Managing taxes as a small business owner can feel overwhelming, and less than half (48%) of small business owners feel that they're paying taxes correctly. Understanding which forms you need to file is the first step toward closing that confidence gap and avoiding IRS penalties.

We've simplified business taxation into an easy-to-follow roadmap covering essential tax forms you'll need. From quarterly estimates to year-end filing, we’ve got you covered.

Let’s walk through the essential tax forms for the upcoming tax season.

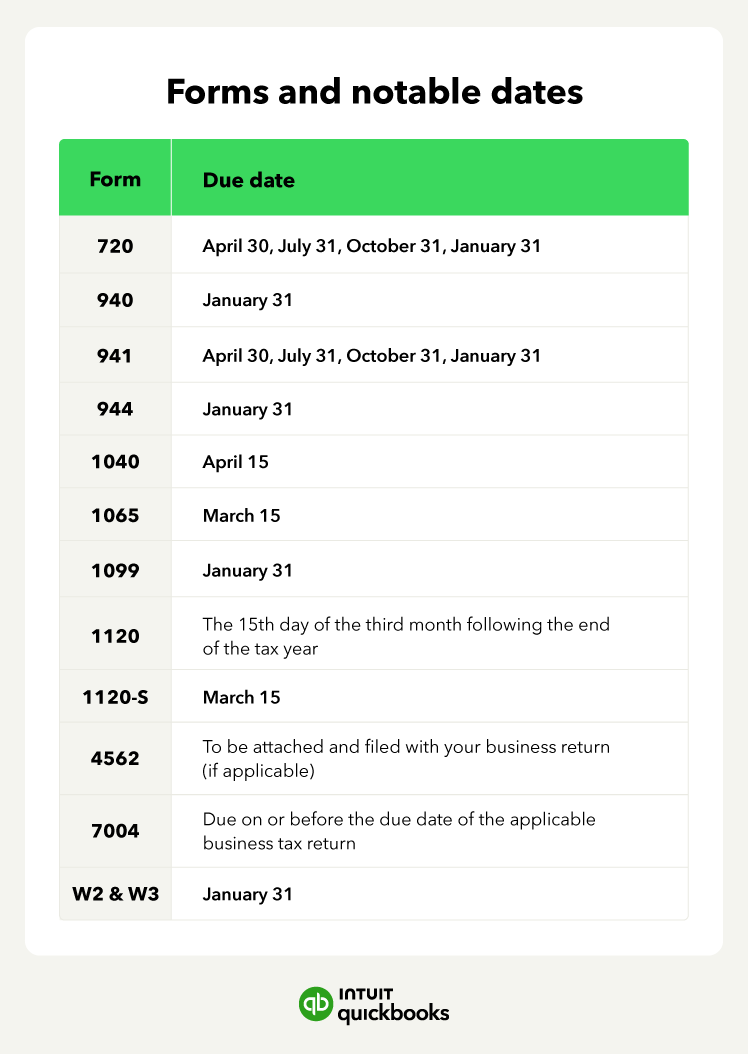

Notable dates: The IRS wants Form 720 by the last day of the month following the end of a quarter. For large and small businesses, quarterly taxes must reach the IRS or receive a postmark by:

Notable dates: The IRS wants Form 720 by the last day of the month following the end of a quarter. For large and small businesses, quarterly taxes must reach the IRS or receive a postmark by: