- Introduction

- Know thy customer

- Get ahead of the busy season

- Hybrid shopping is a hit if you have a store

- Crowd control is key

- Seamless checkouts to support crowd control

- Bring in Buy Now, Pay Later for a boost

- Discounts can make a sale

- Venture into video

- Don’t forget the importance of Facebook for social media selling

- Partner with influencers for more sway with younger customers

- Remind customers you’re local and reward them for loyalty

Holiday shopping survey: Consumer spending is up—here’s how small businesses can set up for success

Introduction

As competition for consumers increases with an ever-expanding market, small businesses need to be smart and strategic about attracting customers and closing sales—particularly around the holidays. Data shows that up to 65% of small businesses’ annual revenue was generated during the holidays last year. With that much money on the line, holidays mean big business for small businesses.

But when the busy season of the holidays nears, limited resources and high demand can stretch small businesses to the limit and leave them unsure where to put their time and money. A new Intuit QuickBooks-commissioned survey of 6,500 adults in the US reveals how small businesses can unwrap success this holiday season.

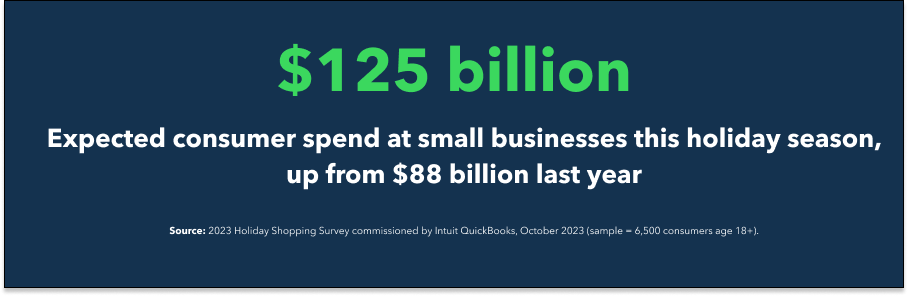

This year, small businesses can look forward to a 42% increase in consumer spending over the holiday season, increasing from $88 billion to an estimated $125 billion. This averages approximately $485 towards what each consumer may have earmarked to shop small this year. Despite economic volatility and a climate where inflation and interest rates continue to fluctuate, shopping small is holding strong with consumers.

What’s driving the increase in small business spending? Work bonuses and savings. More than a third of respondents (34%) expect a bonus this holiday season and of these, more than two-thirds (69%) say this will allow them to spend more money at small businesses. Further, 7 in 10 consumers (70%) shared that they began saving for their holiday gift shopping in September of this year or earlier.

Know thy customer

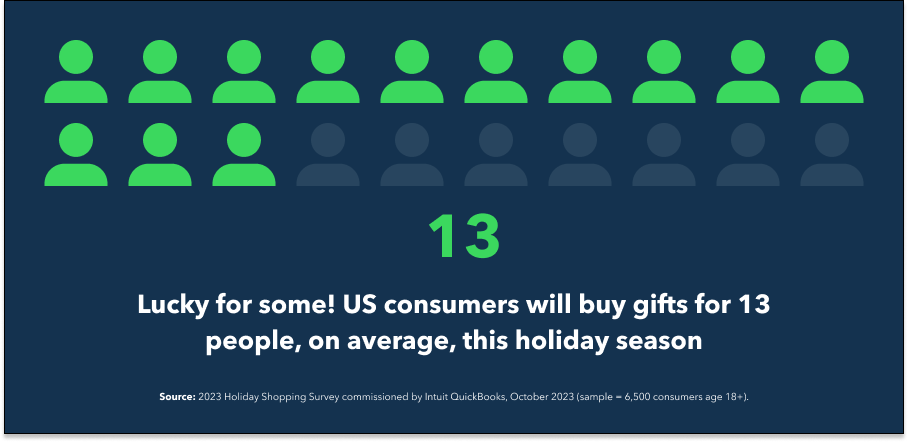

The spirit of gift-giving is alive and well this holiday season. More than 9 in 10 (94%) consumers plan to buy gifts this holiday season with most buying gifts for children (58%), a spouse (41%), or a parent (40%). On average, consumers will be shopping for gifts for 13 people this year.

And while gifting experiences is a trend that comes and goes, small businesses need not feel that pressure this holiday season. As more time passes from the start of the pandemic, 2 in 5 (43%) consumers say they do not have a preference between presents and experiences and a majority (55%) prefer to gift presents over experiences.

Get ahead of the busy season

The early kick-off to holiday shopping is still in effect this year. Nearly 1 in 5 (19%) consumers say they’re planning to start shopping before October. Small businesses don’t want to be unprepared for early shoppers and can stay ahead by making sure inventory is available before the busy season and well stocked in November. Two in 5 (41%) consumers say they plan to start shopping in November this year and almost half (48%) of consumers indicate they do most of their shopping in November. Among those planning to shop small this year, Small Business Saturday (November 25) is the most popular day (46%) with Black Friday (November 24) as a close second (43%).

Hybrid shopping is a hit if you have a store

Bridging the gap between an online and in-person shopping experience could boost sales for small businesses this season—and remembering to advertise sales online. Now more than ever, consumers have a sea of options at their fingertips. And with the peak of the pandemic firmly in the rearview mirror, the appeal of in-person shopping is growing. Data shows that consumer interest in balancing the digital and in-person experience will have a surge this holiday season. Most consumers (43%) plan to shop equally online and in-person for the holidays this year (compared with only 28% who say they plan to shop primarily in-person and 29% who say they plan to shop primarily online). Behind this push? Three in 5 (61%) consumers say they find the best small business deals in-person. When it comes to customer service, consumers are clear: 73% say the option to buy online and pick up in store and home delivery options are more likely to get them to buy from small businesses.

Crowd control is key

Small businesses selling in-person this season should be mindful of keeping crowds from becoming too overwhelming. While holiday cheer should be in the air, many consumers are drained by the shopping demands of the season. Excitement could be waning because a majority of consumers find holiday shopping to be a stressful experience. More than 1 in 2 (57%) consumers say shopping for the holidays is stressful and the biggest contributor to this stress is crowded stores (67%).

Consumers looking to avoid the stressors of holiday shopping are favoring small businesses. Nearly 3 in 5 (59%) consumers say shopping at small businesses is less stressful than shopping at big retailers. Among these consumers, almost half (49%) expect to spend more at small businesses this holiday season.

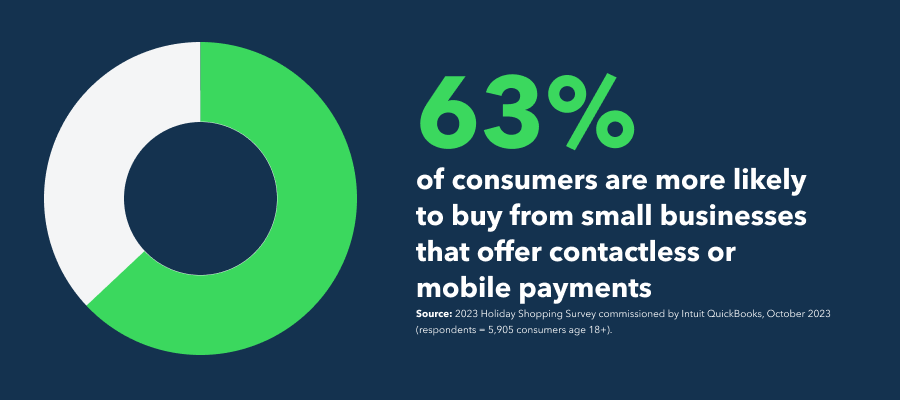

Seamless checkouts to support crowd control

A major factor in supporting crowd control is offering a seamless and fast checkout experience. As shown above, almost two-thirds (63%) of consumers say they’re more likely to buy from small businesses with a physical store if they offer contactless or mobile payments. Digitizing the checkout experience as much as possible and integrating payment solutions that allow consumers to pay the way they want with online invoicing, mobile payment apps, and in-person card readers is good for business.

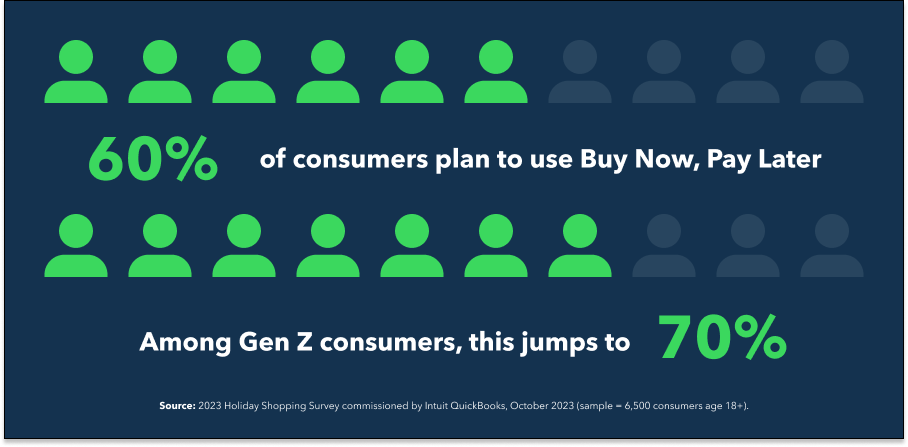

Bring in Buy Now, Pay Later for a boost

Small online retailers, particularly those with younger customers, should offer Buy Now, Pay Later (BNPL) for a boost in sales. Providing flexibility and the appeal of no interest rates for shorter terms, BNPL has the potential to attract new customers and retain loyal ones. Three in 5 (60%) consumers plan to use BNPL for holiday shopping this year. Demand for BNPL is higher among younger consumers with 70% aged 18-24 planning to use it for the holidays.

Discounts can make a sale

Small businesses hoping for a successful holiday season can offer discounts and sales as a strategic move. For small businesses with a store, remember to offer discounts both in-store and online. Consumers are doing their research with holiday deals and shipping options top of mind. Almost all (94%) consumers say they compare prices between small businesses and big retailers during the holiday season. Among those who compare prices, 50% say they do so always or often. But most importantly, 51% of consumers say finding a better deal at a bigger retailer or better shipping options (44%) would make them not buy from a small business. Small businesses can leverage an updated website, email marketing, and social media to advertise too-good-to-pass-up deals during this busy season.

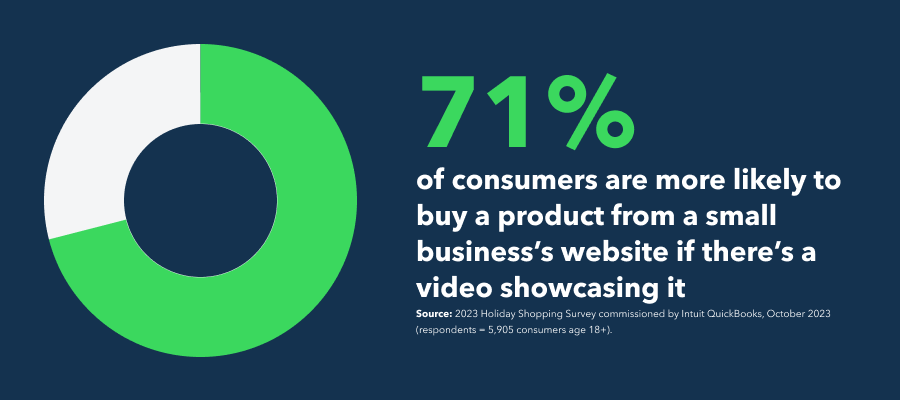

Venture into video

Product-based small businesses that sell directly from a website can capitalize on the rise of video. Video has become increasingly important. With small businesses hoping to find new customers and keep current customers coming back, video is an important tool. Search engines, particularly Google, and social media love videos—and so do consumers. Seven in 10 (71%) consumers say they’re more likely to buy a product from a small business's website during the holiday season if there’s a video showcasing it.

Don’t forget the importance of Facebook for social media selling

With a long list of social media apps, it can be hard for small businesses to know where to focus their energies. And while TikTok’s popularity is solidly in place among Gen Z, Facebook is still a major player overall. One third (36%) of consumers say they look to Facebook for gift inspiration, making it top the list of social media platforms for holiday inspiration. This holds true for millennial consumers aged 25-44 as well with almost half (49%) saying they turn to Facebook for gift inspiration.

When it comes to sales, consumers planning to buy from social media rank Facebook (62%) as the top app they’re most likely to purchase from. Instagram (55%) is a close second.

Partner with influencers for more sway with younger customers

The power of the influencer is redefining marketing. For small businesses with a larger base of young customers, partnering with influencers to promote their products and services during the holiday season can have a large return on investment. While 1 in 3 (33%) consumers agree that they’re more likely to buy from a small business if an influencer promotes their products, services, or experiences, among Gen Z consumers aged 18-24, this jumps to 43%. For consumers persuaded by the pull of influencers, 57% said they trust influencers with up to 1 million followers the most.

Remind customers you’re local and reward them for loyalty

Just as data showed last holiday season, customers are eager to support local small businesses this holiday season. For small businesses, leaning into their location and building a community of loyal shoppers could be the key to holiday success. Three in 5 (62%) consumers say they’re more likely to buy from a small business if it’s local. And 2 in 3 (68%) consumers say already being part of a small business’s rewards or loyalty program is more likely to make them shop there this holiday season. Donating small business proceeds to charity (38%) is the second biggest pull among consumers.

Sample and methodology

Intuit QuickBooks Holiday Shopping Survey 2023

Intuit QuickBooks commissioned an online survey, completed in October 2023, of 6,500 consumers (adults aged 18+) throughout the US. Insights for Gen Z consumers are from respondents aged 18-24 (n=636), while insights for Millennial consumers are from respondents aged 25-44 (n=2,820). Small business consumer spending estimates are based on a weighted average percentage of total spend budget each survey respondent indicated they planned to spend at small businesses this holiday season multiplied by the equivalent number of people in the US population based on the latest available data from the U.S. Census Bureau ($485 average spend at small businesses per person multiplied by 258 million US adults over the age of 18 equals $125 billion potential revenue for small businesses this holiday season). To ensure the survey findings are as representative as possible, they have been re-weighted using post-stratification based on local census data. For clarity, percentages have been rounded to the nearest decimal place—so values shown in charts and graphics may not add up to 100%. Responses to multiple choice survey questions are shown as a percentage of the number of respondents, not the total number of responses, so will always sum to more than 100%. Respondents received remuneration.

Disclaimer

This content, report and materials are for informational purposes only and should not be considered legal, accounting, financial, investment, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc., or its affiliates do not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc., or its affiliates do not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit Inc. or its affiliates do not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Neither Intuit Inc. nor its affiliates assume responsibility for the accuracy, legality, or content on these sites.

Recommended for you

Get the latest data insights in your inbox

Sign up to get the latest insights from the Small Business Index as soon as they are published each month.

Thanks for subscribing.

We'll send you the latest insights from the Small Business Index as soon as they are published each month.