Basic financial ratio analysis

With the data from your financial statements, you can gain insight into your business's health and performance using a few basic financial ratios. These metrics measure things like profitability, liquidity, leverage, and efficiency. Let’s explore how a few of these ratios work.

Current ratio

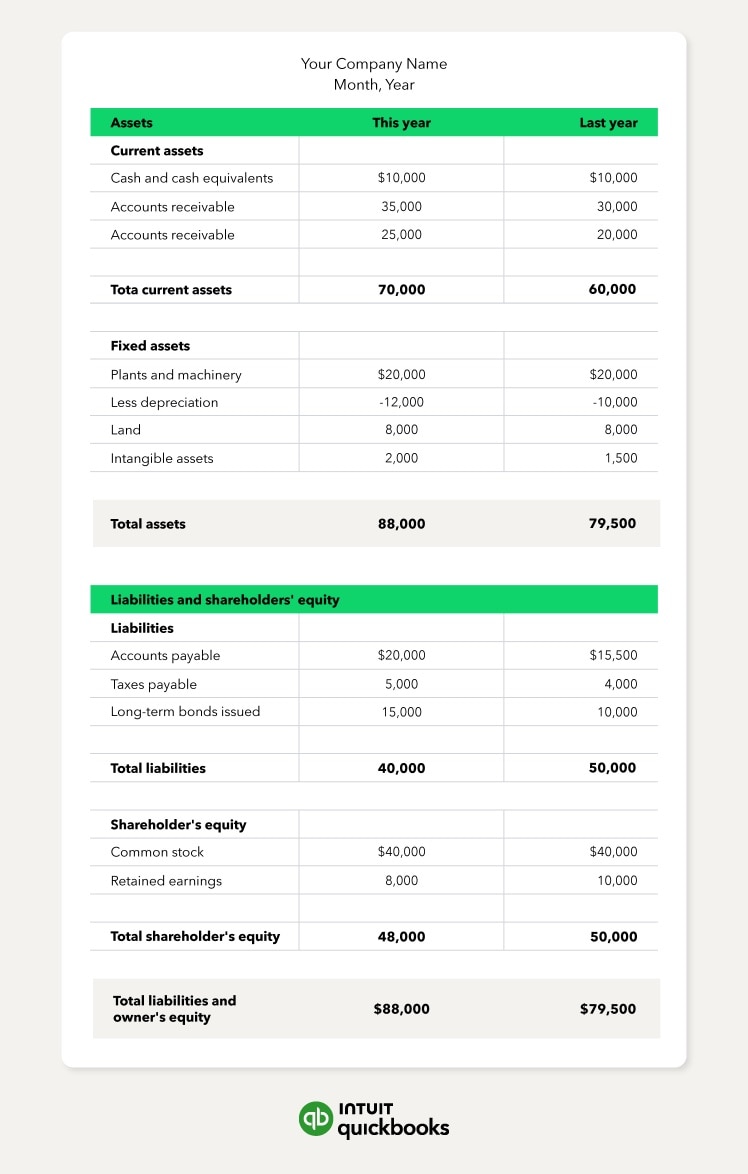

The current ratio is a type of liquidity ratio that measures your ability to pay off short-term liabilities with your current assets. Short-term (current) liabilities consist of expenses like accounts payable, salaries owed, and lease payments.

To calculate this ratio, the formula takes the sum of your current assets and divides it by your current liabilities:

Current ratio = Current Assets ÷ Current Liabilities

Assets like accounts receivable, inventory, and cash all qualify as current assets. Having a high current ratio indicates that your company has more than enough to pay off your short-term debts and other liabilities.

However, it can also indicate that you are holding onto too much inventory or need to invest in growth.

Inversely, having a low current ratio suggests that you may have trouble meeting your short-term financial commitments. But it can also reflect normal seasonal changes, low inventory, and other temporary issues.

Debt-to-equity ratio

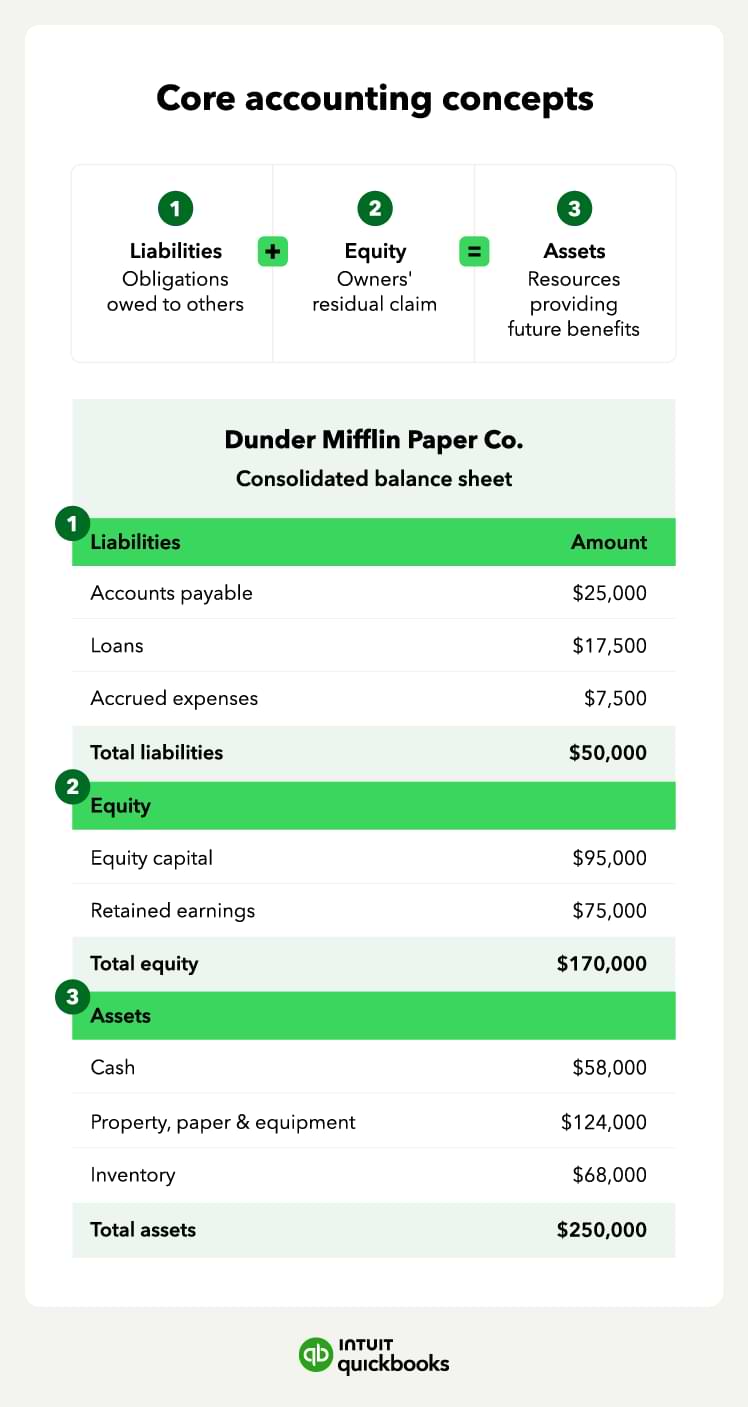

The debt-to-equity ratio is a type of solvency or leverage ratio that looks at the proportion of your operations that are financed through debt versus equity. The formula looks like this:

Debt-To-Equity Ratio = Total Liabilities ÷ Total Equity

When your business has a high debt-to-equity ratio, it indicates you are relying heavily on debt to fund operations. While this is often tax-advantageous, it can put you at high risk during economic downturns and make it harder to apply for future financing.

Having a low debt-to-income ratio suggests you are relying more on equity than debt. This makes your business more attractive to inventors and can give you flexibility in managing future financial opportunities and obstacles. However, it can also indicate that you are missing out on growth opportunities.

Understanding the

Understanding the

Accounting software and apps are used by 51% of small businesses in the US according to

Accounting software and apps are used by 51% of small businesses in the US according to