Bookkeeping is a necessary part of running a small business, but it can be tricky. Many business owners manage their own bookkeeping because they have to, not because they feel confident with business accounting.

Everyone wants to know how they can be compliant and avoid penalties. And it all starts with a reliable accounting system and accurate bookkeeping. We compiled these bookkeeping tips to help small business owners navigate the bookkeeping process:

Jump to:

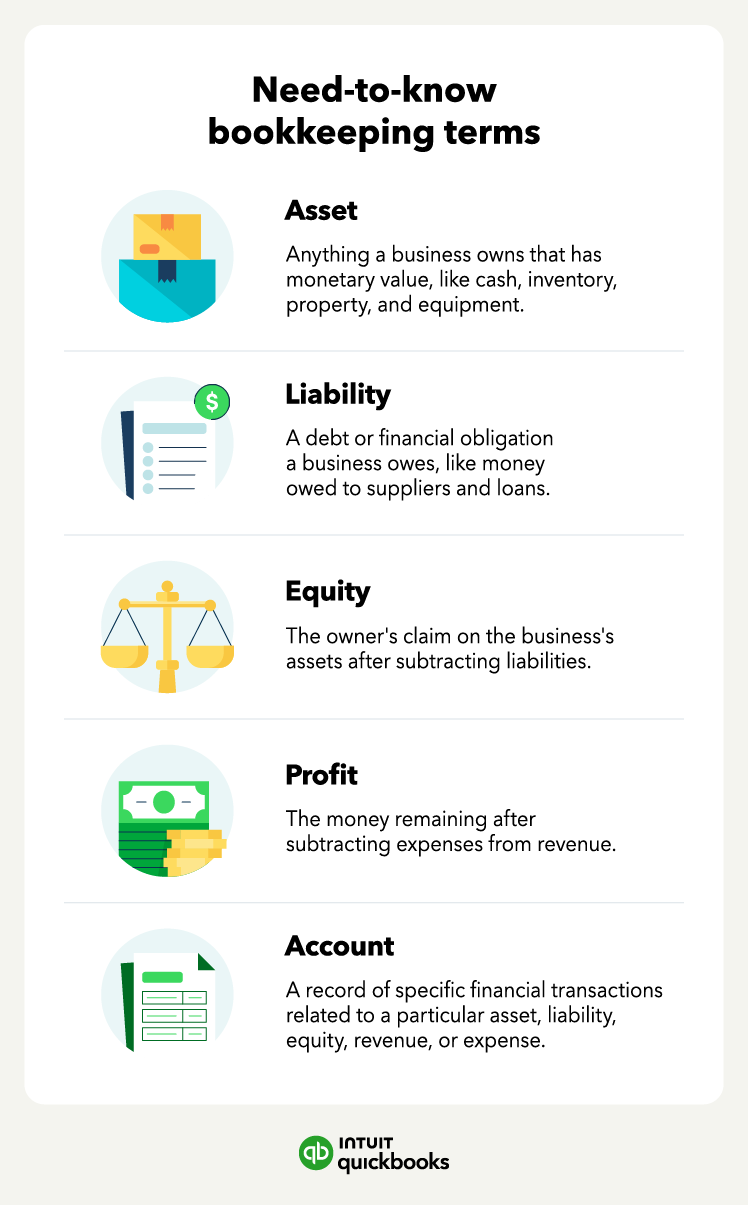

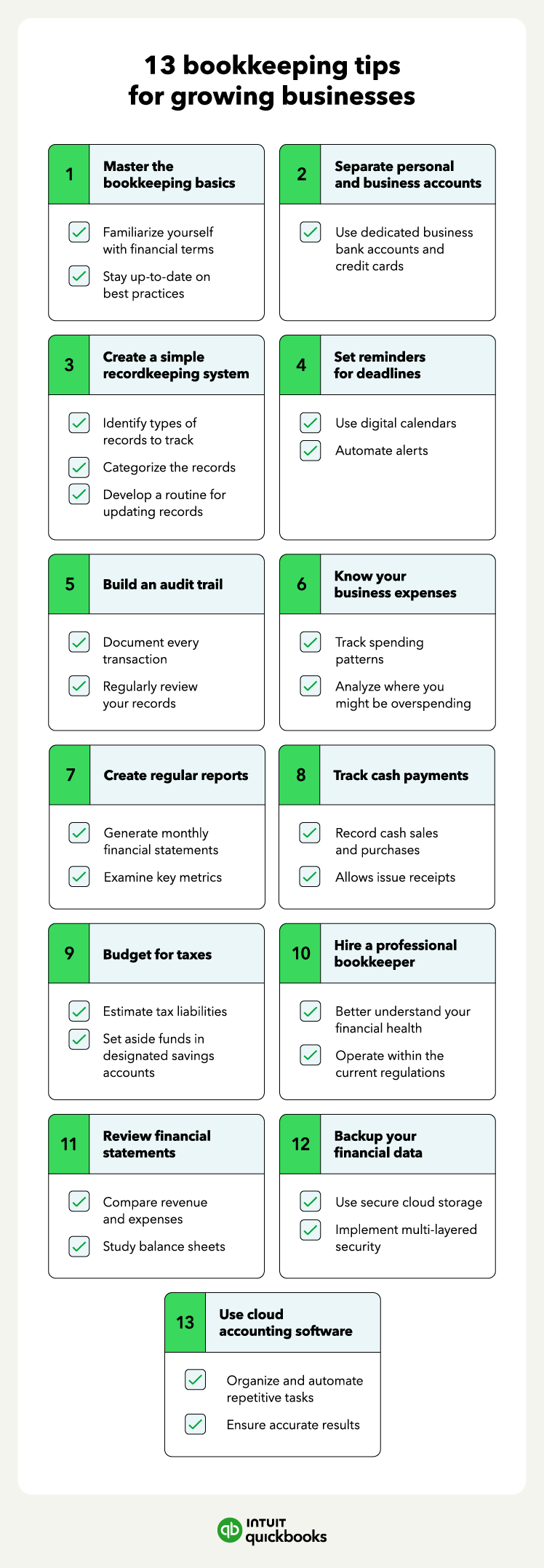

- Master the bookkeeping basics

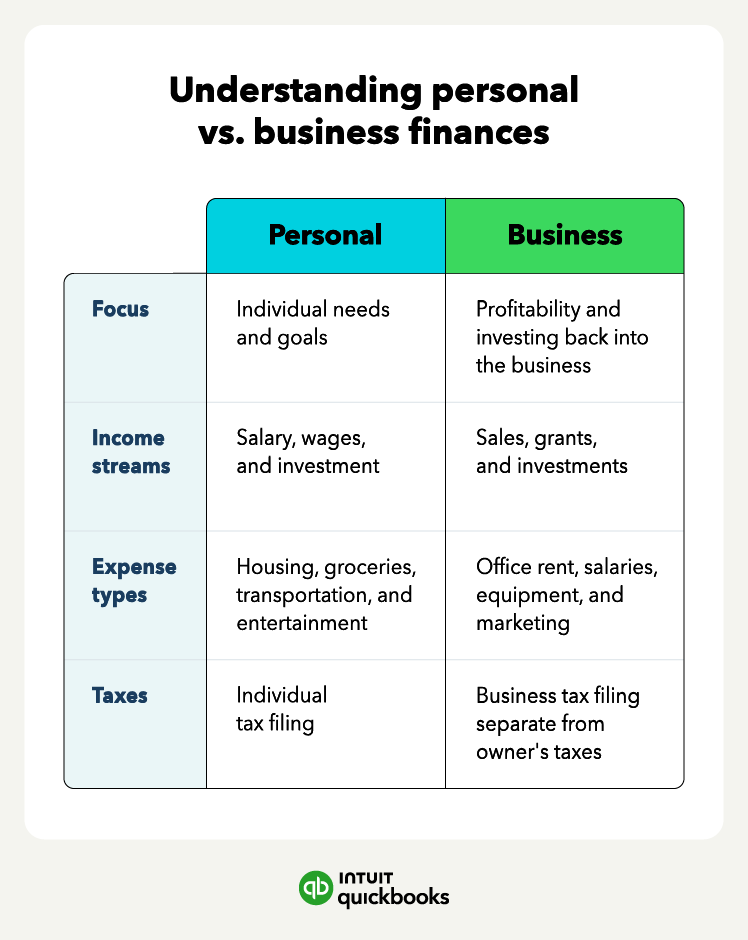

- Separate personal and business accounts

- Create a simple record-keeping system

- Set reminders for deadlines

- Build an audit trail

- Know your business expenses

- Create regular reports

- Track cash transactions

- Budget for taxes

- Hire a professional bookkeeper

- Review financial statements

- Backup your financial data

- Use cloud accounting software