Two ways to calculate a bad debt expense

Calculating bad debt expenses is an important part of business accounting principles. Not only does it parse out which invoices are collectible and uncollectible, but it also helps you generate accurate financial statements.

There’s more than one method to calculate bad debt expenses. Here are some ways to do it.

1. The write-off method

The direct write-off method is best for business owners whose customers typically fulfill their credit payments. This means you only have a few bad debts and don’t have to keep track of dozens of unpaid or past due invoices.

The process is straightforward and allows you to write off the value of those outstanding invoices from your total taxable income on a case-by-case basis. We’ll go over an example later.

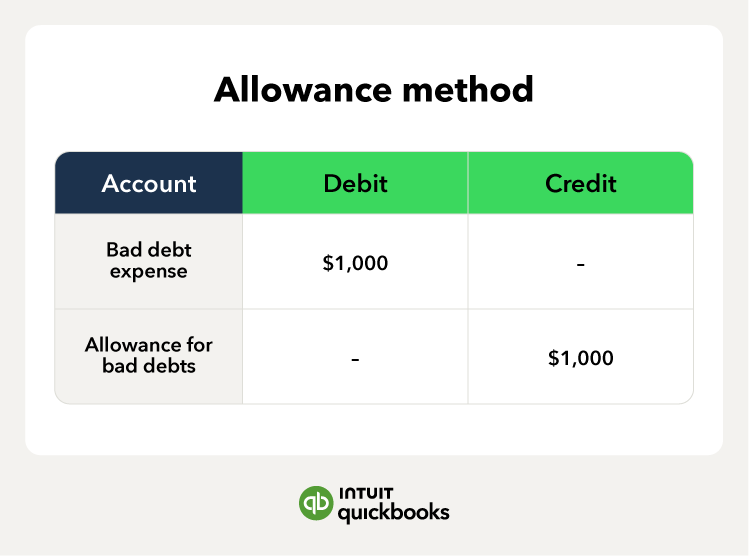

2. The allowance method

The allowance method, also called the allowance for doubtful accounts, lets you preemptively label a certain portion of your total credit sales as doubtful debts. It functions under the assumption that at least some of your customers won’t pay the invoices you send. You effectively set aside money or create an allowance fund to help cover costs if your customers don’t pay invoices.

It’s best for businesses that conduct most sales on credit and that are usually more likely to encounter bad debts.

The bad debt expense formula

To estimate bad debts using the allowance method, you can use the bad debt formula. The formula uses historical data from previous bad debts to calculate your percentage of bad debts based on your total credit sales in a given accounting period.

Percentage of bad debt = total bad debts/total credit sales

Why should you calculate bad debt expenses?

Calculating bad debt expenses can help you save money when you file your taxes. The IRS often considers qualifying bad debt expenses as business expenses and may let you deduct those outstanding invoices from your total taxable business income.

Bad debt expenses are usually categorized as operational costs and are found on a company’s income statement.

Bad debt expenses are usually categorized as operational costs and are found on a company’s income statement.