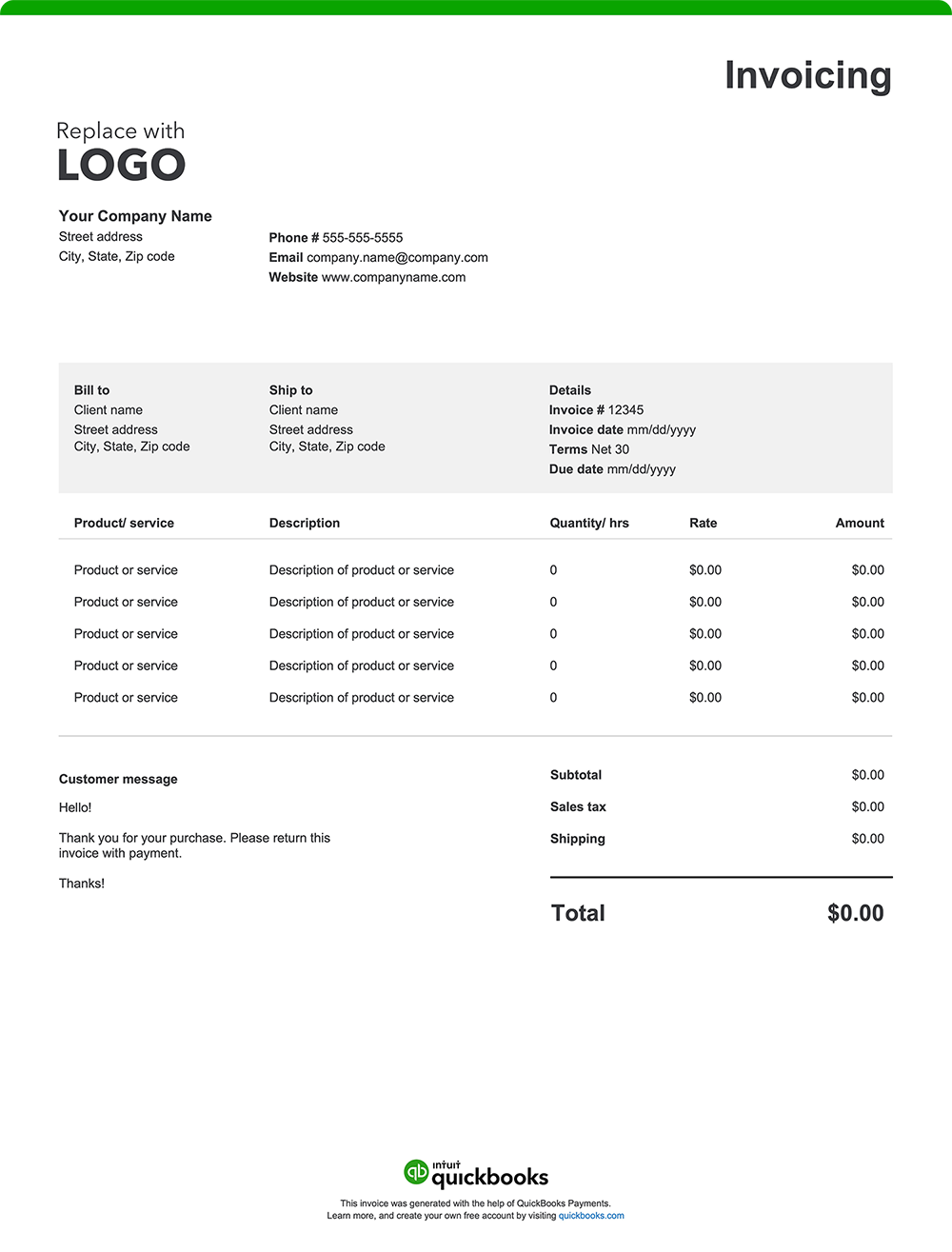

Whether you’re exporting goods or working with clients on large transactions, using a free customizable invoice template or special proforma invoicing software can ensure billing accuracy and professionalism. Download a free, customizable, and printable proforma invoice template from QuickBooks.

See invoice template | Generate free invoice*

Jump to:

- Downloadable proforma invoice templates

- 9 elements every proforma invoice should include

- Proforma invoice template vs QuickBooks

- Common industries that use proforma invoices

- Why are proforma invoices issued?

- When are proforma invoices issued?

- Is a proforma invoice legally binding?

- Proforma invoice vs. commercial invoice

- Draft invoice vs. proforma invoice

- Advance invoice vs. proforma invoice

- Try our free proforma invoice generator