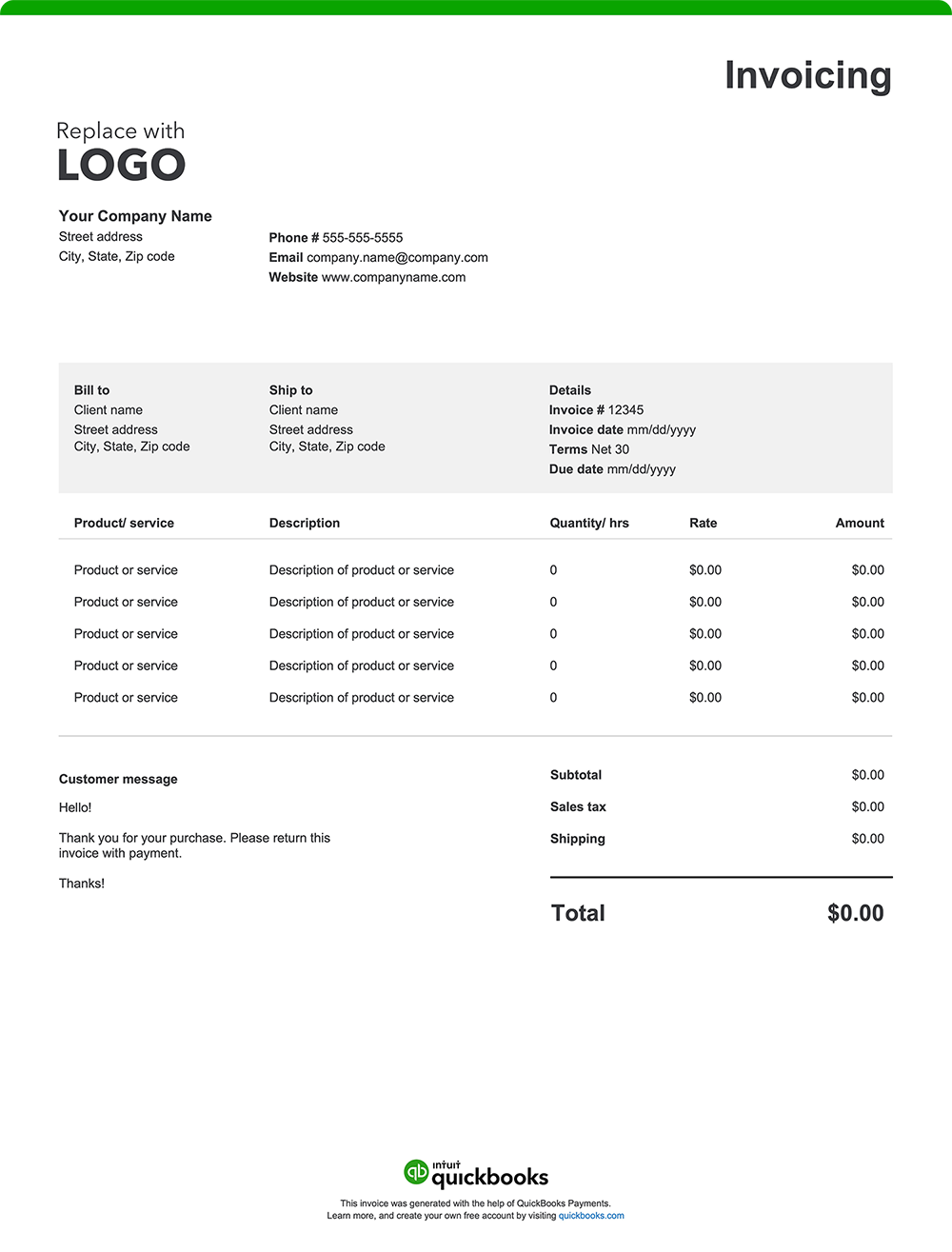

Musicians juggle a variety of projects: live shows, studio recordings, private lessons, session work, and more. Each job is unique, so keeping your invoices detailed and organized makes it easy for clients to understand their charges and helps you avoid payment delays or disputes. Here are ten essentials every musician’s invoice should have:

1. Musician and branding info

Your invoice should include your name (or band name), contact info, and, if you have them, a logo or social handles. A polished presentation helps clients remember and recommend you.

2. Invoice and gig dates

State the invoice date, your performance or service date, and the timeline for multi-day projects.

3. Venue or session location

List where you worked, for example, a concert hall, club, catering venue, recording studio, or student’s home. This information keeps your records neat and clarifies service details for clients.

4. Services provided

Clearly outline what you delivered—such as “Solo guitar performance at Local Café – 2 sets” or “Four private piano lessons in June.”

5. Rates and session details

Break down your fees: hourly or flat rate, how many sets or sessions, overtime charges, or extra rehearsals. This helps clients understand exactly what they’re paying for.

6. Materials and equipment

Include any costs for materials or equipment that fall outside your normal performance or teaching setup. This could include sheet music or scores purchased for a specific project, or instrument and sound equipment rentals, studio time, or specialized gear arranged for the client. Listing these items ensures you’re reimbursed for project-related expenses that go beyond your standard tools of the trade.

7. Additional fees

Include any extra charges, such as rush bookings, travel per diem, or hiring backup musicians. Transparent invoicing helps avoid awkward conversations later.

8. Totals

Calculate your subtotal, taxes (if any), and total amount due.

9. Payment terms

Your invoice should include straightforward payment terms and instructions that outline exactly how and when you expect to be paid. Be sure it lists the following:

Payment timeframe

Specify the timeframe for payment, such as "Net 30" (payment due within 30 days of the invoice date), "Due on Receipt," or any other agreed-upon terms.

Accepted payment method

List the accepted payment types, such as checks, credit cards, online payments, or cash.

Payment details

Include all required information for each payment method, like your check mailing address or online payment portal link.

Late payment penalties

If you charge penalties for late payments, state the penalty amount or percentage.

Early payment discount

Mention any discount available for early payment and eligibility criteria.

Notes or thank-you message

Leave space at the end of your invoice for a note or thank-you message. A brief, friendly message such as "Thank you for your business!" adds a personal touch and reinforces positive client relations.