Less manual entry means fewer errors

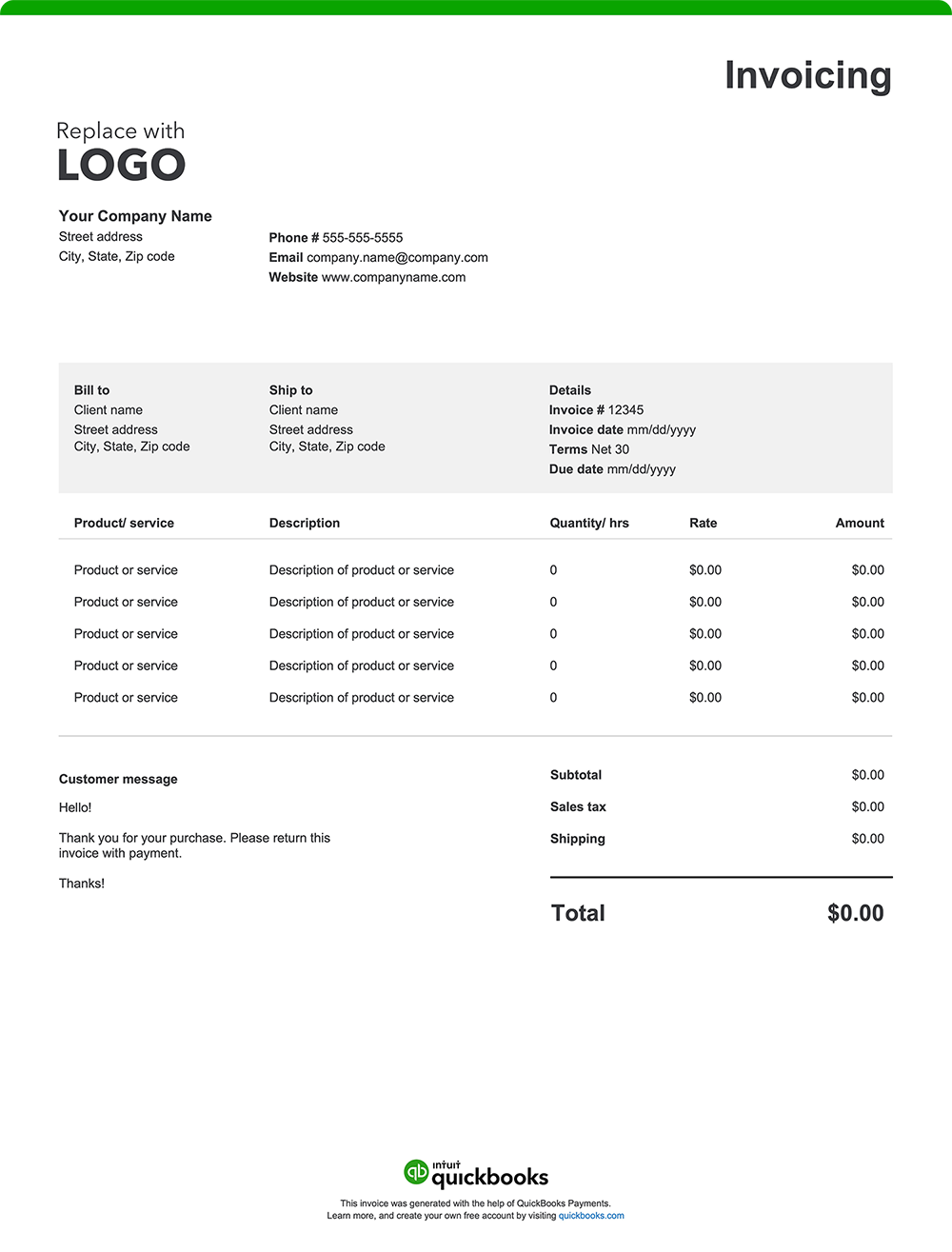

Traditional invoice templates often require manual data entry for essential details like client information and service descriptions. This process can be time-consuming and prone to errors, especially for consultants juggling multiple clients.

QuickBooks streamlines invoicing by automating much of this manual work. It automatically populates client details, service descriptions, and pricing information, saving you valuable time and reducing the risk of costly errors.

Automate invoicing

Managing numerous clients with diverse billing schedules can be challenging for consultants. QuickBooks offers automation features tailored to streamline your invoicing process:

Batch invoicing

Quickly create and send multiple invoices at once, cutting down on manual data entry. With batch invoicing, you can generate invoices 37% faster.¹

Automated workflows

Set up customized workflows to automate tasks such as sending invoice reminders or approving invoices, ensuring timely communication and consistency.

Real-time tracking

QuickBooks lets you see when clients view or pay invoices, making it easy to follow up on overdue payments and streamline collections.

Invoice from anywhere

Whether you're remote or on-site with your clients, QuickBooks lets you create and send invoices from your mobile device or tablet. You can also attach important documents like contracts or scope of work quotes to promote clarity and keep everything in one place.

Manage cash flow throughout the project lifecycle

Consulting projects can have unpredictable payment schedules. QuickBooks integrates invoicing with bookkeeping so you can track outstanding invoices, monitor due dates, and forecast incoming payments.

Offer flexible payment options

Provide your clients with various payment methods, including credit cards, debit cards, ACH transfers, and popular platforms like Apple Pay, PayPal, and Venmo. This flexibility can expedite payments and enhance client satisfaction.

Send invoices through email or SMS

QuickBooks allows you to send invoices directly via email or SMS, catering to client preferences and ensuring prompt delivery. For recurring services, automated invoices can save time and ensure consistent billing.

How do I accept payments in QuickBooks?

You are in control of how you get paid. Accept payment options such as credit cards, bank transfers, checks, or even cash. Create invoices with a "Pay Now" button for instant online payments, or you can swipe cards on the spot with our mobile card reader. Payments will be tracked to the correct job, and funds will be deposited directly into your bank account.