EBITDA vs. EBIT vs. EBT

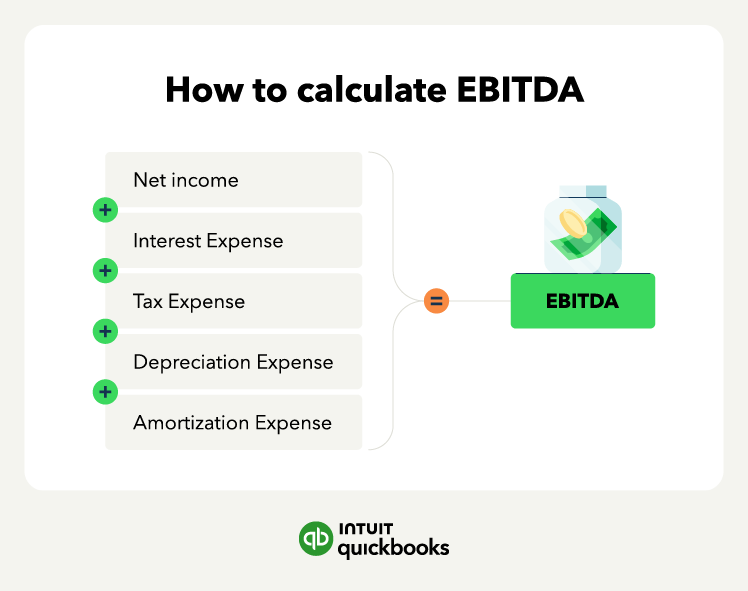

While EBITDA is a widely used metric for assessing a company's profitability, it's not the only one. As we've explored, EBITDA provides a valuable view of core operational performance. However, some other measures offer different perspectives on profitability, each with its own unique focus. Two such measures are EBIT (Earnings Before Interest and Taxes) and EBT (Earnings Before Taxes). Let's delve into each of these.

EBIT

EBIT, which stands for Earnings Before Interest and Taxes, is also known as operating income. It focuses on the profit a company generates from its core operations, excluding the impact of financing costs (interest expense) and income taxes.

Unlike EBITDA, however, EBIT includes depreciation and amortization expenses. This means EBIT reflects the company's operating profit after accounting for the costs associated with the wear and tear of its assets.

The formula for calculating EBIT is:

EBIT = Revenue - Cost of Goods Sold - Operating Expenses (including Depreciation and Amortization)

EBIT is a useful metric for evaluating a company's operational efficiency and profitability before considering the effects of its capital structure (debt) and tax burden. Now, let's move on to EBT.

EBT

EBT, or Earnings Before Taxes, is sometimes called pre-tax income. This metric shows a company's profitability before income taxes are deducted. Unlike EBIT and EBITDA, EBT includes both interest expense and depreciation/amortization. This makes EBT useful for understanding a company's overall profitability, including the impact of financing decisions, but before considering the complexities of tax regulations.

The formula for EBT is straightforward:

EBT = Revenue - Cost of Goods Sold - Operating Expenses

EBIT and EBT, when considered alongside EBITDA, offer a more well-rounded understanding of a company's financial performance. Each metric brings unique insights, and their combined analysis provides a clearer picture of profitability.

Be mindful of extraordinary items or one-time gains/losses that can significantly impact net income and distort the true picture of recurring operational performance.

Be mindful of extraordinary items or one-time gains/losses that can significantly impact net income and distort the true picture of recurring operational performance.

Don't just focus on your overall EBITDA margin. Calculate EBITDA margins for individual product lines or services to identify your most and least profitable areas. This can help you make strategic decisions about pricing, resource allocation, and even which offerings to discontinue.

Don't just focus on your overall EBITDA margin. Calculate EBITDA margins for individual product lines or services to identify your most and least profitable areas. This can help you make strategic decisions about pricing, resource allocation, and even which offerings to discontinue.