Nearly 1 in 4 payments to small businesses are late, according to the QuickBooks Small Business Insights report. Those delays cost you time, strain your resources, and disrupt your cash flow. One way to encourage timely payments—and protect your bottom line—is by adding a finance charge to overdue invoices.

In this post, we’ll break down what finance charges are, how they work, and when it makes sense to use them. Plus, we’ll cover key rules like the Truth in Lending Act to help you stay compliant.

Jump to:

- Common reasons for getting a finance charge

- Examples of a finance charge

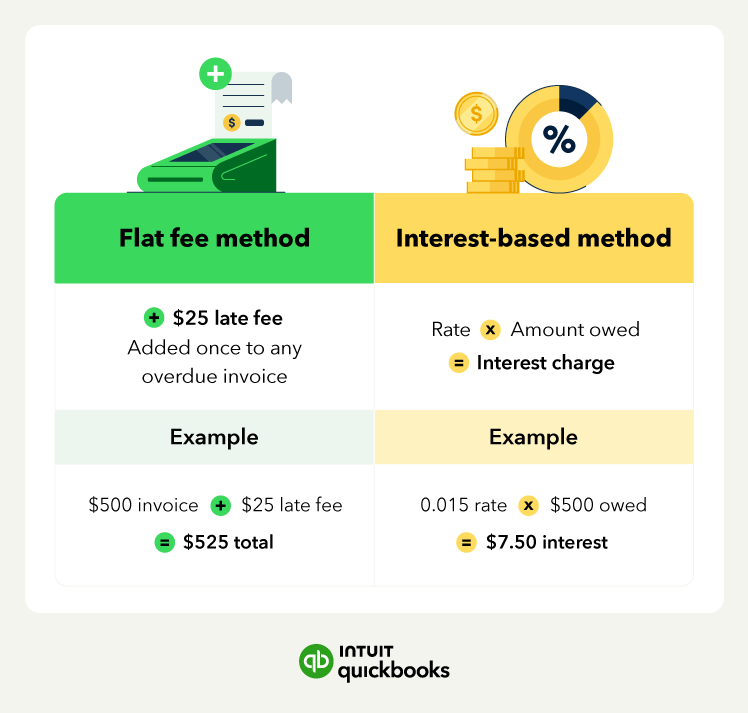

- How to calculate finance charges for your small business

- Finance charges vs. interest rates

- How does a finance charge work?

- Placing finance charges on a bill

- Ways of finding ongoing finance charges

- Helping customers pay off a finance charge

- Finance charges and regulations

- For 2025, there are a few regulations and updates to keep in mind

- Automate billing and stay in control of cash flow