With 61% of business owners saying inflation has had the most impact on growth, now is the time to review your strategy and make sure you're ready for the challenges of the coming year.

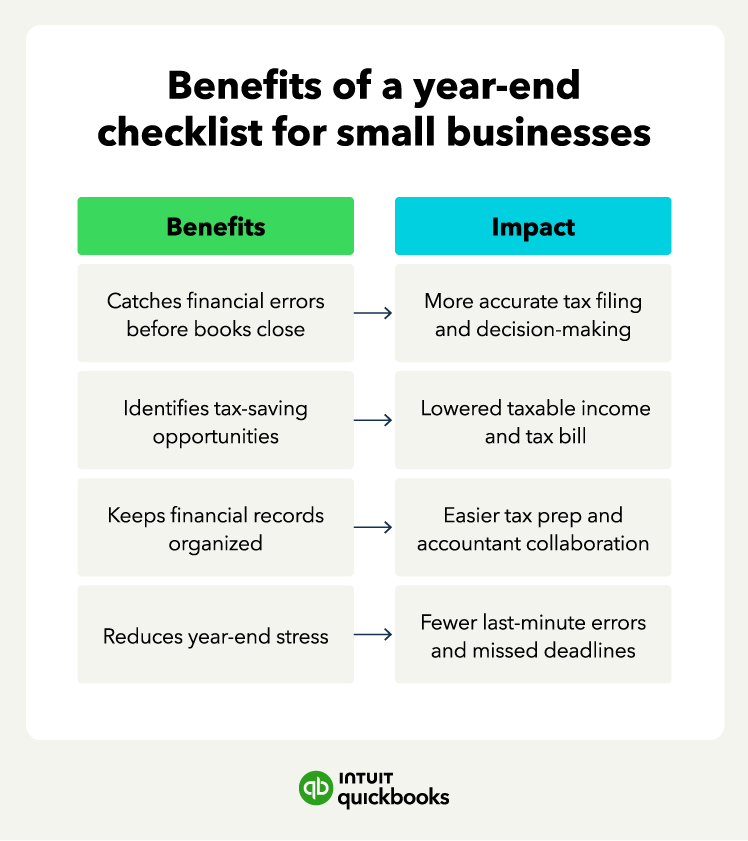

The end of the year is always busy with holidays, family time, and planning for the new year. As a small business owner, you also need to tackle tasks like income statements, taxes, and employee incentives.

Balancing work and life as December 31 approaches can be tricky, but focusing on your business now can help you finish the year strong and set yourself up for success in the new year.

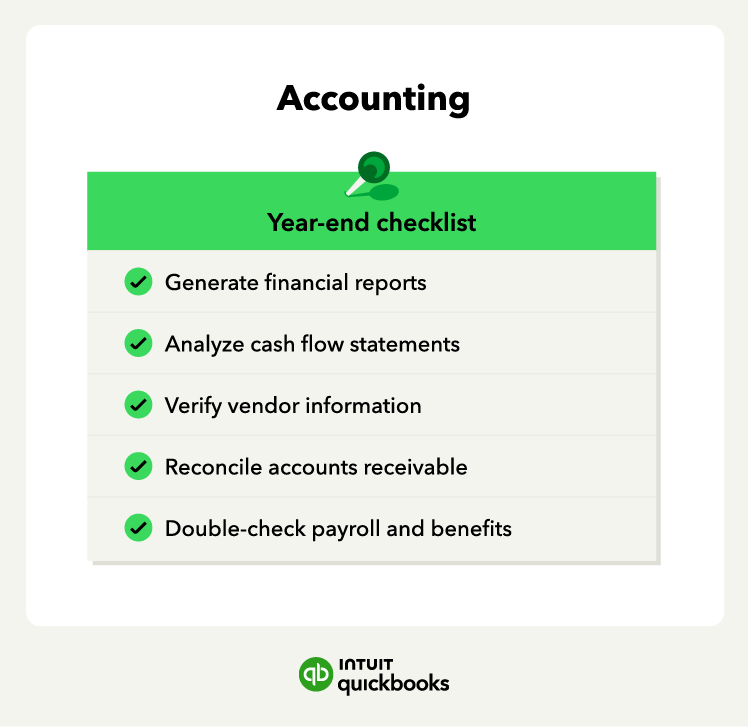

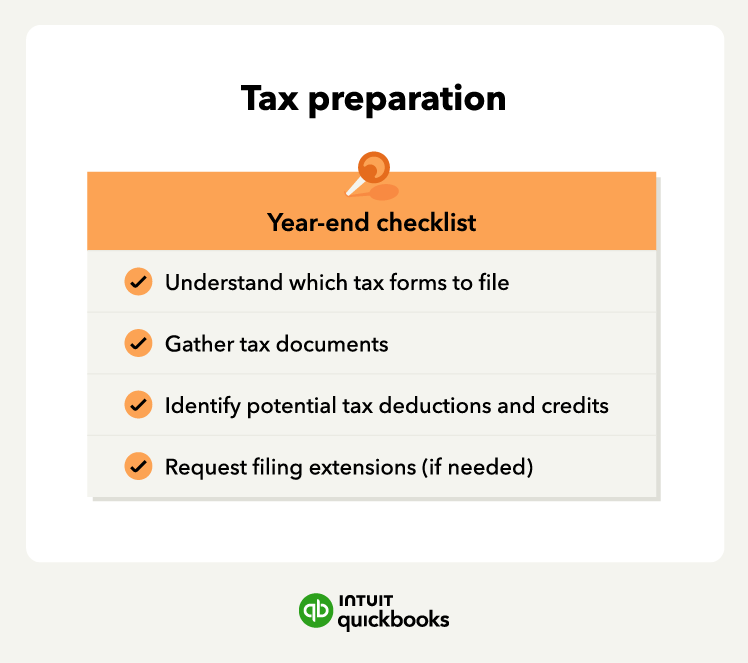

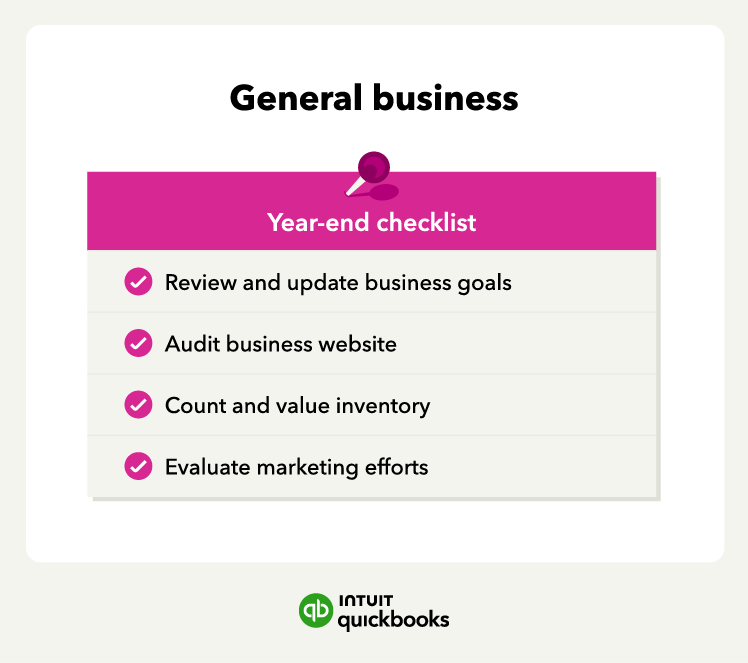

What needs to be done, and what’s optional? Use this year-end checklist to knock out the essential tasks and free up time for what matters most.