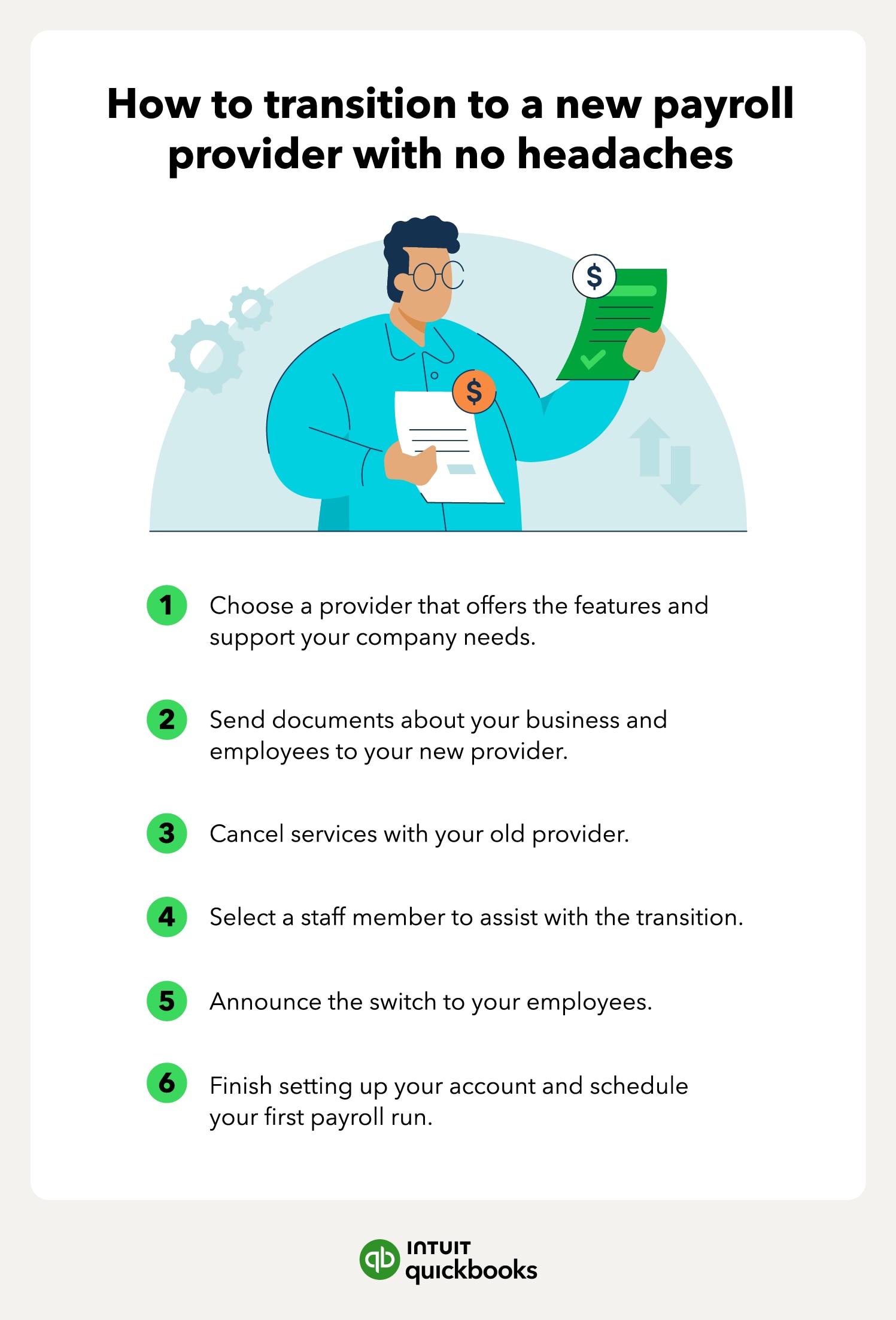

After you’ve agreed on a start date and developed a transition plan with your new provider, talk to your old one about canceling services.

Keep in mind that it may take a few business days for your provider to terminate your contract, so be sure to give them plenty of time so you don’t get roped into another month. Generally, you can give written notice to terminate your contract a couple of weeks before your next payment is due, but some companies require a 30-day notice.

If you’re not sure if you’re under contract, review the sign-on materials they sent you or reach out to your customer support representative for answers and next steps.

You also need to ask when they will close out your account to ensure you transfer over all of your information before you lose access.

What To Avoid When Canceling

If you have a good relationship with your current provider and are just leaving because your company outgrew them, you might want to let them down easy—but it’s important not to lie.

For example, if you tell them you just don’t need to run payroll anymore, they may notify the Internal Revenue Service (IRS) and your state government.

This isn’t vindictive. They may just think they’re responsible for closing out your account if they’re under the impression that you’re going out of business.

4. Appoint a lead

If you won’t be handling the transition yourself, choose someone within your organization to take charge of finalizing details and ensuring that your new payroll company has the information they need to process the next payroll without a hitch.

This person should ensure that all of your data is transferred to the new platform before you lose access.

5. Notify your staff

Your new provider should help ensure a seamless transition, so the switch shouldn’t affect your employees much. However, they will lose access to old paystubs and they need to be on the lookout for errors on their first paycheck in case their personal data is entered incorrectly.

Send out a payroll change announcement so all of your employees are aware and have sufficient time to prepare.

Tip: Encourage employees to print and file at least one year’s worth of their paystubs for tax purposes.

6. Set up your new account

Upload company and employee information and payroll data to your account yourself or connect with an HR advisor for help starting and maintaining your account.

Before finalizing your account, you will need to schedule the first payroll processing date and verify that the future pay dates align with the schedule you ran last year.

Then, you should be good to go!

You should also familiarize yourself with the details of your account so you’re aware of fees, cancellation requirements, and how to keep your account active.

Tip: Closely assess all paystubs that go out on the first payroll run to ensure all of the data was transferred correctly.