How payroll reconciliation works

Payroll reconciliation compares your payroll register with the amount of money you’re paying your employees to ensure they match. You're essentially double-checking your math to ensure you pay your employees correctly.

Payroll reconciliation should happen frequently

You should reconcile payroll at least two days before each payday to catch and correct any discrepancies before issuing paychecks. You’ll also want to reconcile quarterly when submitting Form 941 and annually before issuing Form W-2s to ensure all records are accurate.

- Every pay period before you cut employee checks—ideally, at least two days before your payday.

- Quarterly when you submit Form 941 with your quarterly federal tax return.

- Annually before tax due dates when you confirm that your payroll data matches each employee’s Form W-2.

Why is payroll reconciliation important?

Payroll reconciliation is essential for several key reasons, such as avoiding fines and penalties. Making mistakes with payroll not only destroys morale but can also lead to penalties from the IRS. You also want to keep accurate payroll records to avoid major headaches and hassles come tax time—plus the potential for more penalties.

What to look for during reconciliations

During quarterly reconciliation, compare the total wages and taxes in your payroll register to what’s reported on Form 941. Look for mismatches in income tax, Social Security, or Medicare amounts. Any inconsistencies could signal a reporting or withholding error.

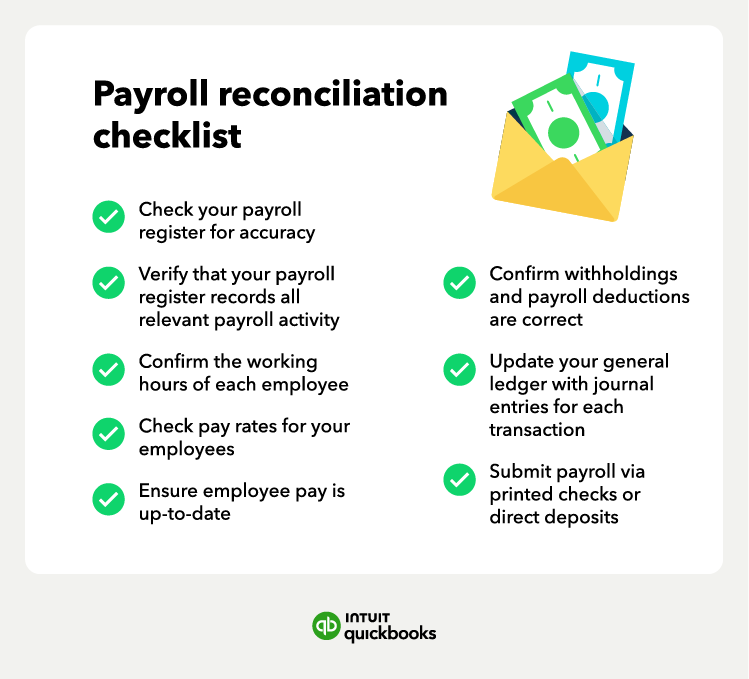

You’ll need a few things before you start your payroll reconciliation process. Make sure you have the following within reach:

- Your payroll register: To get all of the payroll data you need.

- Employee time cards or time sheets: To get hours worked for that specific payroll period.

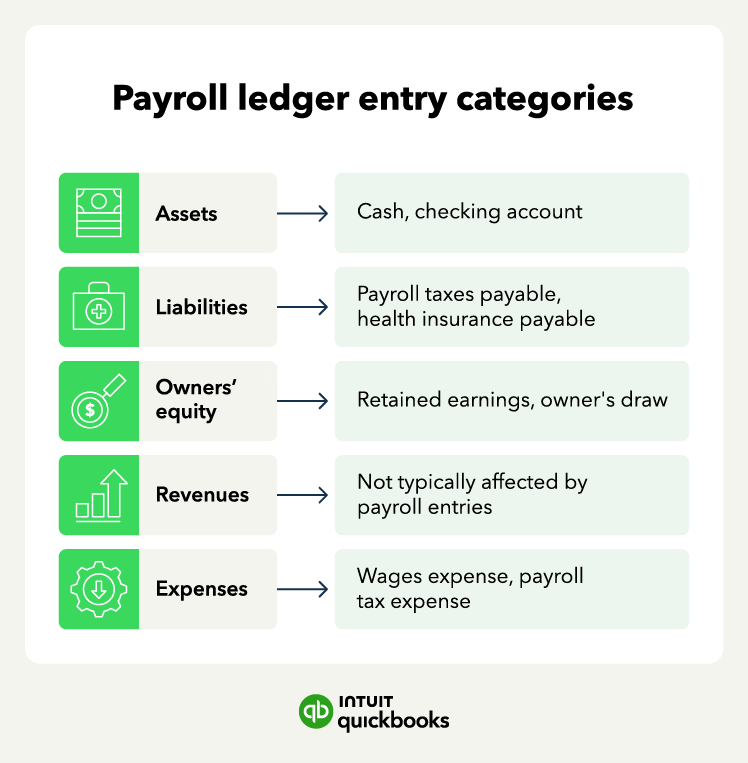

- Your general ledger: To record wages and deductions and maintain accurate financial records.

With these items, you can get into the specific payroll reconciliation steps: