is a user-friendly payment solution that offers an integrated system for businesses of all sizes, focusing on ease of use and scalability. It is especially beneficial for those with physical locations or mobile businesses, offering a range of tools to manage sales, inventory, and reporting.

Square’s ability to accept various payment types, both in-person and online, makes it a versatile option for business owners seeking efficiency and simplicity. A transparent pricing model and low-cost hardware options further solidify Square as an attractive choice for small to medium-sized businesses.

Who is it for?

Square is a versatile payment solution designed for small to medium-sized businesses, especially those that rely on in-person transactions. It’s ideal for retailers, restaurants, and service providers who need a reliable, all-in-one system for processing payments.

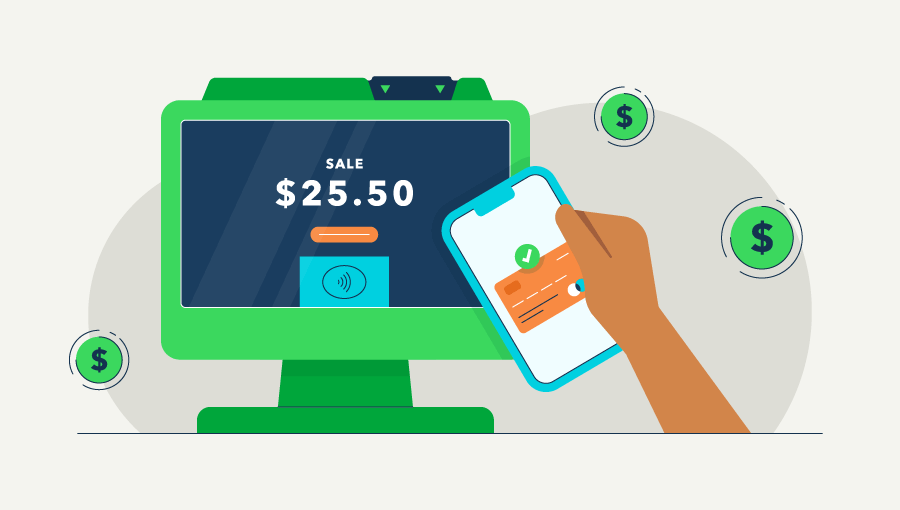

Hardware options, such as card readers and point-of-sale (POS) systems, make it a convenient choice for brick-and-mortar businesses. Additionally, its robust software features cater to businesses looking for tools to manage inventory, track sales, and generate reports.

For businesses on the go, such as food trucks or pop-up shops, Square’s mobile card readers allow for seamless payments anywhere. The user-friendly interface and scalability make it appealing to new entrepreneurs and established businesses alike.

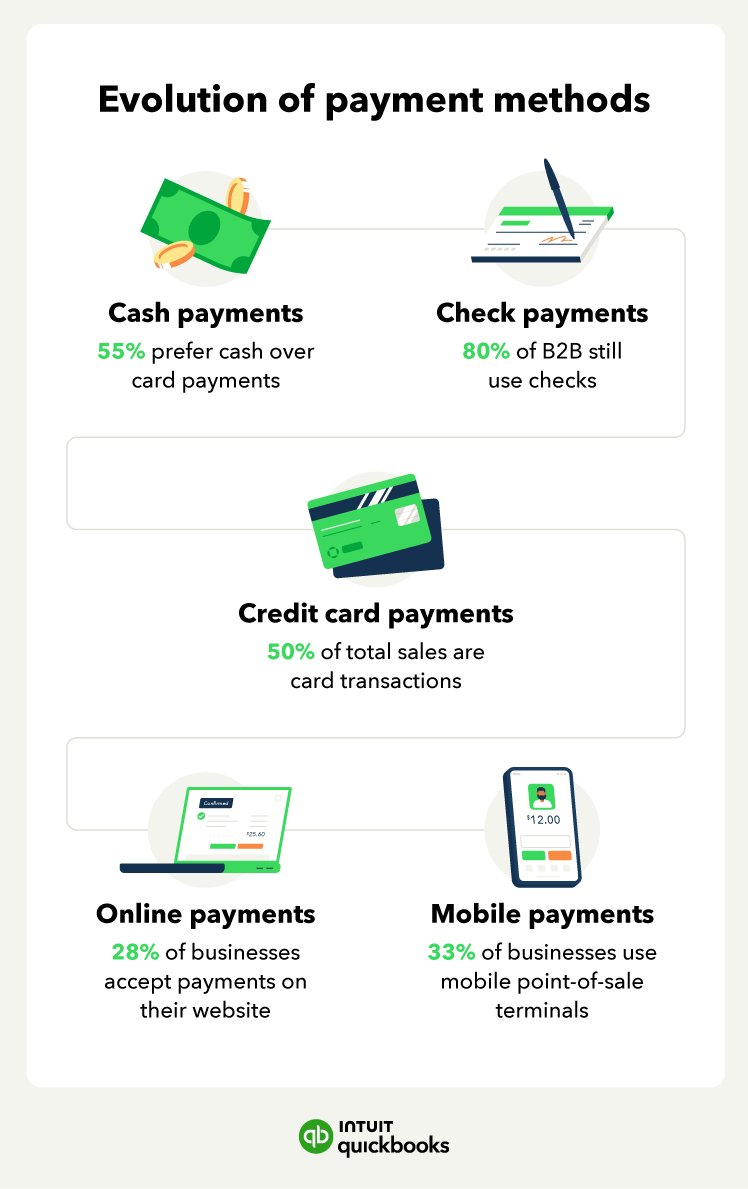

What types of payments does it accept?

Supported payment methods include debit and credit cards, digital wallets like Apple Pay and Google Pay, and other contactless options.

Customers can also pay via Square’s online payment links, which make it easy to send invoices or facilitate online sales. The platform supports recurring payments and subscriptions, broadening its use cases for service-based businesses.

Hardware devices such as the Square Terminal and Square Register accept chip cards, magnetic stripe cards, and NFC (near-field communication) payments, giving customers several ways to pay.

What does it cost?

For businesses on the free plan, processing fees are 2.6% + 15 cents per transaction for tap, dip, or swipe payments, and 3.3% + 30 cents for online payments. There are no monthly fees for its free plan. If you upgrade to a paid plan, you’ll get lower in-person processing fees along with advanced industry-specific tools.

Hardware costs vary, with contactless card readers starting at $59 and full POS systems priced higher. Square offers transparent pricing, which makes it easier for businesses to predict and manage costs.