Time Savings

Time spent worrying about payroll tax documentation, payroll processing, and more is time you’re not spending elsewhere. As a leader in your business, it’s important to devote your time to the things that matter most. Outsourced payroll services allow for that.

Cost Savings

Hiring someone to work on payroll in-house can be expensive. And if you’re spending time on payroll rather than on other aspects of your business, you could lose money. Outsourcing payroll can be a much more affordable option.

Quick payments

One thing is certain, employees like being paid on time. Outsourced payroll allows you to set up automatic direct deposit so no one’s ever wondering when their pay will come in.

Tax penalty protection

Let’s face it. Taxes can be confusing. And when you’re juggling the responsibilities of a small business owner, it can be easy to let a tax-related error slip under your radar. In some cases, outsourcing your payroll can provide you with tax penalty protection, helping protect you in case of a costly payroll error.

Maintain compliance

Outsourcing of payroll ensures that you maintain compliance as payroll professionals stay on top of any changing regulations or requirements.

Accuracy

Payroll errors can lead to plenty of headaches. Employees may become frustrated and leave your company if you pay them incorrectly or too late. Outsourcing payroll processing helps reduce the chance of errors, especially for companies with a large number of employees.

Fast onboarding

Outsourcing payroll will quickly get new hires on the payroll and ready for their first day on the job before the next pay period.

HR services

Some platforms include a suite of both HR and payroll features, such as time off and insurance management. These can also help decrease costs to your business while streamlining your employee management.

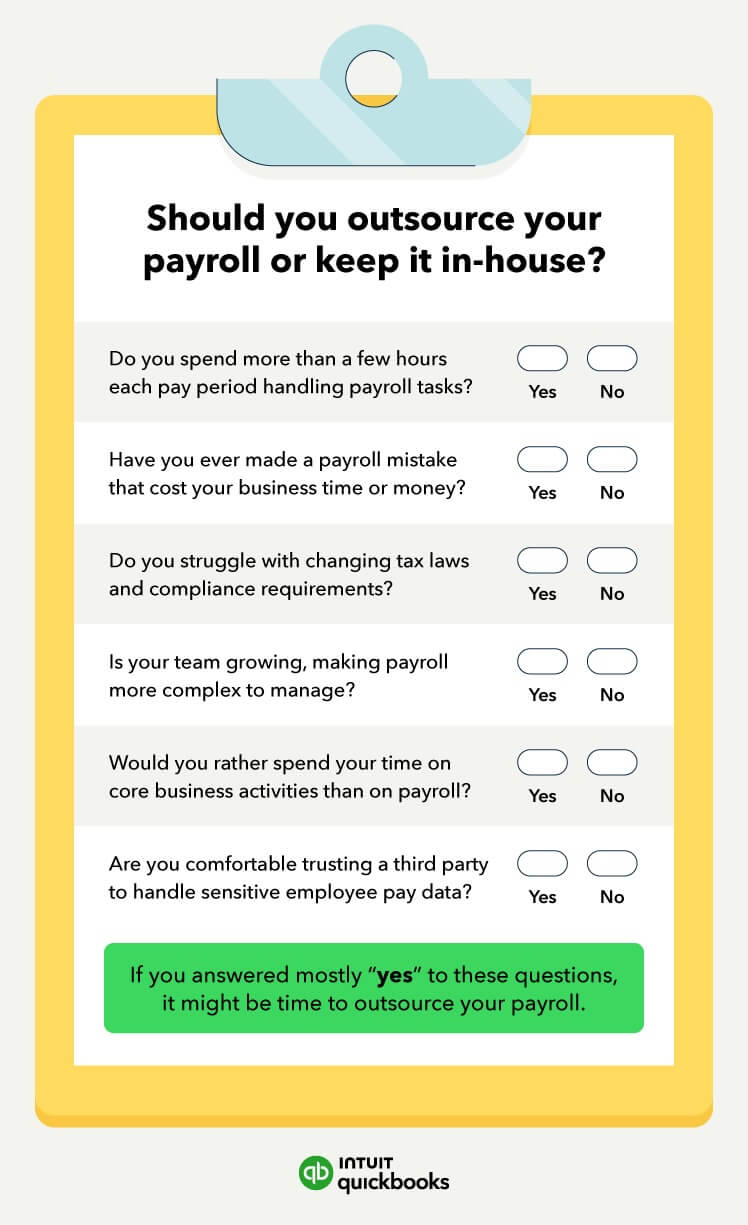

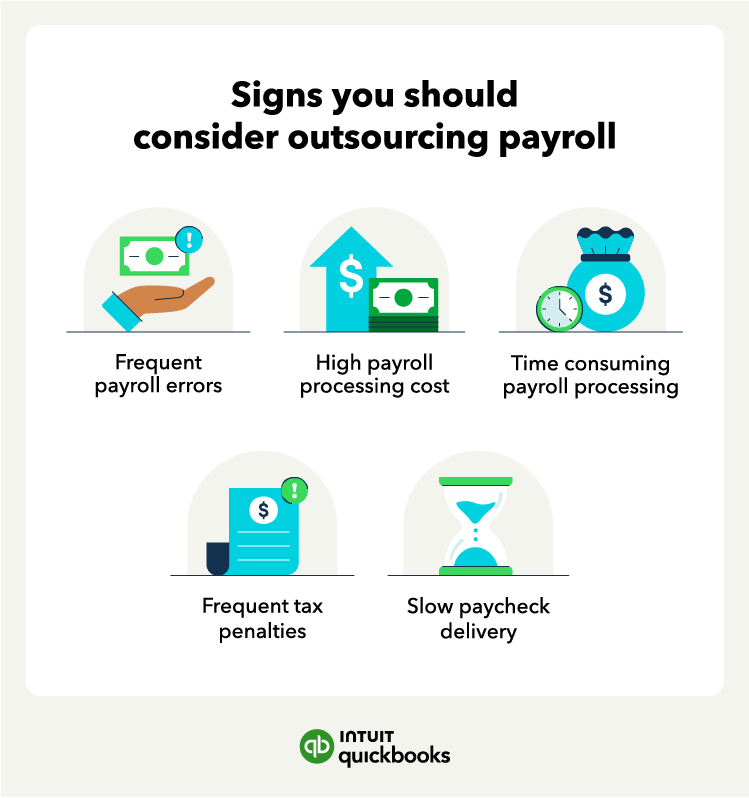

When to consider outsourcing payroll

If your current payroll system leads to frequent mistakes, compliance issues, or wasted time, it may be time to outsource. Payroll errors can cost your business in penalties and lost productivity, and can frustrate employees if paychecks are delayed. Outsourcing helps reduce these risks and gives you more time to focus on growing your business.

Whether you’re looking to save some extra time or are interested in additional HR features, outsourcing your payroll could be the right choice for your small business.