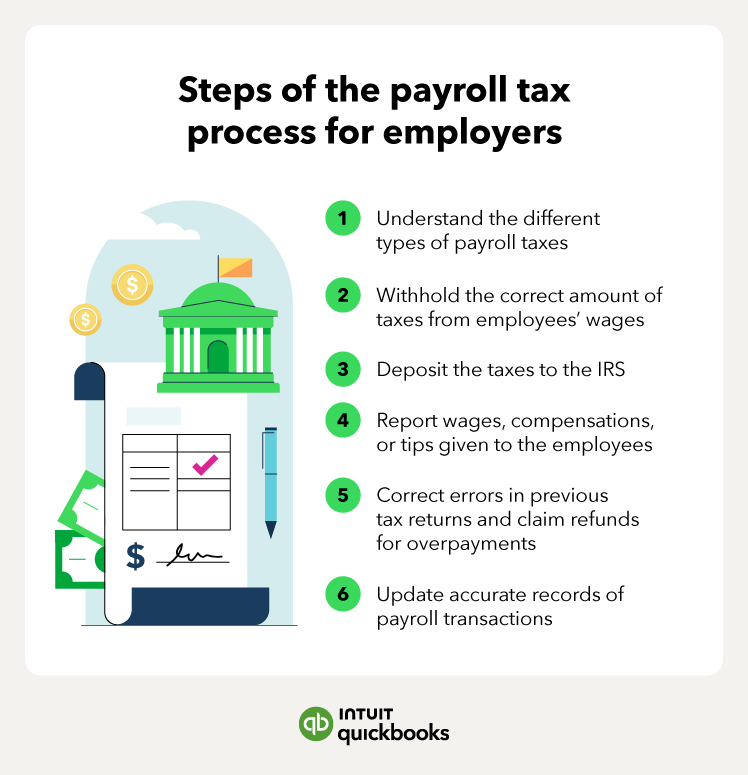

How to file payroll taxes as a small business owner?

As a small business owner, you have to ensure proper filing of taxes, meeting the deadlines, and keeping track of all the updated tax-related forms and regulations.

Depending on the date of the tax deposit, you have to report federal (FICA and FUTA) and state (SUTA) taxes post-payroll to file payroll taxes.

Federal tax deposits

There are three main types of federal tax deposits a small business owner will file: FICA, income, and FUTA.

- FICA and income tax deposits: You are required to pay FICA and federal income tax withheld either monthly, semiweekly, or the next day, depending on your predetermined tax deposit date.

- FUTA tax deposits: You’ll only pay FUTA taxes (unemployment taxes) to the IRS on a quarterly basis. However, if your FUTA tax contributions are less than $500, you roll them over to the next quarter and pay biannually.

If you’re in the last quarter of the year and still haven’t hit $500, use Form 940 to pay the tax by January 31.

In addition to paying the FICA and FUTA tax deposits electronically, you also need to report your taxes on Forms 941 and 940.

- Form 941 is for your quarterly federal tax return for your FICA and federal income taxes. You will fill out and submit a Form 941 for each quarter, summing all of your FICA and federal income taxes paid within those months.

- Form 940 is mainly for your yearly federal unemployment (FUTA) tax return. You will fill out and submit Form 940 annually, summing all of your FUTA tax contributions for the previous year. If your FUTA contributions haven't reached $500 by the last quarter, use Form 940 to pay the tax by January 31.

While you can also file these forms electronically, you can still mail them to the IRS.

State tax deposits

SUTA tax is state-specific and varies from state to state. Find out the state-specific SUTA tax rates and requirements by registering with the state’s unemployment agency. After registering, you will get an employer tax number. Most states will ask to file a yearly return and make quarterly payments.

You have to calculate SUTA taxes based on the state’s wage base (SUTA wage base/wage limit) and the tax rate assigned to you. SUTA wage refers to the amount of your employee’s earnings that are taxable under the SUTA Act, and it is the same for all employees living within a state.

For example, in Florida, the wage base is $7000, so if an employee earns $40,000 per year, the SUTA tax will only be calculated on the first $7000 of the salary and not on the entire $40,000. In this case, the employer will pay the taxes and not the employees.

Just make sure to regularly check your state government’s official website for updates on the wage limits.

Using payroll software and AI tools to stay compliant

Modern payroll software and AI-powered tools can simplify every step of payroll taxes. From calculating FICA, FUTA, and SUTA obligations to filing forms and depositing taxes on time, AI agents reduce human error and save time. Using these tools helps you stay compliant, meet deadlines, and focus on running your business without worrying about tax mistakes.